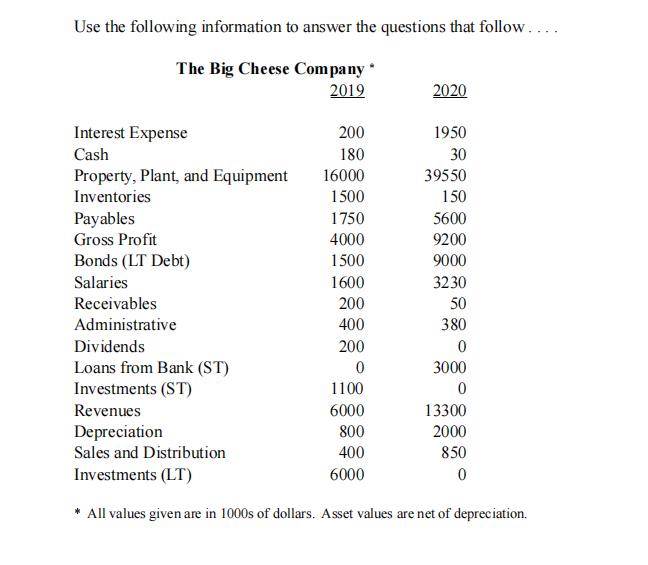

Use the following information to answer the questions that follow.... The Big Cheese Company * 2019 2020 Interest Expense 200 1950 Cash 180 30

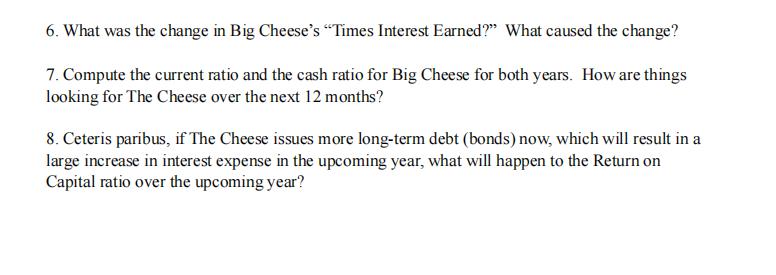

Use the following information to answer the questions that follow.... The Big Cheese Company * 2019 2020 Interest Expense 200 1950 Cash 180 30 Property, Plant, and Equipment 16000 39550 Inventories 1500 150 Payables 1750 5600 Gross Profit 4000 9200 Bonds (LT Debt) 1500 9000 Salaries 1600 3230 Receivables 200 50 Administrative 400 380 Dividends 200 Loans from Bank (ST) Investments (ST) 3000 1100 Revenues 6000 13300 Depreciation 800 2000 Sales and Distribution 400 850 Investments (LT) 6000 All values given are in 1000s of dollars. Asset values are net of depreciation. 6. What was the change in Big Cheese's "Times Interest Earned?" What caused the change? 7. Compute the current ratio and the cash ratio for Big Cheese for both years. How are things looking for The Cheese over the next 12 months? 8. Ceteris paribus, if The Cheese issues more long-term debt (bonds) now, which will result in a large increase in interest expense in the upcoming year, what will happen to the Return on Capital ratio over the upcoming year?

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

6 Debt to Assets Total Debt Total Assets 100 The same for both years have been calculated as shown b...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started