Question

Brenda Chatterjee is wealthy, single, and generous. During the previous year she made the following gifts: Gift of stock to the local art museum (a

Brenda Chatterjee is wealthy, single, and generous. During the previous year she made the following gifts:

•Gift of stock to the local art museum (a 501(c)(3) nonprofit organization): $245,000

•College tuition payment for niece: $29,000 made directly to the institution

•Medical bills for elderly neighbor: $18,000 paid directly to the hospital

•Home down payment gift to daughter: $30,000 paid directly to the mortgage lender

•Cash gift to son: $17,000

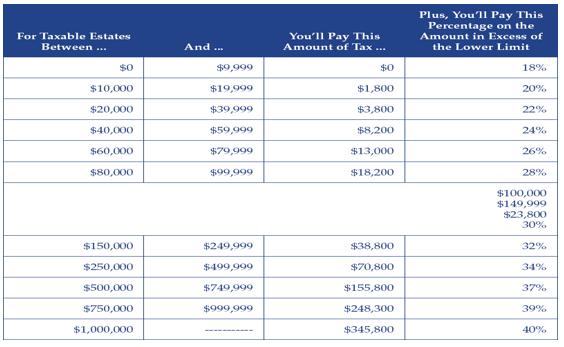

•Use the gift tax rates shown below as a guide to answer the following questions:

a. What is the total amount of taxable gifts in 2018?

b. What is Brenda’s gift tax liability in 2018?

c. Assuming a unified credit of $4,425,800, what alternative does Brenda have in terms of paying the gift tax liability?

Plus, You'll Pay This Percentage on the Amount in Excess of For Taxable Estates You'll Pay This Amount of Tax ... Between ... And . the Lower Limit $0 $9,999 $0 18% $10,000 $19,999 $1,800 20% $20,000 $39,999 $3,800 22% $40,000 $59,999 $8,200 24% $60,000 $79,999 $13,000 26% $80,000 $99,999 $18,200 28% $100,000 $149,999 $23,800 30% $150,000 $249,999 $38,800 32% $250,000 $499,999 $70,800 34% $500,000 $749,999 $155,800 37% $750,000 $999,999 $248,300 39% $1,000,000 $345,800 40%

Step by Step Solution

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a From the above table we can see that upto 9999 gifts are not taxable In the question given all ind...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started