Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julie is single with no dependent. She receives a salary of $15,000 per month from Big Corporation. Julie earned interest of $35,000 on City

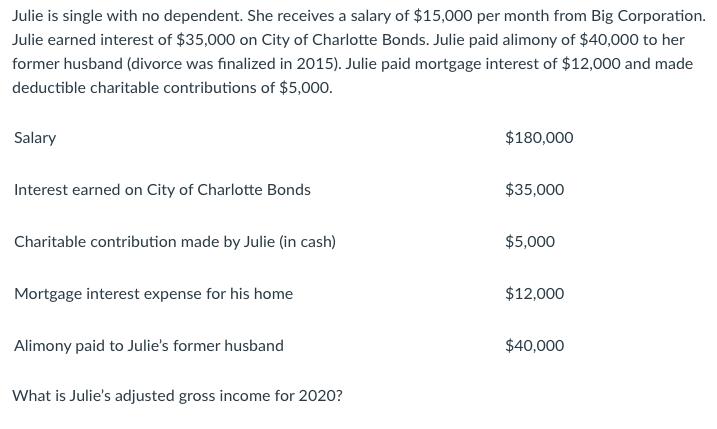

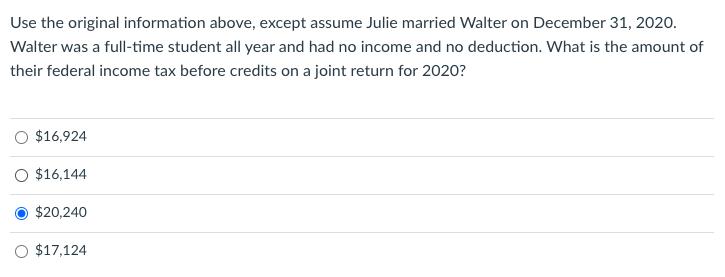

Julie is single with no dependent. She receives a salary of $15,000 per month from Big Corporation. Julie earned interest of $35,000 on City of Charlotte Bonds. Julie paid alimony of $40,000 to her former husband (divorce was finalized in 2015). Julie paid mortgage interest of $12,000 and made deductible charitable contributions of $5,000. Salary $180,000 Interest earned on City of Charlotte Bonds $35,000 Charitable contribution made by Julie (in cash) $5,000 Mortgage interest expense for his home $12,000 Alimony paid to Julie's former husband $40,000 What is Julie's adjusted gross income for 2020? Use the original information above, except assume Julie married Walter on December 31, 2020. Walter was a full-time student all year and had no income and no deduction. What is the amount of their federal income tax before credits on a joint return for 2020? $16,924 O $16,144 $20,240 O $17,124

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Salary 180000 Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started