Question

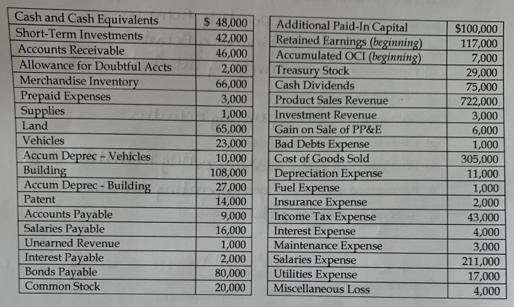

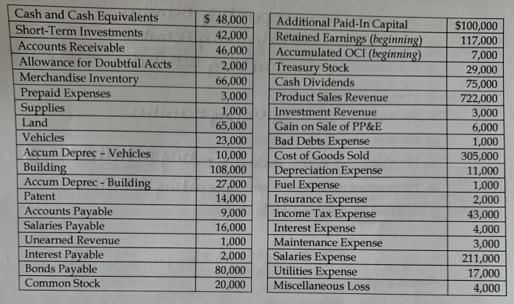

Using the adjusted) balances and additional information provided below, as of December 31, 20xx, prepare in good form (i) An Income Statement, (ii) A Statement

Using the adjusted) balances and additional information provided below, as of December 31, 20xx, prepare in good form

(i) An Income Statement,

(ii) A Statement of Comprehensive Income,

(iii) A Statement of Stockholders' Equity,

(iv) A Balance Sheet for Mautz Machinery Co.

• Mautz Machinery is authorized to sell 30,000 shares of $2 par common stock. For all of 20xx, 10,000 shares were issued. In the middle of 20xx, 1,000 shares were purchased for treasury, at $29 per share. (So, the average number of shares outstanding during 20xx was 9,500.)

• The miscellaneous loss relates to a decline as of the end of 20xx in the market value of short-term investments classified as available-for-sale.

• The income tax expense amount above includes a $1,000 tax benefit derived from the miscellaneous loss; so, $44,000 of income tax expense applies to all other items.

Using the adjusted) balances and additional information provided below, as of December 31, 20xx, prepare in good form

(i) An Income Statement,

(ii) A Statement of Comprehensive Income,

(iii) A Statement of Stockholders' Equity,

(iv) A Balance Sheet for Mautz Machinery Co.

• Mautz Machinery is authorized to sell 30,000 shares of $2 par common stock. For all of 20xx, 10,000 shares were issued. In the middle of 20xx, 1,000 shares were purchased for treasury, at $29 per share. (So, the average number of shares outstanding during 20xx was 9,500.)

• The miscellaneous loss relates to a decline as of the end of 20xx in the market value of short-term investments classified as available-for-sale.

• The income tax expense amount above includes a $1,000 tax benefit derived from the miscellaneous loss; so, $44,000 of income tax expense applies to all other items.

Cash and Cash Equivalents $ 48,000 Additional Paid-In Capital Retained Earnings (beginning) Accumulated OCI (beginning) Treasury Stock $100,000 117,000 7,000 29,000 75,000 722,000 3,000 6,000 1,000 305,000 11,000 Short-Term Investments 42,000 Accounts Receivable Allowance for Doubtful Accts Merchandise Inventory Prepaid Expenses Supplies Land 46,000 2,000 66,000 3,000 Cash Dividends Product Sales Revenue 1,000 65,000 Investment Revenue Gain on Sale of PP&E Bad Debts Expense Vehicles 23,000 Accum Deprec - Vehicles Building Accum Deprec - Building 10,000 108,000 27,000 Cost of Goods Sold Depreciation Expense Fuel Expense Insurance Expense Income Tax Expense Interest Expense Maintenance Expense Salaries Expense Utilities Expense 1,000 Patent 14,000 9,000 16,000 1,000 2,000 2,000 43,000 4,000 3,000 211,000 Accounts Payable Salaries Payable Unearned Revenue Interest Payable Bonds Payable Common Stock 80,000 17,000 20,000 Miscellaneous Loss 4,000

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 Do you feel comfortable using a digital camera Why or why not The question is immeasurable we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started