Question

Waterway Limited owes $200,000 to Teal Mountain Inc. on a 10-year, 10% note due on December 31, 2020. The note was issued at par.

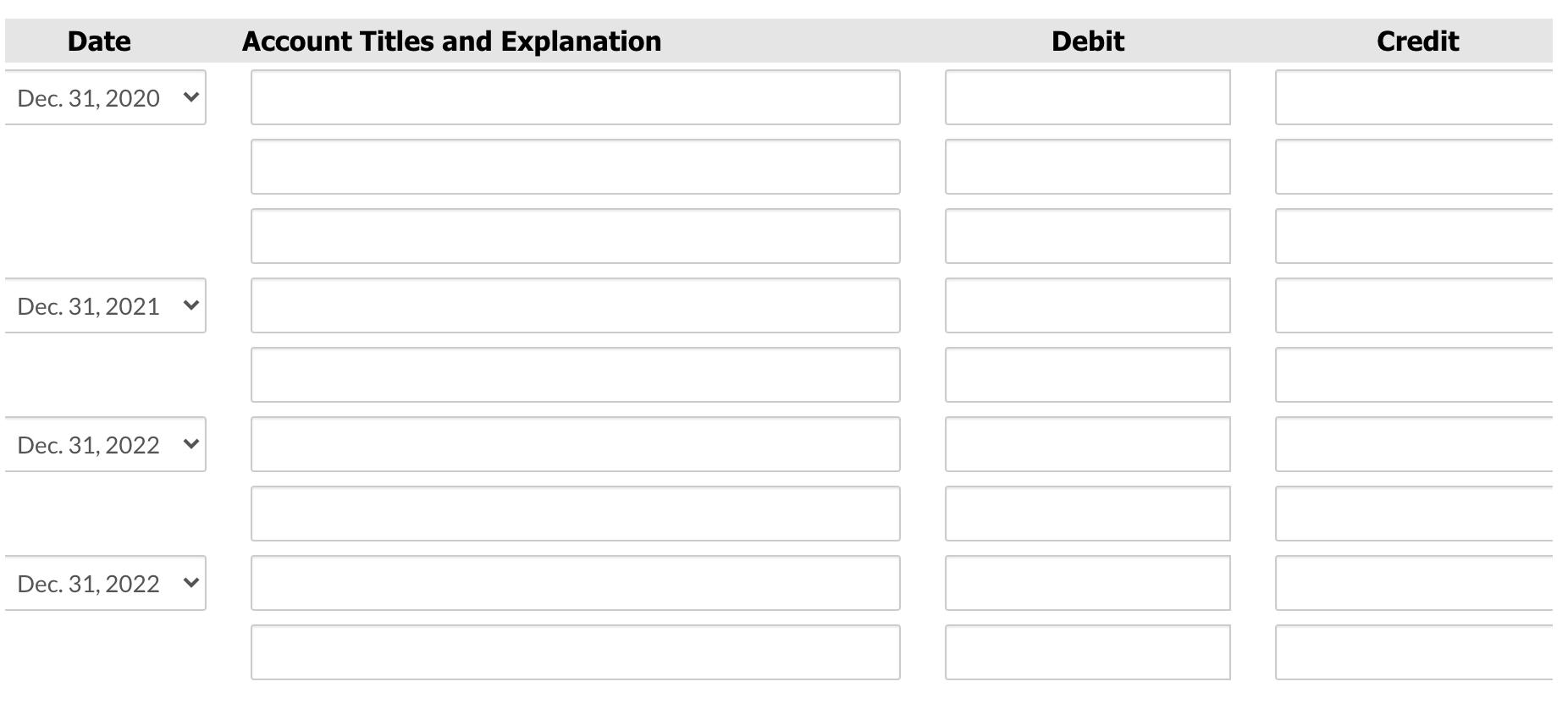

Waterway Limited owes $200,000 to Teal Mountain Inc. on a 10-year, 10% note due on December 31, 2020. The note was issued at par. Because Waterway is in financial trouble, Teal Mountain Inc. agrees to extend the maturity date to December 31, 2022, reduce the principal to $150,000, and reduce the interest rate to 3%, payable annually on December 31. The market rate is currently 3%. Waterway prepares financial statements in accordance with IFRS. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2022

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App