Answered step by step

Verified Expert Solution

Question

1 Approved Answer

rn With below information provide, construct a balance sheet statement 1) Ben Nice Shoe Company has Dec 31 2019 year end 2) The ending balance

rn

rn

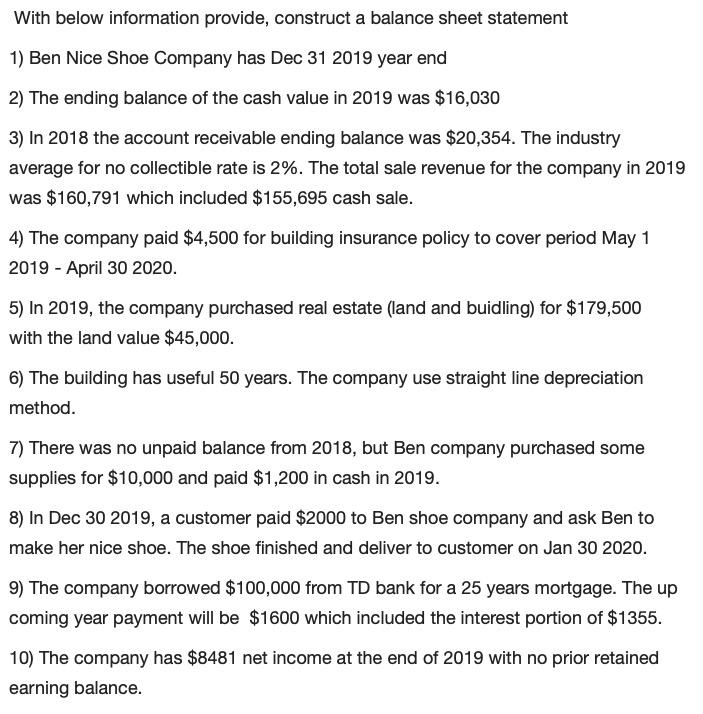

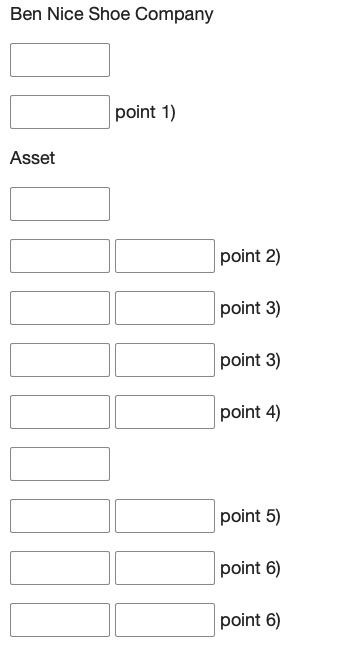

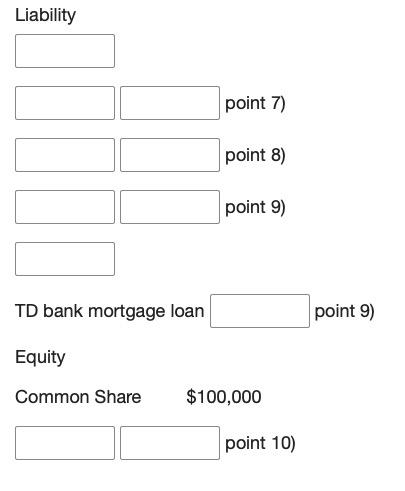

With below information provide, construct a balance sheet statement 1) Ben Nice Shoe Company has Dec 31 2019 year end 2) The ending balance of the cash value in 2019 was $16,030 3) In 2018 the account receivable ending balance was $20,354. The industry average for no collectible rate is 2%. The total sale revenue for the company in 2019 was $160,791 which included $155,695 cash sale. 4) The company paid $4,500 for building insurance policy to cover period May 1 2019 - April 30 2020. 5) In 2019, the company purchased real estate (land and buidling) for $179,500 with the land value $45,000. 6) The building has useful 50 years. The company use straight line depreciation method. 7) There was no unpaid balance from 2018, but Ben company purchased some supplies for $10,000 and paid $1,200 in cash in 2019. 8) In Dec 30 2019, a customer paid $2000 to Ben shoe company and ask Ben to make her nice shoe. The shoe finished and deliver to customer on Jan 30 2020. 9) The company borrowed $100,000 from TD bank for a 25 years mortgage. The up coming year payment will be $1600 which included the interest portion of $1355. 10) The company has $8481 net income at the end of 2019 with no prior retained earning balance.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings to construct the balance sheet for Ben Nice Shoe Company as of December 31 2019 1 Assets Cash The ending balance of c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started