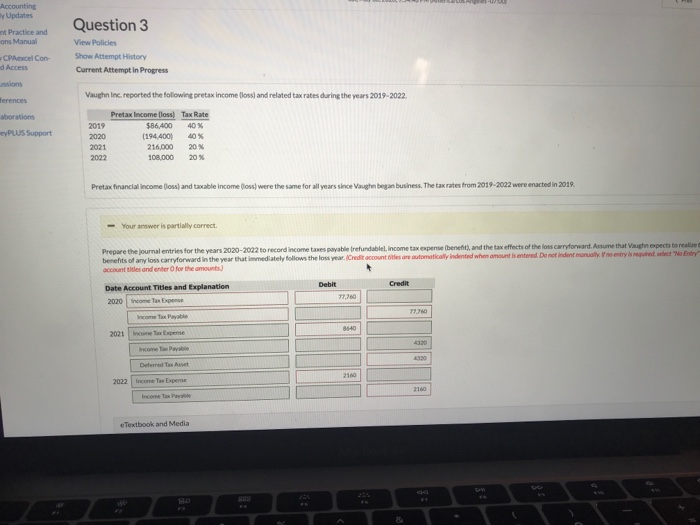

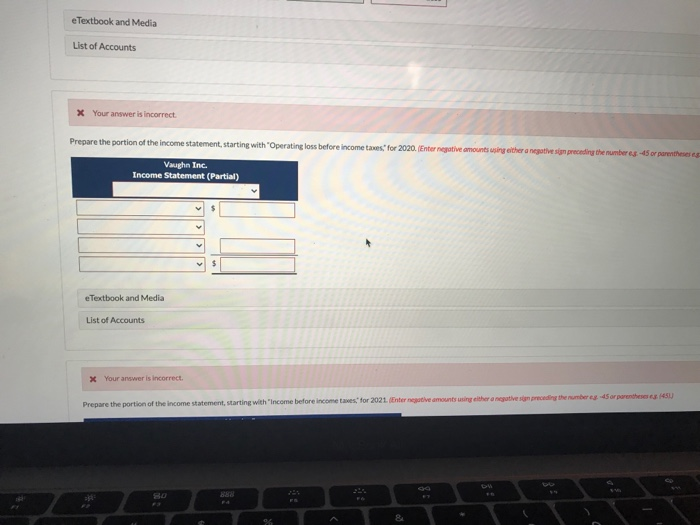

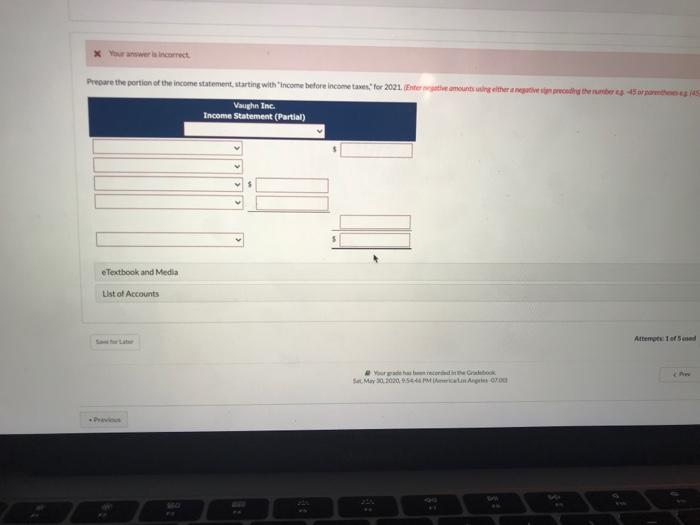

Accounting y Updates int Practice and ons Manual Question 3 MP3 Xe Con d Access View Policies Show Attempt History Current Attempt in Progress ssions erences aborations Vaughn Inc. reported the following pretax income foss) and related tax rates during the years 2019-2022 Pretax Income loss) Tax Rate 2019 $86,400 40 % 2020 (194.4001 40 % 2021 216,000 20% 2022 108.000 20% PLUS Support Pretax financial income oss) and taxable income foss) were the same for all years since Vaughn began business. The tax rates from 2019-2022 were enacted in 2019 - your answer is partially correct. Prepare the journal entries for the years 2020-2022 to record income taxes payable refundable, income tax expense benefit), and the tax effects of the loss carryforward. Assume that Vaughn expects to realize benefits of any loss carryforward in the year that immediately follows the loss year. (Credit account titles are automatically indented when amount is entered Denetindent manual entry is required select ry account titles and enter for the amounts) Date Account Titles and Explanation Debit Credit 2020 Income Tax Exem 77,760 77.760 8640 2021 Income taxpense 4320 Deferred to 2100 2022 Income Tax Depene e Textbook and Media SO e Textbook and Media List of Accounts X Your answer is incorrect Prepare the portion of the income statement, starting with "Operating loss before income taxes." for 2020. (Enter negative amounts using either a negative sin preceding the number -45 or parentheses Vaughn Inc. Income Statement (Partial) e Textbook and Media List of Accounts x Your answer is incorrect. Prepare the portion of the income statement, starting with "Income before income taxes, for 2021. Enter negative amounts using the native spreading the numbers. 45 or parentheses 1450 SO BE 96 x Your answer is incorrect Prepare the portion of the income statement, starting with "Income before income taxes for 2021. (Enterative amounts using either a notive preceding the number -45or parenthese 145 Vaughn Inc. Income Statement (Partial) eTextbook and Media List of Accounts Safor Later Attempt of Sused Your grad has been recorded in the Gradebook Sot, May 30, 2030, 9.5446 PM America Los Angeles-07.001 - Previous