Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q4. X ltd is flows are as follows. Year considering investing in projects A, B and C. The forecasted cash 0 project A project

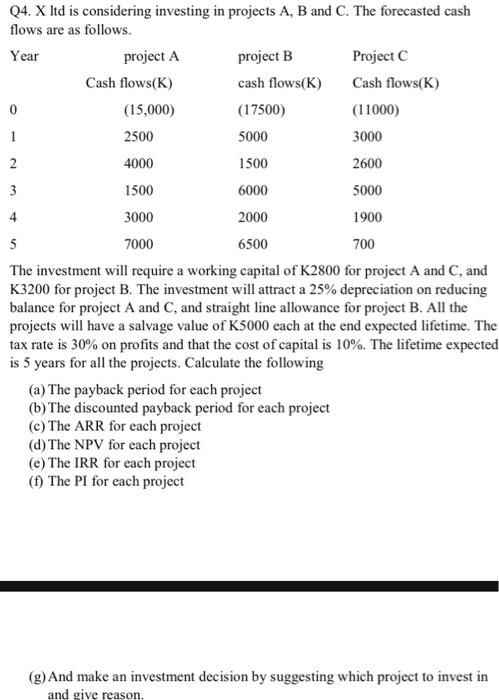

Q4. X ltd is flows are as follows. Year considering investing in projects A, B and C. The forecasted cash 0 project A project B Project C Cash flows(K) cash flows(K) Cash flows(K) (15,000) (17500) (11000) 2500 5000 3000 2 4000 1500 2600 3 1500 6000 5000 4 3000 2000 1900 5 7000 6500 700 The investment will require a working capital of K2800 for project A and C, and K3200 for project B. The investment will attract a 25% depreciation on reducing balance for project A and C, and straight line allowance for project B. All the projects will have a salvage value of K5000 each at the end expected lifetime. The tax rate is 30% on profits and that the cost of capital is 10%. The lifetime expected is 5 years for all the projects. Calculate the following (a) The payback period for each project (b) The discounted payback period for each project (c) The ARR for each project (d) The NPV for each project (e) The IRR for each project (f) The PI for each project (g) And make an investment decision by suggesting which project to invest in and give reason.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The payback period for project A is 35 years for project B is 32 years and for project C is 29 years To calculate the payback period we need to find ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started