Question: You are an analyst for Opulent Wealth Management. One of the companies you follow is Metagrobolize Industries. While looking at the company's financials, you

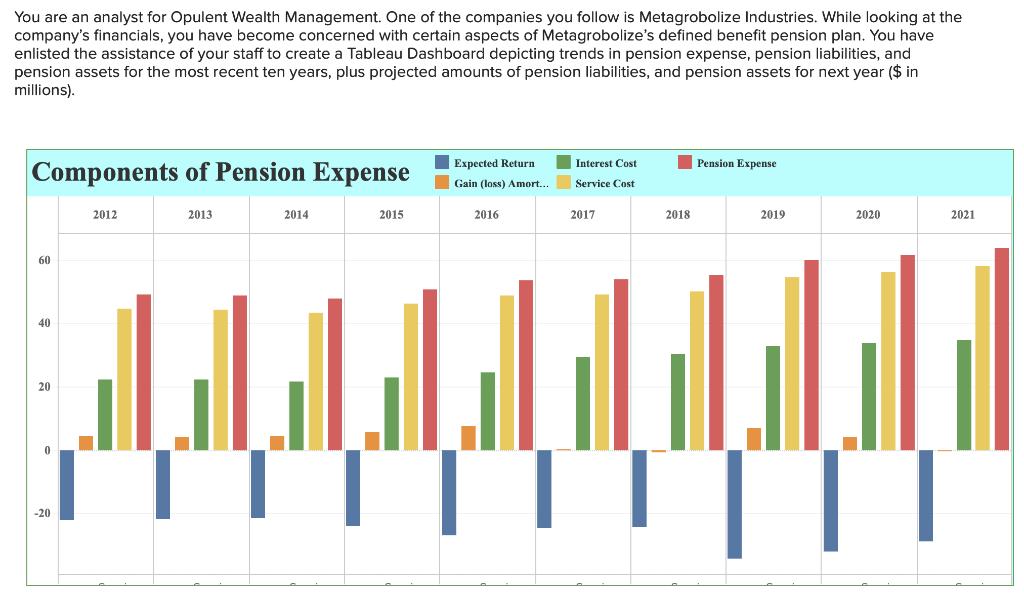

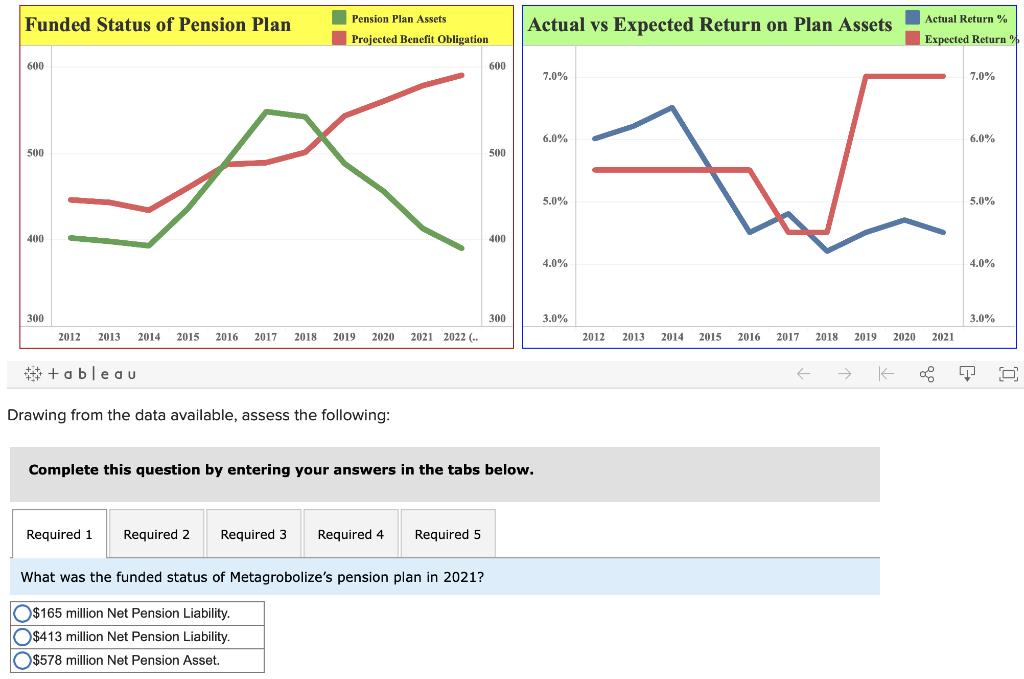

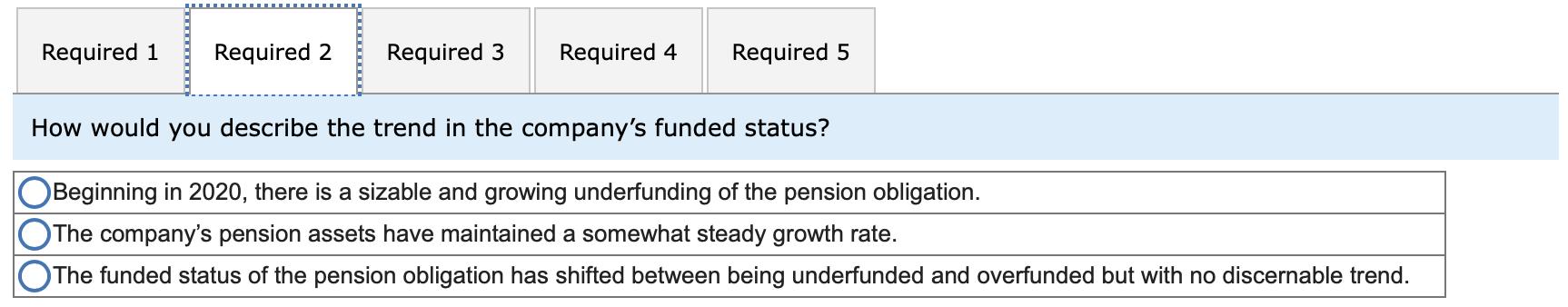

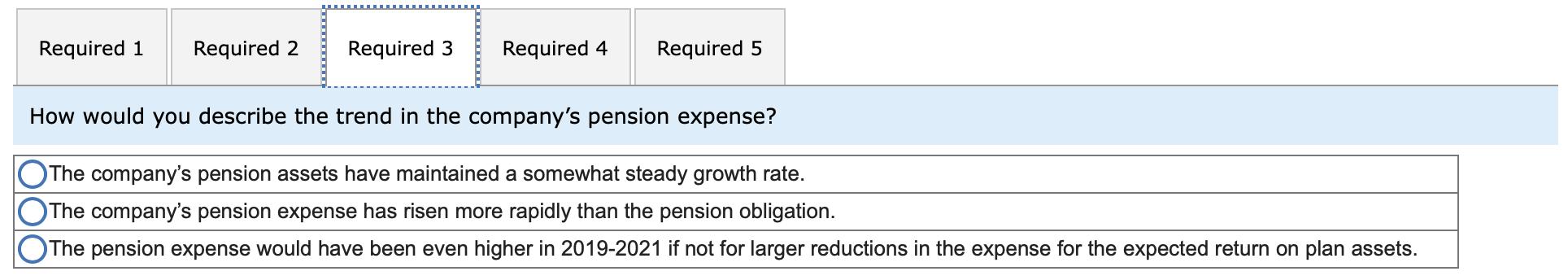

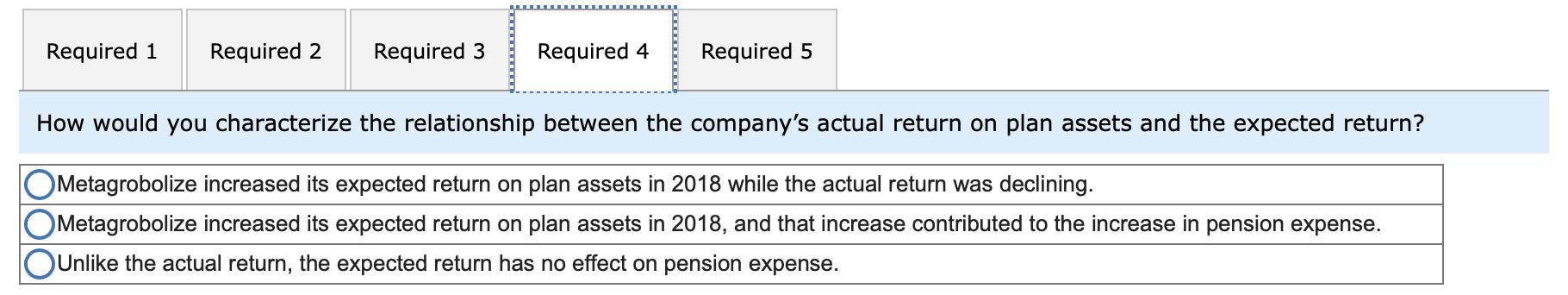

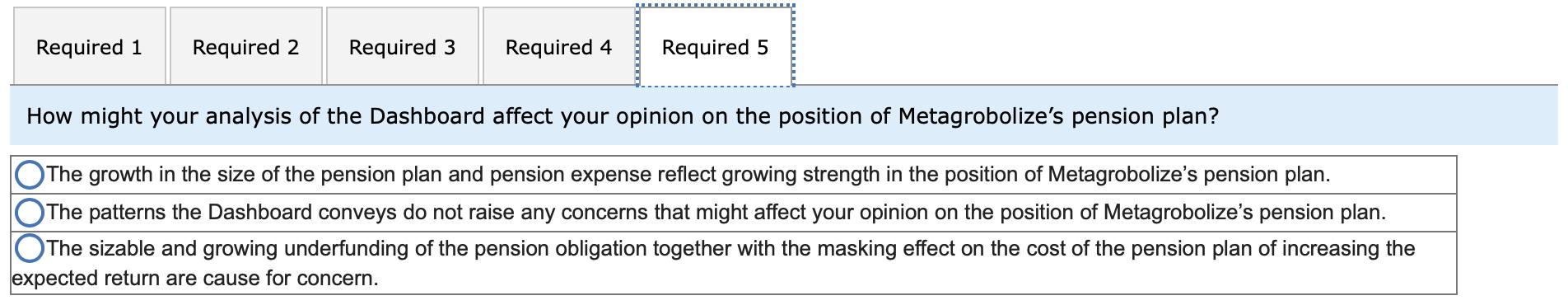

You are an analyst for Opulent Wealth Management. One of the companies you follow is Metagrobolize Industries. While looking at the company's financials, you have become concerned with certain aspects of Metagrobolize's defined benefit pension plan. You have enlisted the assistance of your staff to create a Tableau Dashboard depicting trends in pension expense, pension liabilities, and pension assets for the most recent ten years, plus projected amounts of pension liabilities, and pension assets for next year ($ in millions). Expected Return Interest Cost Pension Expense Components of Pension Expense Gain (loss) Amort... Service Cost 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 60 40 20 -20 Pension Plan Assets Actual Return % Funded Status of Pension Plan Actual vs Expected Return on Plan Assets Projected Benefit Obligation Expected Return % 600 600 7.0% 7.0% 6.0% 6.0% 500 500 5.0% 5.0% 400 400 4.0% 4.0% 300 300 3.0% 3.0% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 (.. 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 * +ableau Drawing from the data available, assess the following: Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 What was the funded status of Metagrobolize's pension plan in 2021? O$165 million Net Pension Liability. O$413 million Net Pension Liability. O$578 million Net Pension Asset. Required 1 Required 2 Required 3 Required 4 Required 5 How would you describe the trend in the company's funded status? OBeginning in 2020, there is a sizable and growing underfunding of the pension obligation. The company's pension assets have maintained a somewhat steady growth rate. The funded status of the pension obligation has shifted between being underfunded and overfunded but with no discernable trend. Required 1 Required 2 Required 3 Required 4 Required 5 How would you describe the trend in the company's pension expense? OThe company's pension assets have maintained a somewhat steady growth rate. The company's pension expense has risen more rapidly than the pension obligation. The pension expense would have been even higher in 2019-2021 if not for larger reductions in the expense for the expected return on plan assets. Required 1 Required 2 Required 3 Required 4 Required 5 How would you characterize the relationship between the company's actual return on plan assets and the expected return? OMetagrobolize increased its expected return on plan assets in 2018 while the actual return was declining. OMetagrobolize increased its expected return on plan assets in 2018, and that increase contributed to the increase in pension expense. OUnlike the actual return, the expected return has no effect on pension expense. Required 1 Required 2 Required 3 Required 4 Required 5 How might your analysis of the Dashboard affect your opinion on the position of Metagrobolize's pension plan? OThe growth in the size of the pension plan and pension expense reflect growing strength in the position of Metagrobolize's pension plan. The patterns the Dashboard conveys do not raise any concerns that might affect your opinion on the position of Metagrobolize's pension plan. OThe sizable and growing underfunding of the pension obligation together with the masking effect on the cost of the pension plan of increasing the expected return are cause for concern.

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Solution Required 1 The Funded status of a pension plan is the exess of plan assets over plan benefi... View full answer

Get step-by-step solutions from verified subject matter experts