Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an analyst for Opulent Wealth Management. One of the companies you follow is Westbridge Insulation. A highlight of Westbridge's financials is its

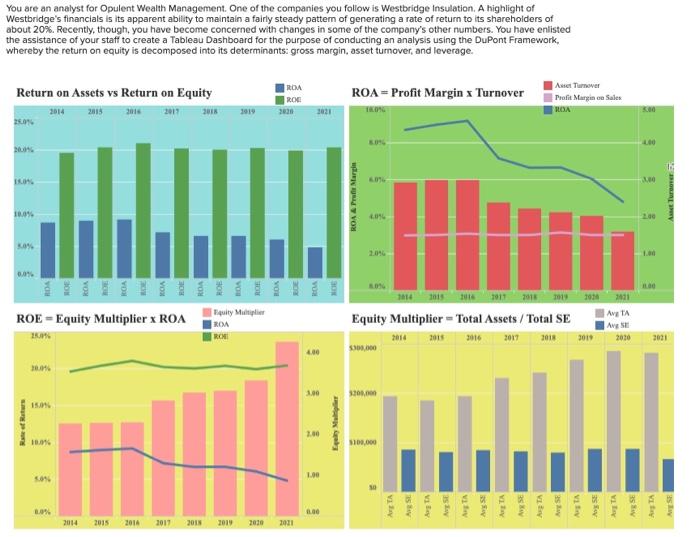

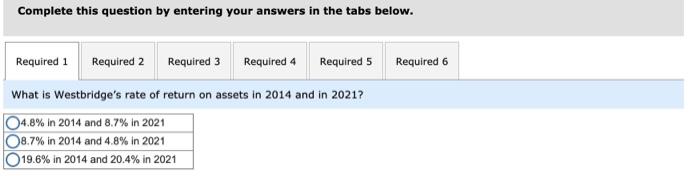

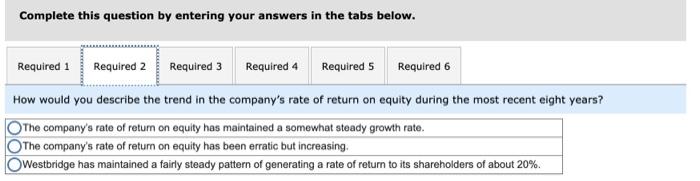

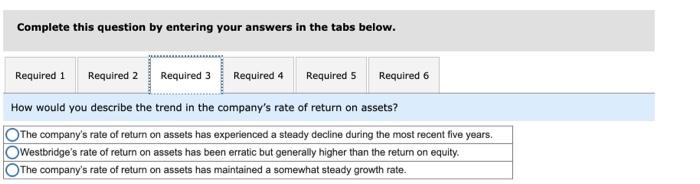

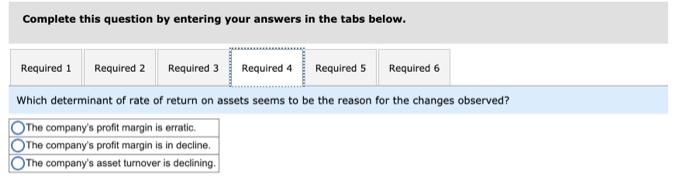

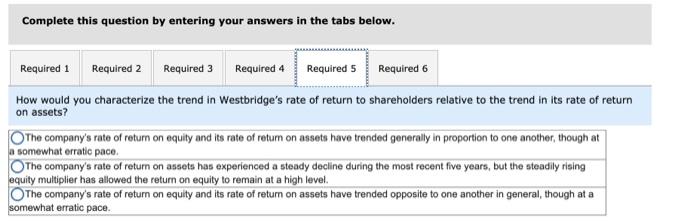

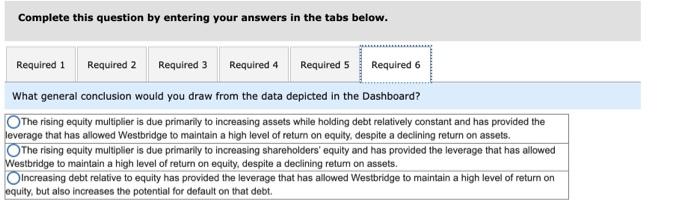

You are an analyst for Opulent Wealth Management. One of the companies you follow is Westbridge Insulation. A highlight of Westbridge's financials is its apparent ability to maintain a fairly steady pattem of generating a rate of return to its shareholders of about 20%. Recently, though, you have become concerned with changes in some of the company's other numbers. You have enlisted the assistance of your staff to create a Tableau Dashboard for the purpose of conducting an analysis using the DuPont Framework, whereby the return on equity is decomposed into its determinants: gross margin, asset turnover, and leverage. Asset Turmover ROA ROE Return on Assets vs Return on Equity ROA = Profit Margin x Turnover Profit Margin on Sales ROA 5.00 2014 2018 2016 2011 2018 3019 2020 2021 200 20% 1.00 LLLLLLLLLLILLL 2014 201s 2014 2011 2018 2019 2020 221 Fquity Maltiplier ROA Equity Multiplier = Total Assets / Total SE Avg TA ROE = Equity Multiplier x ROA Avg SE ROMI 2014 2017 2018 3019 2010 2021 4.00 2.00 L00 .00 2014 2015 2014 2017 2018 2019 2020 2011 Rate ef Raturs Eguity Multipler ROA A Pru Margin Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What is Westbridge's rate of return on assets in 2014 and in 2021? D4.8% In 2014 and 8.7% in 2021 08.7% in 2014 and 4.8% in 2021 19.6% in 2014 and 20.4% in 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on equity during the most recent eight years? The company's rate of return on equity has maintained a somewhat steady growth rate. The company's rate of return on equity has been erratic but increasing. OWestbridge has maintained a fairly steady pattern of generating a rate of return to its shareholders of about 20%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on assets? OThe company's rate of return on assets has experienced a steady decline during the most recent five years. OWestbridge's rate of return on assets has been erratic but generally higher than the return on equity. The company's rate of return on assets has maintained a somewhat steady growth rate. Complete this question by entering your answers in the tabs below. Required 3 Required 4 Required 1 Required 2 Required 5 Required 6 Which determinant of rate of return on assets seems to be the reason for the changes observed? OThe company's profit margin is erratic. The company's profit margin is in decline. The company's asset turnover is declining. Complete this question by entering your answers in the tabs below. Required 5 Required 6 Required 1 Required 2 Required 3 Required 4 How would you characterize the trend in Westbridge's rate of return to shareholders relative to the trend in its rate of return on assets? OThe company's rate of return on equity and its rate of retum on assets have trended generally in proportion to one another, though at asomewhat erratic pace. OThe company's rate of return on assets has experienced a steady decline during the most recent five years, but the steadily rising equity multiplier has allowed the return on equity to remain at a high level. OThe company's rate of return on equity and its rate of return on assets have trended opposite to one another in general, though at a somewhat erratic pace. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What general conclusion would you draw from the data depicted in the Dashboard? The rising equity multiplier is due primarity to increasing assets while holding debt relatively constant and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a decining return on assets. OThe rising equity multiplier is due primarily to increasing shareholders' equity and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a declining retum on assets. Olncreasing debt relative to equity has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, but also increases the potential for default on that debt. You are an analyst for Opulent Wealth Management. One of the companies you follow is Westbridge Insulation. A highlight of Westbridge's financials is its apparent ability to maintain a fairly steady pattem of generating a rate of return to its shareholders of about 20%. Recently, though, you have become concerned with changes in some of the company's other numbers. You have enlisted the assistance of your staff to create a Tableau Dashboard for the purpose of conducting an analysis using the DuPont Framework, whereby the return on equity is decomposed into its determinants: gross margin, asset turnover, and leverage. Asset Turmover ROA ROE Return on Assets vs Return on Equity ROA = Profit Margin x Turnover Profit Margin on Sales ROA 5.00 2014 2018 2016 2011 2018 3019 2020 2021 200 20% 1.00 LLLLLLLLLLILLL 2014 201s 2014 2011 2018 2019 2020 221 Fquity Maltiplier ROA Equity Multiplier = Total Assets / Total SE Avg TA ROE = Equity Multiplier x ROA Avg SE ROMI 2014 2017 2018 3019 2010 2021 4.00 2.00 L00 .00 2014 2015 2014 2017 2018 2019 2020 2011 Rate ef Raturs Eguity Multipler ROA A Pru Margin Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What is Westbridge's rate of return on assets in 2014 and in 2021? D4.8% In 2014 and 8.7% in 2021 08.7% in 2014 and 4.8% in 2021 19.6% in 2014 and 20.4% in 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on equity during the most recent eight years? The company's rate of return on equity has maintained a somewhat steady growth rate. The company's rate of return on equity has been erratic but increasing. OWestbridge has maintained a fairly steady pattern of generating a rate of return to its shareholders of about 20%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on assets? OThe company's rate of return on assets has experienced a steady decline during the most recent five years. OWestbridge's rate of return on assets has been erratic but generally higher than the return on equity. The company's rate of return on assets has maintained a somewhat steady growth rate. Complete this question by entering your answers in the tabs below. Required 3 Required 4 Required 1 Required 2 Required 5 Required 6 Which determinant of rate of return on assets seems to be the reason for the changes observed? OThe company's profit margin is erratic. The company's profit margin is in decline. The company's asset turnover is declining. Complete this question by entering your answers in the tabs below. Required 5 Required 6 Required 1 Required 2 Required 3 Required 4 How would you characterize the trend in Westbridge's rate of return to shareholders relative to the trend in its rate of return on assets? OThe company's rate of return on equity and its rate of retum on assets have trended generally in proportion to one another, though at asomewhat erratic pace. OThe company's rate of return on assets has experienced a steady decline during the most recent five years, but the steadily rising equity multiplier has allowed the return on equity to remain at a high level. OThe company's rate of return on equity and its rate of return on assets have trended opposite to one another in general, though at a somewhat erratic pace. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What general conclusion would you draw from the data depicted in the Dashboard? The rising equity multiplier is due primarity to increasing assets while holding debt relatively constant and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a decining return on assets. OThe rising equity multiplier is due primarily to increasing shareholders' equity and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a declining retum on assets. Olncreasing debt relative to equity has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, but also increases the potential for default on that debt. You are an analyst for Opulent Wealth Management. One of the companies you follow is Westbridge Insulation. A highlight of Westbridge's financials is its apparent ability to maintain a fairly steady pattem of generating a rate of return to its shareholders of about 20%. Recently, though, you have become concerned with changes in some of the company's other numbers. You have enlisted the assistance of your staff to create a Tableau Dashboard for the purpose of conducting an analysis using the DuPont Framework, whereby the return on equity is decomposed into its determinants: gross margin, asset turnover, and leverage. Asset Turmover ROA ROE Return on Assets vs Return on Equity ROA = Profit Margin x Turnover Profit Margin on Sales ROA 5.00 2014 2018 2016 2011 2018 3019 2020 2021 200 20% 1.00 LLLLLLLLLLILLL 2014 201s 2014 2011 2018 2019 2020 221 Fquity Maltiplier ROA Equity Multiplier = Total Assets / Total SE Avg TA ROE = Equity Multiplier x ROA Avg SE ROMI 2014 2017 2018 3019 2010 2021 4.00 2.00 L00 .00 2014 2015 2014 2017 2018 2019 2020 2011 Rate ef Raturs Eguity Multipler ROA A Pru Margin Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What is Westbridge's rate of return on assets in 2014 and in 2021? D4.8% In 2014 and 8.7% in 2021 08.7% in 2014 and 4.8% in 2021 19.6% in 2014 and 20.4% in 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on equity during the most recent eight years? The company's rate of return on equity has maintained a somewhat steady growth rate. The company's rate of return on equity has been erratic but increasing. OWestbridge has maintained a fairly steady pattern of generating a rate of return to its shareholders of about 20%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on assets? OThe company's rate of return on assets has experienced a steady decline during the most recent five years. OWestbridge's rate of return on assets has been erratic but generally higher than the return on equity. The company's rate of return on assets has maintained a somewhat steady growth rate. Complete this question by entering your answers in the tabs below. Required 3 Required 4 Required 1 Required 2 Required 5 Required 6 Which determinant of rate of return on assets seems to be the reason for the changes observed? OThe company's profit margin is erratic. The company's profit margin is in decline. The company's asset turnover is declining. Complete this question by entering your answers in the tabs below. Required 5 Required 6 Required 1 Required 2 Required 3 Required 4 How would you characterize the trend in Westbridge's rate of return to shareholders relative to the trend in its rate of return on assets? OThe company's rate of return on equity and its rate of retum on assets have trended generally in proportion to one another, though at asomewhat erratic pace. OThe company's rate of return on assets has experienced a steady decline during the most recent five years, but the steadily rising equity multiplier has allowed the return on equity to remain at a high level. OThe company's rate of return on equity and its rate of return on assets have trended opposite to one another in general, though at a somewhat erratic pace. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What general conclusion would you draw from the data depicted in the Dashboard? The rising equity multiplier is due primarity to increasing assets while holding debt relatively constant and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a decining return on assets. OThe rising equity multiplier is due primarily to increasing shareholders' equity and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a declining retum on assets. Olncreasing debt relative to equity has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, but also increases the potential for default on that debt. You are an analyst for Opulent Wealth Management. One of the companies you follow is Westbridge Insulation. A highlight of Westbridge's financials is its apparent ability to maintain a fairly steady pattem of generating a rate of return to its shareholders of about 20%. Recently, though, you have become concerned with changes in some of the company's other numbers. You have enlisted the assistance of your staff to create a Tableau Dashboard for the purpose of conducting an analysis using the DuPont Framework, whereby the return on equity is decomposed into its determinants: gross margin, asset turnover, and leverage. Asset Turmover ROA ROE Return on Assets vs Return on Equity ROA = Profit Margin x Turnover Profit Margin on Sales ROA 5.00 2014 2018 2016 2011 2018 3019 2020 2021 200 20% 1.00 LLLLLLLLLLILLL 2014 201s 2014 2011 2018 2019 2020 221 Fquity Maltiplier ROA Equity Multiplier = Total Assets / Total SE Avg TA ROE = Equity Multiplier x ROA Avg SE ROMI 2014 2017 2018 3019 2010 2021 4.00 2.00 L00 .00 2014 2015 2014 2017 2018 2019 2020 2011 Rate ef Raturs Eguity Multipler ROA A Pru Margin Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What is Westbridge's rate of return on assets in 2014 and in 2021? D4.8% In 2014 and 8.7% in 2021 08.7% in 2014 and 4.8% in 2021 19.6% in 2014 and 20.4% in 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on equity during the most recent eight years? The company's rate of return on equity has maintained a somewhat steady growth rate. The company's rate of return on equity has been erratic but increasing. OWestbridge has maintained a fairly steady pattern of generating a rate of return to its shareholders of about 20%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 How would you describe the trend in the company's rate of return on assets? OThe company's rate of return on assets has experienced a steady decline during the most recent five years. OWestbridge's rate of return on assets has been erratic but generally higher than the return on equity. The company's rate of return on assets has maintained a somewhat steady growth rate. Complete this question by entering your answers in the tabs below. Required 3 Required 4 Required 1 Required 2 Required 5 Required 6 Which determinant of rate of return on assets seems to be the reason for the changes observed? OThe company's profit margin is erratic. The company's profit margin is in decline. The company's asset turnover is declining. Complete this question by entering your answers in the tabs below. Required 5 Required 6 Required 1 Required 2 Required 3 Required 4 How would you characterize the trend in Westbridge's rate of return to shareholders relative to the trend in its rate of return on assets? OThe company's rate of return on equity and its rate of retum on assets have trended generally in proportion to one another, though at asomewhat erratic pace. OThe company's rate of return on assets has experienced a steady decline during the most recent five years, but the steadily rising equity multiplier has allowed the return on equity to remain at a high level. OThe company's rate of return on equity and its rate of return on assets have trended opposite to one another in general, though at a somewhat erratic pace. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 What general conclusion would you draw from the data depicted in the Dashboard? The rising equity multiplier is due primarity to increasing assets while holding debt relatively constant and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a decining return on assets. OThe rising equity multiplier is due primarily to increasing shareholders' equity and has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, despite a declining retum on assets. Olncreasing debt relative to equity has provided the leverage that has allowed Westbridge to maintain a high level of return on equity, but also increases the potential for default on that debt.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

58 Requirement 1 59 60 What is Westbridges rate of return on a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started