Answered step by step

Verified Expert Solution

Question

1 Approved Answer

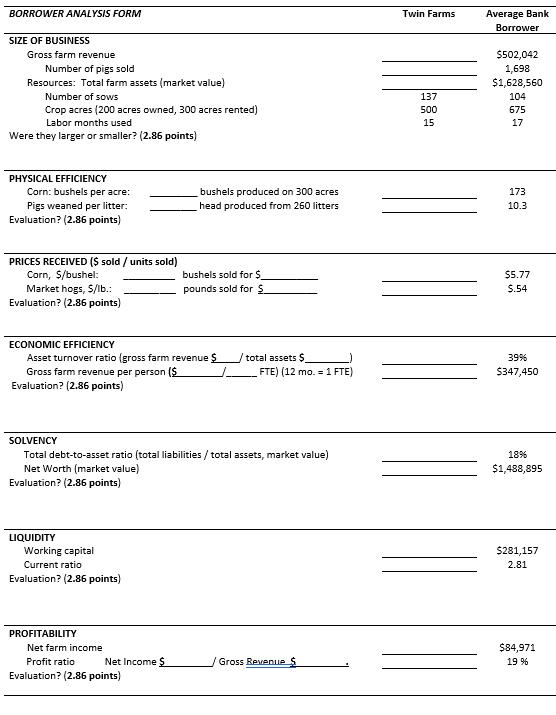

How do you do the size of business and profitability portion? fou are the loan officer who handles Glory Farm's account at the local bank.

How do you do the size of business and profitability portion?

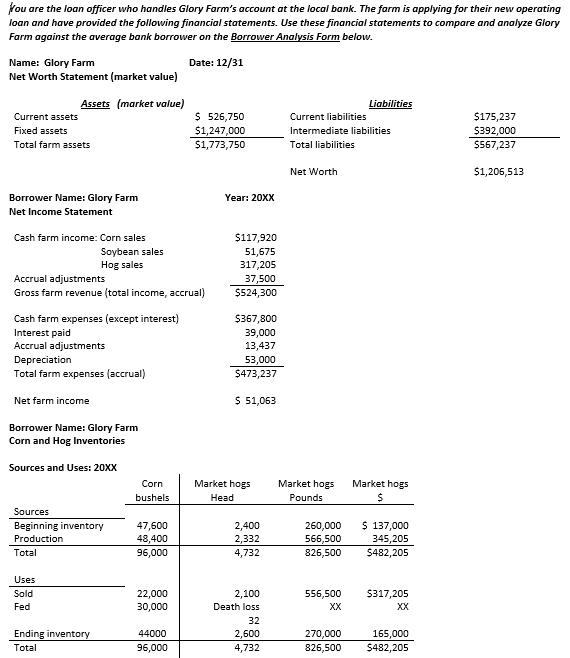

fou are the loan officer who handles Glory Farm's account at the local bank. The farm is applying for their new operating loan and have provided the following financial statements. Use these financial statements to compare and analyze Glory Farm against the average bank borrower on the Borrower Analysis Form below. Name: Glory Farm Date: 12/31 Net Worth Statement (market value) Assets (market value) Liabilities $ 526,750 $1,247,000 S1,773,750 $175,237 $392,000 $567,237 Current assets Current liabilities Fixed assets Intermediate liabilities Total farm assets Total liabilities Net Worth $1,206,513 Borrower Name: Glory Farm Year: 20XX Net Income Statement Cash farm income: Corn sales $117,920 Soybean sales 51,675 317,205 Hog sales Accrual adjustments 37,500 $524,300 Gross farm revenue (total income, accrual) Cash farm expenses (except interest) Interest paid Accrual adjustments $367,800 39,000 13,437 Depreciation 53,000 Total farm expenses (accrual) $473,237 Net farm income $ 51,063 Borrower Name: Glory Farm Corn and Hog Inventories Sources and Uses: 20XX Corn Market hogs Market hogs Market hogs bushels ead Pounds Sources Beginning inventory 47,600 2,400 $ 137,000 260,000 566,500 Production 48,400 2,332 345,205 Total 96,000 4,732 826,500 $482,205 Uses Sold $317,205 22,000 30,000 2,100 556,500 Fed Death loss XX XX 32 2,600 270,000 826,500 Ending inventory 44000 165,000 Total 96,000 4,732 $482,205

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer Assuming All the data Solution SIZE OF BUSINESS Twin Farms Average Bank Borrower Gross f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started