You own a 4%, 6 year to maturity bond which is selling for 94.871. You are concerned that the market rates of interest may

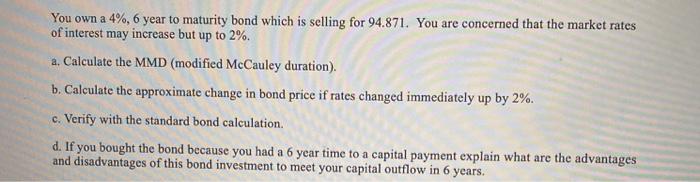

You own a 4%, 6 year to maturity bond which is selling for 94.871. You are concerned that the market rates of interest may increase but up to 2%. a. Calculate the MMD (modified McCauley duration). b. Calculate the approximate change in bond price if rates changed immediately up by 2%. c. Verify with the standard bond calculation. d. If you bought the bond because you had a 6 year time to a capital payment explain what are the advantages and disadvantages of this bond investment to meet your capital outflow in 6 years.

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Part a Yield of the bond Rate Nper PMT PV FV Rate 6 4 x 100 94871 1000 501 Years T NCF PV501 Duratio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started