Answered step by step

Verified Expert Solution

Question

1 Approved Answer

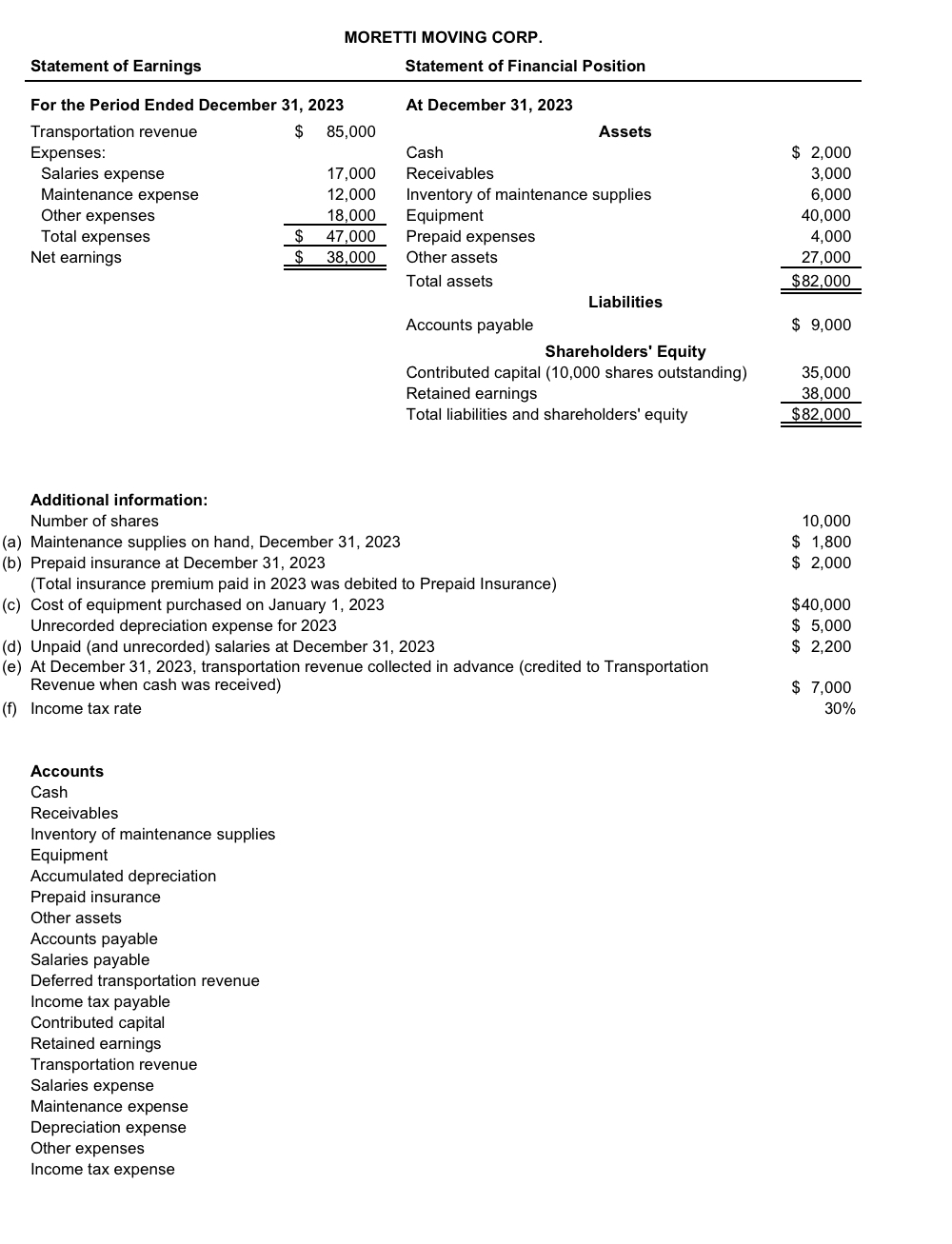

Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed

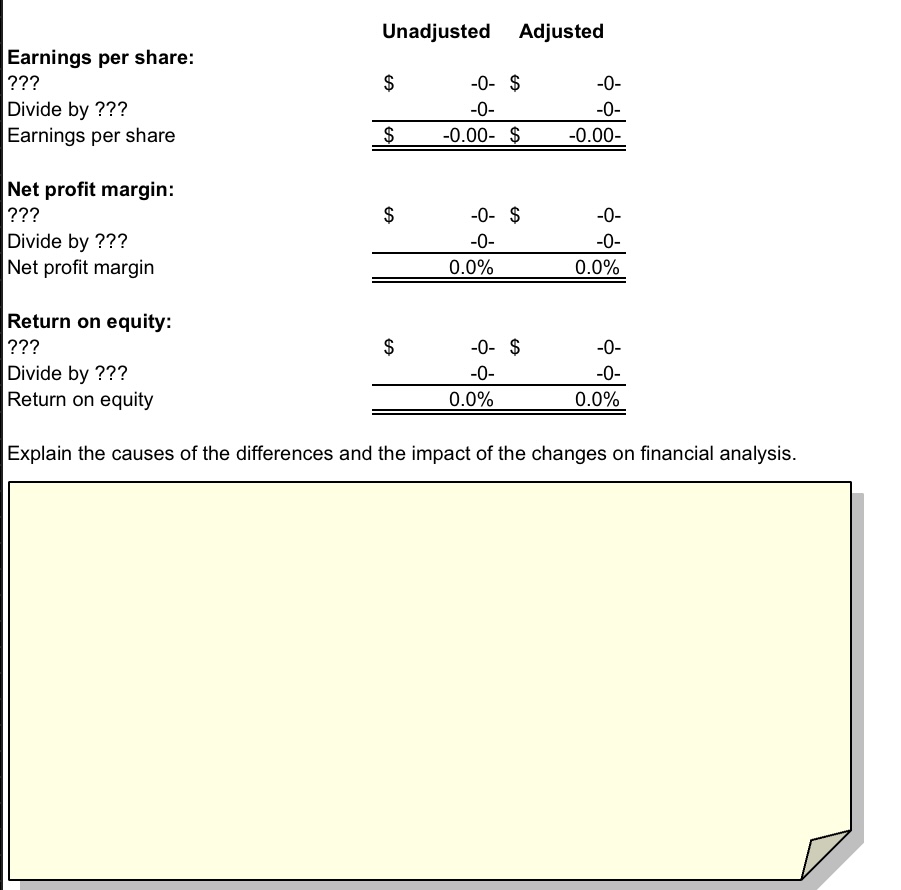

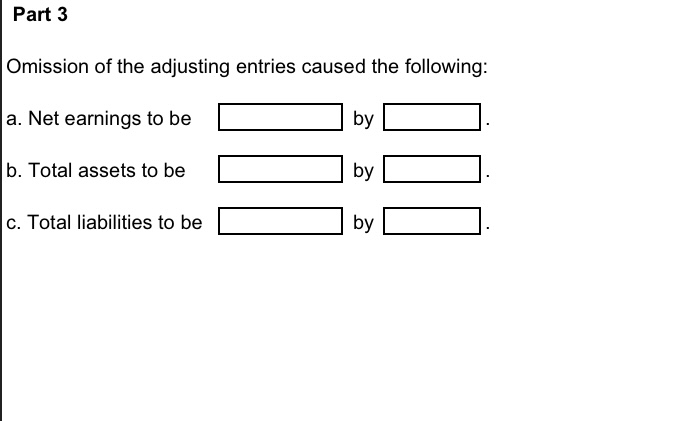

Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed capital Retained earnings Transportation revenue Salaries expense Maintenance expense Depreciation expense Other expenses Income tax expense Explain the causes of the differences and the impact of the changes on financial analysis. Omission of the adjusting entries caused the following: a. Net earnings to be by b. Total assets to be by c. Total liabilities to be by Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed capital Retained earnings Transportation revenue Salaries expense Maintenance expense Depreciation expense Other expenses Income tax expense Explain the causes of the differences and the impact of the changes on financial analysis. Omission of the adjusting entries caused the following: a. Net earnings to be by b. Total assets to be by c. Total liabilities to be by

Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed capital Retained earnings Transportation revenue Salaries expense Maintenance expense Depreciation expense Other expenses Income tax expense Explain the causes of the differences and the impact of the changes on financial analysis. Omission of the adjusting entries caused the following: a. Net earnings to be by b. Total assets to be by c. Total liabilities to be by Accounts Cash Receivables Inventory of maintenance supplies Equipment Accumulated depreciation Prepaid insurance Other assets Accounts payable Salaries payable Deferred transportation revenue Income tax payable Contributed capital Retained earnings Transportation revenue Salaries expense Maintenance expense Depreciation expense Other expenses Income tax expense Explain the causes of the differences and the impact of the changes on financial analysis. Omission of the adjusting entries caused the following: a. Net earnings to be by b. Total assets to be by c. Total liabilities to be by Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started