Answered step by step

Verified Expert Solution

Question

1 Approved Answer

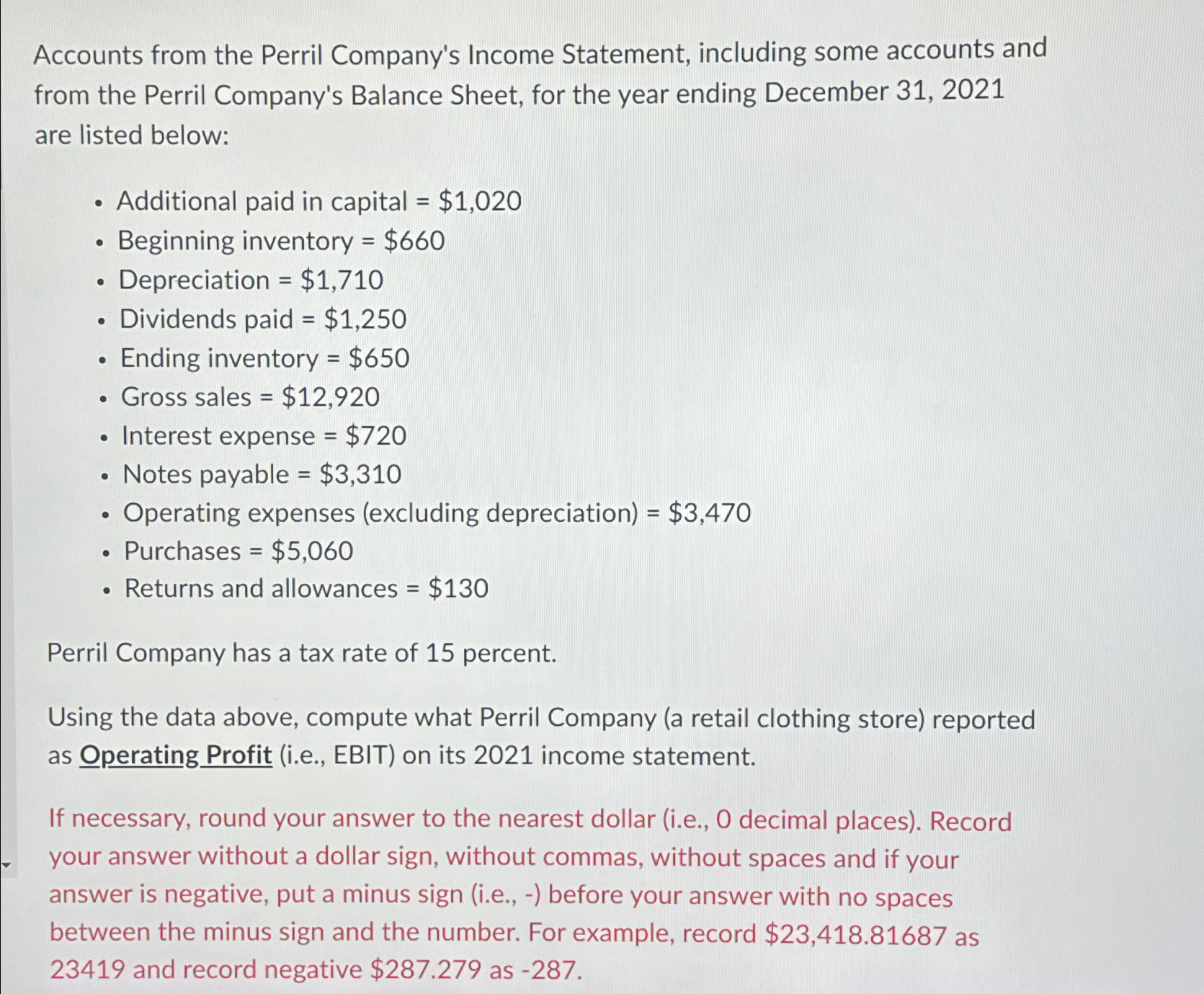

Accounts from the Perril Company's Income Statement, including some accounts and from the Perril Company's Balance Sheet, for the year ending December 3 1 ,

Accounts from the Perril Company's Income Statement, including some accounts and from the Perril Company's Balance Sheet, for the year ending December are listed below:

Additional paid in capital $

Beginning inventory $

Depreciation $

Dividends paid $

Ending inventory $

Gross sales $

Interest expense $

Notes payable $

Operating expenses excluding depreciation$

Purchases $

Returns and allowances $

Perril Company has a tax rate of percent.

Using the data above, compute what Perril Company a retail clothing store reported as Operating Profit ie EBIT on its income statement.

If necessary, round your answer to the nearest dollar ie decimal places Record your answer without a dollar sign, without commas, without spaces and if your answer is negative, put a minus sign ie before your answer with no spaces between the minus sign and the number. For example, record $ as and record negative $ as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started