Harper Products signed a contract with Cranmore Manufacturing to design, develop, and produce a specialized plastic molding machine for its factory operations. The machine

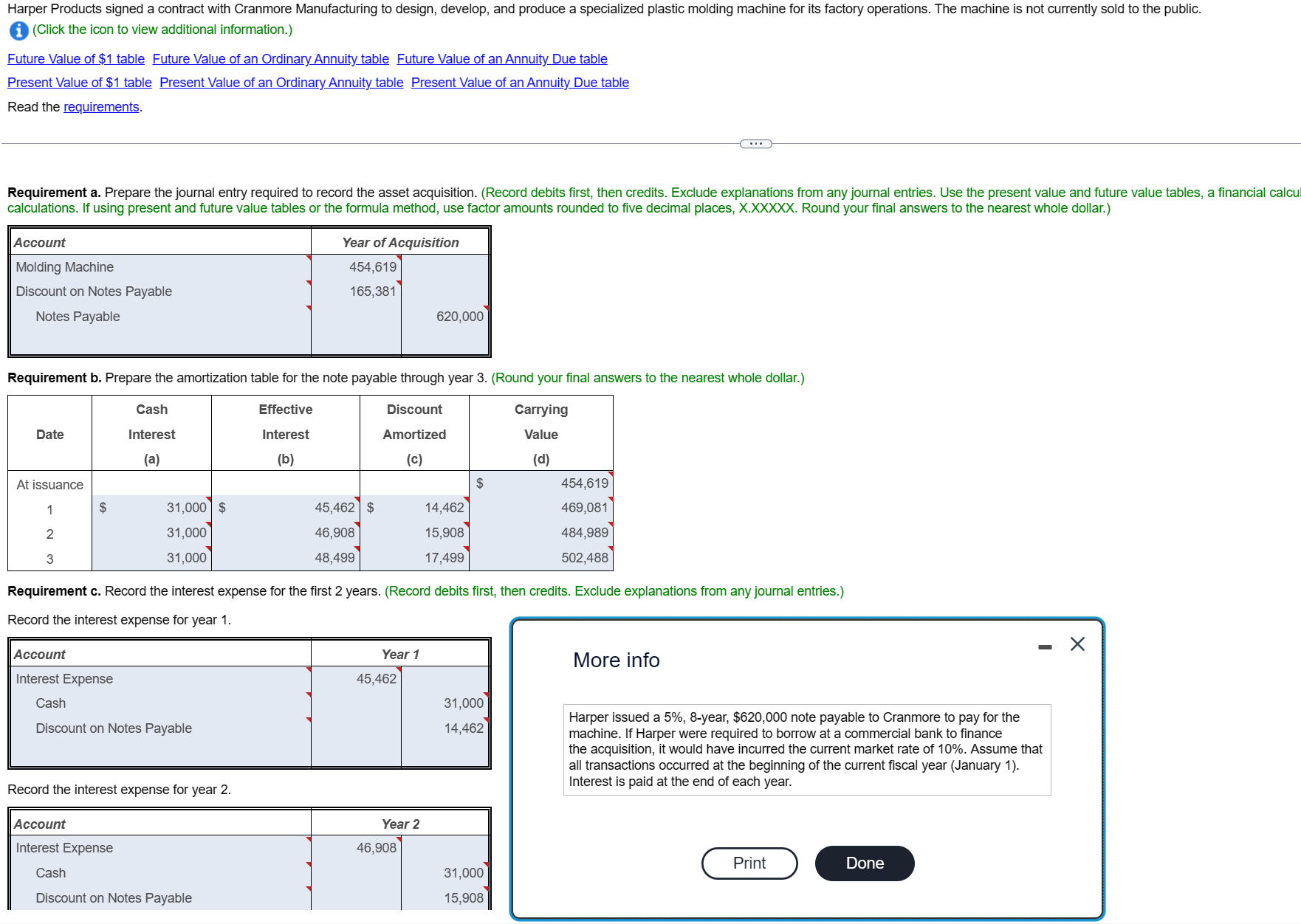

Harper Products signed a contract with Cranmore Manufacturing to design, develop, and produce a specialized plastic molding machine for its factory operations. The machine is not currently sold to the public. (Click the icon to view additional information.) Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Read the requirements. Requirement a. Prepare the journal entry required to record the asset acquisition. (Record debits first, then credits. Exclude explanations from any journal entries. Use the present value and future value tables, a financial calcu calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answers to the nearest whole dollar.) Account Molding Machine Discount on Notes Payable Notes Payable Year of Acquisition 454,619 165,381 620,000 Requirement b. Prepare the amortization table for the note payable through year 3. (Round your final answers to the nearest whole dollar.) Date Cash Interest (a) Effective Interest Discount Carrying Amortized Value (b) (c) (d) At issuance $ 454,619 1 31,000 $ 23 31,000 31,000 45,462 $ 46,908 48,499 14,462 469,081 15,908 484,989 17,499 502,488 Requirement c. Record the interest expense for the first 2 years. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the interest expense for year 1. Account Interest Expense Year 1 45,462 More info Cash Discount on Notes Payable Record the interest expense for year 2. Account Interest Expense Cash Discount on Notes Payable Year 2 46,908 31,000 14,462 31,000 15,908 Harper issued a 5%, 8-year, $620,000 note payable to Cranmore to pay for the machine. If Harper were required to borrow at a commercial bank to finance the acquisition, it would have incurred the current market rate of 10%. Assume that all transactions occurred at the beginning of the current fiscal year (January 1). Interest is paid at the end of each year. Print Done -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing Harper Products Note Payable Requirement a Journal ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started