Answered step by step

Verified Expert Solution

Question

1 Approved Answer

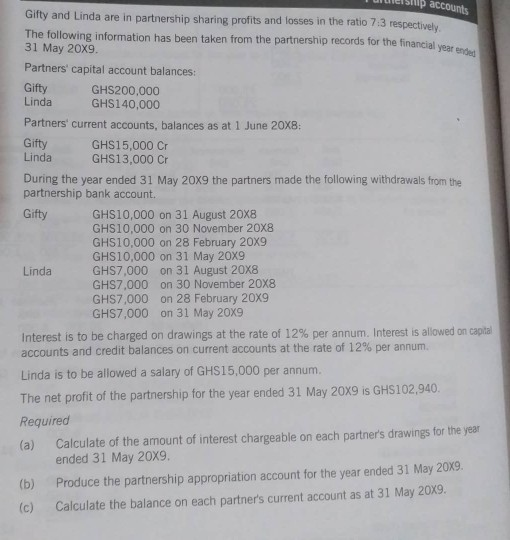

accounts Gifty and Linda are in partnership sharing profits and losses in the ratio 7:3 respectively. The following information has been taken from the partnership

accounts Gifty and Linda are in partnership sharing profits and losses in the ratio 7:3 respectively. The following information has been taken from the partnership records for the financial year endas 31 May 20X9. Partners' capital account balances: Gifty GHS200,000 Linda GHS140,000 Partners' current accounts, balances as at 1 June 20X8: Gifty GHS15,000 Cr Linda GHS13,000 Cr During the year ended 31 May 20x9 the partners made the following withdrawals from the partnership bank account. Gifty GHS10,000 on 31 August 20x8 GHS10,000 on 30 November 20X8 GHS10,000 on 28 February 20X9 GHS10,000 on 31 May 20X9 Linda GHS7,000 on 31 August 20x8 GHS7,000 on 30 November 20x8 GHS7,000 on 28 February 20X9 GHS7,000 on 31 May 20X9 Interest is to be charged on drawings at the rate of 12% per annum. Interest is allowed on capital accounts and credit balances on current accounts at the rate of 12% per annum. Linda is to be allowed a salary of GHS15,000 per annum The net profit of the partnership for the year ended 31 May 20x9 is GHS102,940. Required (a) Calculate of the amount of interest chargeable on each partner's drawings for the year ended 31 May 20X9. (b) Produce the partnership appropriation account for the year ended 31 May 20X9. (c) Calculate the balance on each partner's current account as at 31 May 20X9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started