Answered step by step

Verified Expert Solution

Question

1 Approved Answer

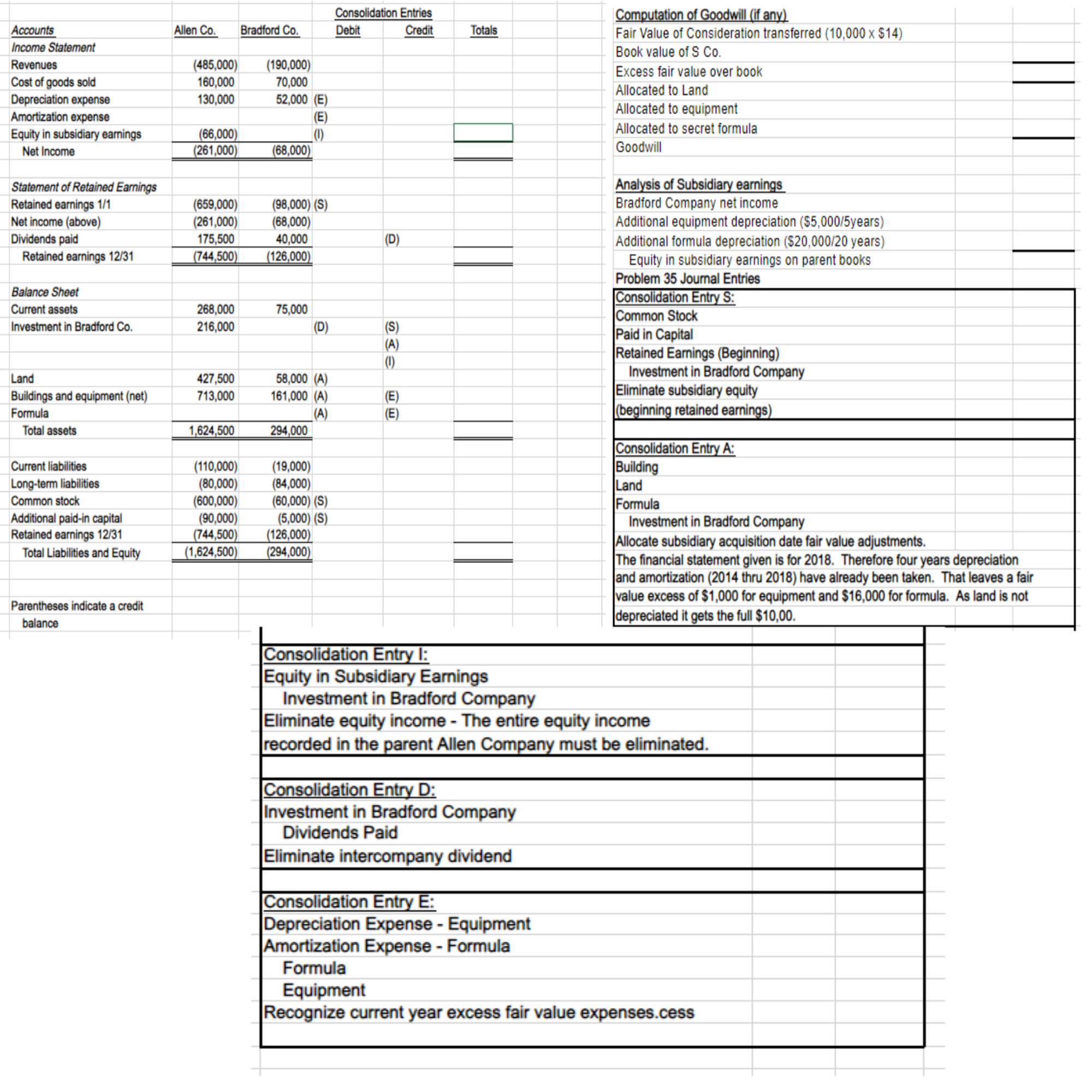

Accounts Income Statement Revenues Cost of goods sold Allen Co. Bradford Co. Debit (485,000) (190,000) 160,000 70,000 Depreciation expense 130,000 52,000 (E) Amortization expense

Accounts Income Statement Revenues Cost of goods sold Allen Co. Bradford Co. Debit (485,000) (190,000) 160,000 70,000 Depreciation expense 130,000 52,000 (E) Amortization expense (E) Equity in subsidiary earnings (66,000) (0) Net Income (261,000) (68,000) Statement of Retained Earnings Retained earnings 1/1 (659,000) (98,000) (S) Net income (above) (261,000) (68,000) Dividends paid 175,500 40,000 Retained earnings 12/31 (744,500) (126,000) Balance Sheet Current assets 268,000 75,000 Investment in Bradford Co. 216,000 (D) (S) (A) (0) Land 427,500 58,000 (A) Buildings and equipment (net) 713,000 161,000 (A) (E) Formula (A) (E) Total assets 1,624,500 294,000 Current liabilities (110,000) (19,000) Long-term liabilities (80,000) (84,000) Common stock (600,000) (60,000) (S) Additional paid-in capital (90,000) (5,000) (S) Retained earnings 12/31 (744,500) (126,000) Total Liabilities and Equity (1,624,500) (294,000) Parentheses indicate a credit balance Consolidation Entries (D) ww Credit Totals Computation of Goodwill (if any) Fair Value of Consideration transferred (10,000 x $14) Book value of S Co. Excess fair value over book Allocated to Land Allocated to equipment Allocated to secret formula Goodwill Analysis of Subsidiary earnings Bradford Company net income Additional equipment depreciation ($5,000/5years) Additional formula depreciation ($20,000/20 years) Equity in subsidiary earnings on parent books Problem 35 Journal Entries Consolidation Entry S: Common Stock Paid in Capital Retained Earnings (Beginning) Investment in Bradford Company Eliminate subsidiary equity (beginning retained earnings) Consolidation Entry A: Building Land Formula Investment in Bradford Company Allocate subsidiary acquisition date fair value adjustments. The financial statement given is for 2018. Therefore four years depreciation and amortization (2014 thru 2018) have already been taken. That leaves a fair value excess of $1,000 for equipment and $16,000 for formula. As land is not depreciated it gets the full $10,00. Consolidation Entry I: Equity in Subsidiary Earnings Investment in Bradford Company Eliminate equity income - The entire equity income recorded in the parent Allen Company must be eliminated. Consolidation Entry D: Investment in Bradford Company Dividends Paid Eliminate intercompany dividend Consolidation Entry E: Depreciation Expense - Equipment Amortization Expense - Formula Formula Equipment Recognize current year excess fair value expenses.cess

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the consolidation entries required Consolidation Entry S Retained Earnings Bradfor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started