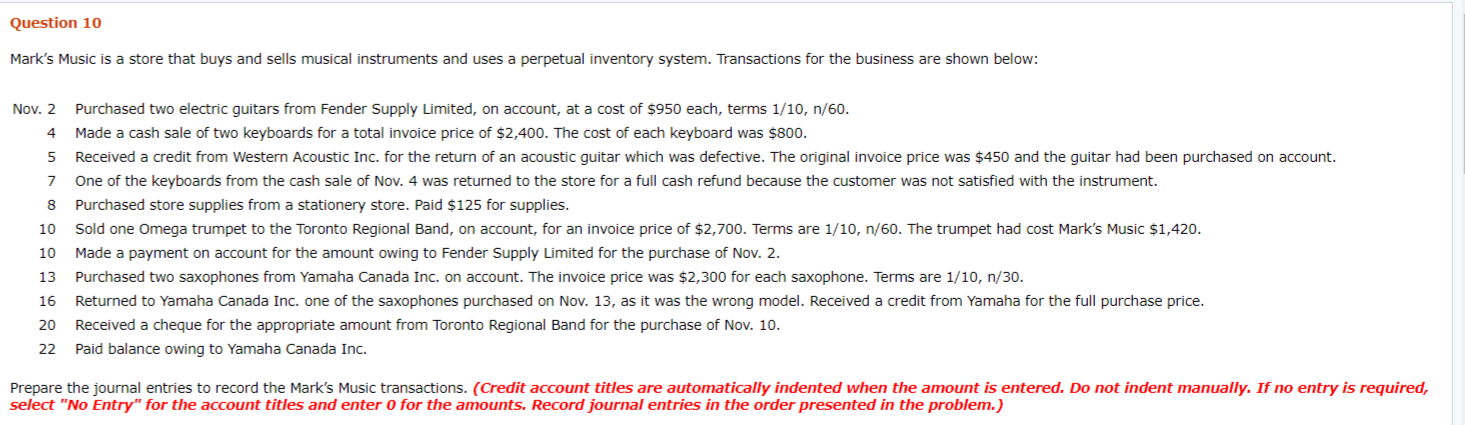

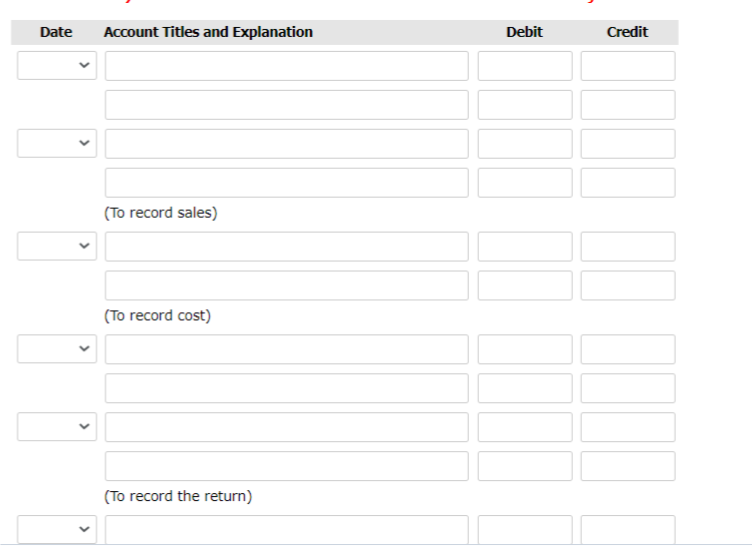

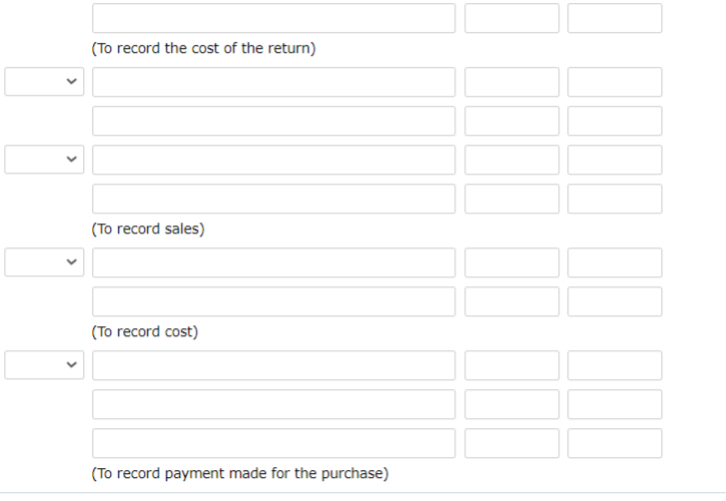

Question

Accounts Payable Accounts Receivable Accumulated Depreciation - Building Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture Advertising Expense Building Cash Cost of Goods Sold Current

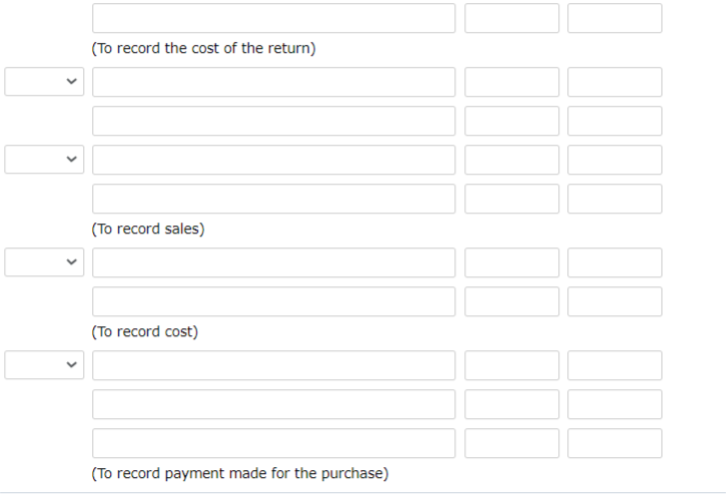

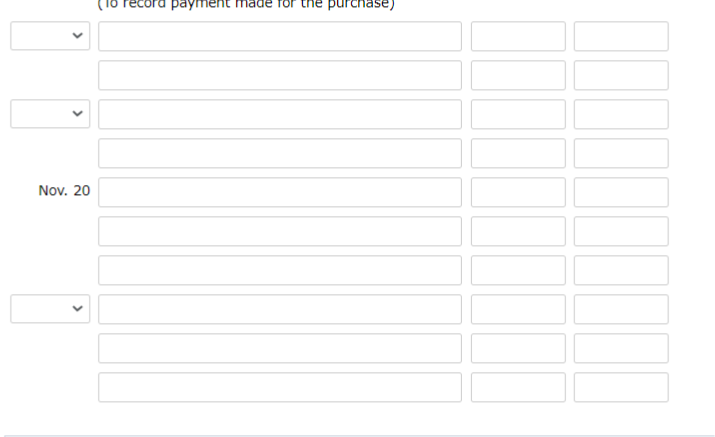

Accounts Payable Accounts Receivable Accumulated Depreciation - Building Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture Advertising Expense Building Cash Cost of Goods Sold Current Portion of Mortgage Payable Current Portion of Non-Current Notes Payable Depreciation Expense Freight In Freight Out Furniture Income Summary Insurance Expense Interest Expense Interest Payable Interest Revenue Merchandise Inventory No Entry Notes Payable Owner's Capital Owner's Drawings Prepaid Insurance Property Tax Expense Purchase Discounts Purchase Returns and Allowances Purchases Rent Expense Rent Revenue Salaries Expense Salaries Payable Sales Sales Discounts Sales Returns and Allowances Short-Term Investments Supplies Supplies Expense Telephone Expense Unearned Revenue Utilities Expense

Accounts Payable Accounts Receivable Accumulated Depreciation - Building Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture Advertising Expense Building Cash Cost of Goods Sold Current Portion of Mortgage Payable Current Portion of Non-Current Notes Payable Depreciation Expense Freight In Freight Out Furniture Income Summary Insurance Expense Interest Expense Interest Payable Interest Revenue Merchandise Inventory No Entry Notes Payable Owner's Capital Owner's Drawings Prepaid Insurance Property Tax Expense Purchase Discounts Purchase Returns and Allowances Purchases Rent Expense Rent Revenue Salaries Expense Salaries Payable Sales Sales Discounts Sales Returns and Allowances Short-Term Investments Supplies Supplies Expense Telephone Expense Unearned Revenue Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started