Answered step by step

Verified Expert Solution

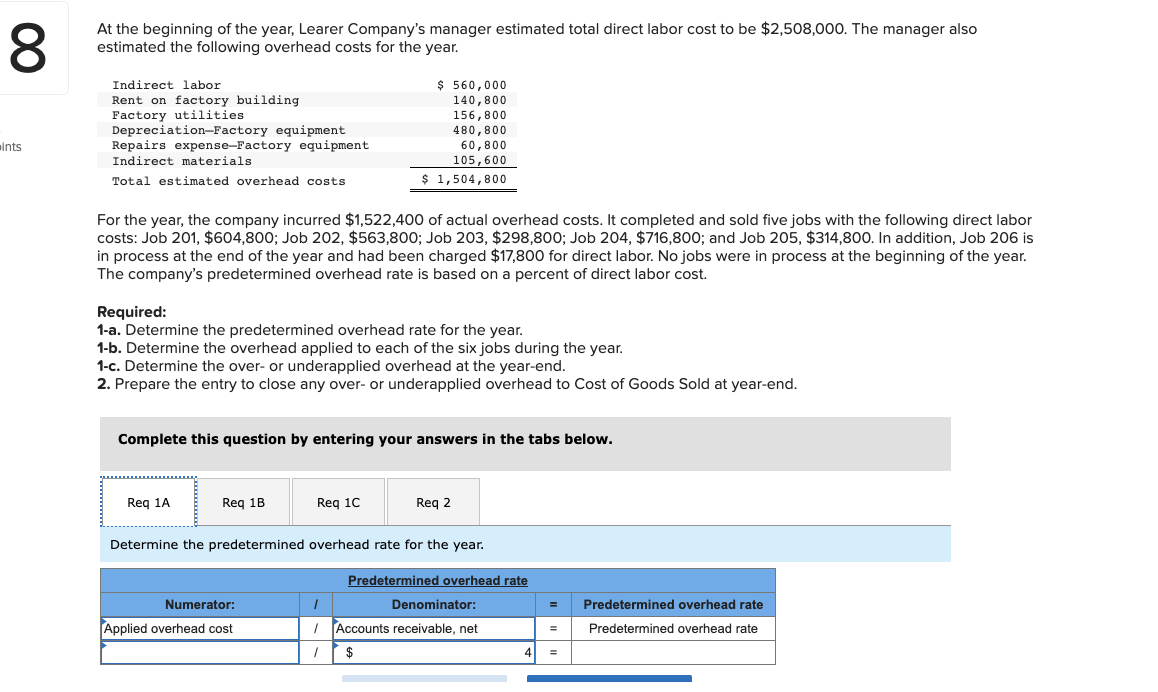

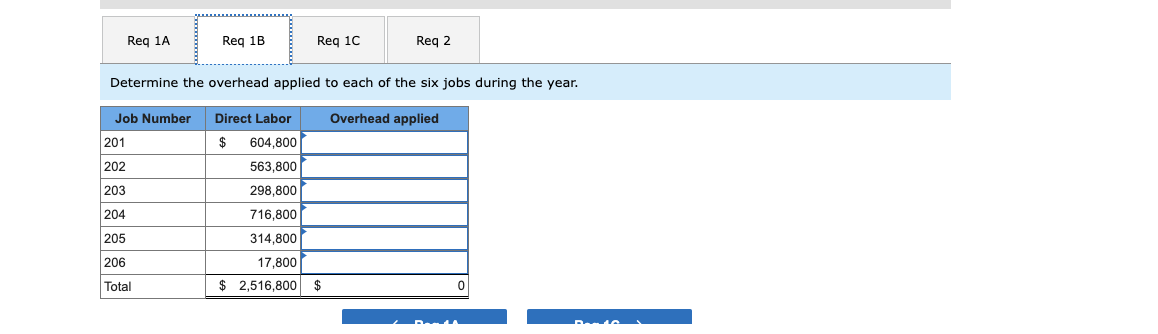

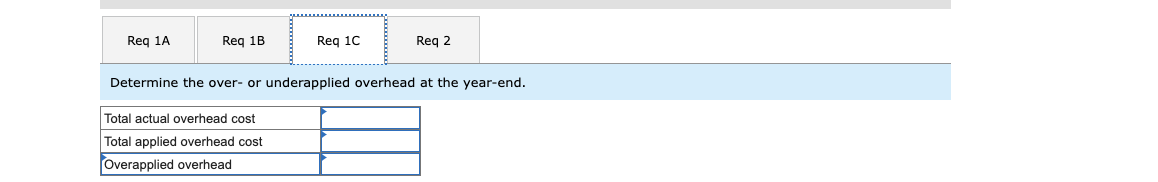

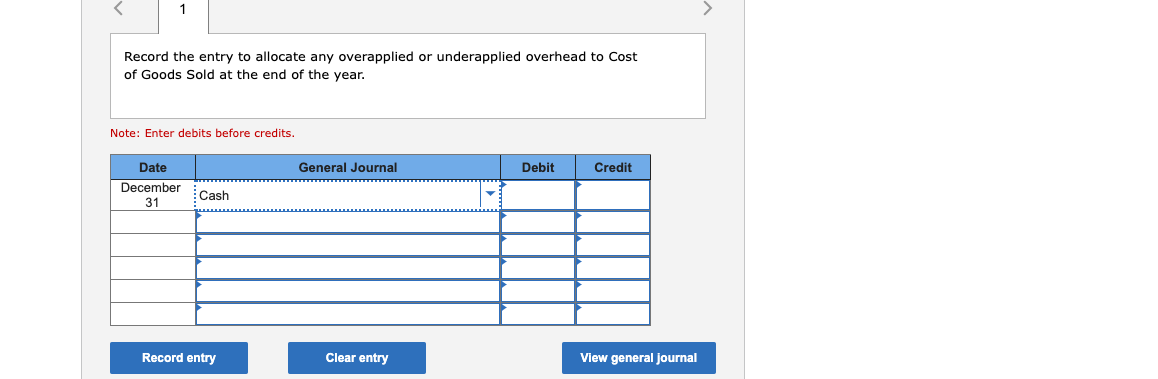

Question

1 Approved Answer

Accounts payable Accounts receivable Accumulated depreciation Cash Common stock Cost of goods sold Factory overhead Factory wages payable Finished goods inventory General and administrative expenses

- Accounts payable

- Accounts receivable

- Accumulated depreciation

- Cash

- Common stock

- Cost of goods sold

- Factory overhead

- Factory wages payable

- Finished goods inventory

- General and administrative expenses

- Notes payable

- Prepaid rent

- Raw materials inventory

- Retained earnings

- Sales

- Work in process inventory

- Accounts receivable, net

- Actual overhead cost

- Applied overhead cost

- Cost of goods sold

- Current assets

- Current liabilities

- Estimated direct labor cost

- Estimated overhead costs

- Net sales

- THANKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started