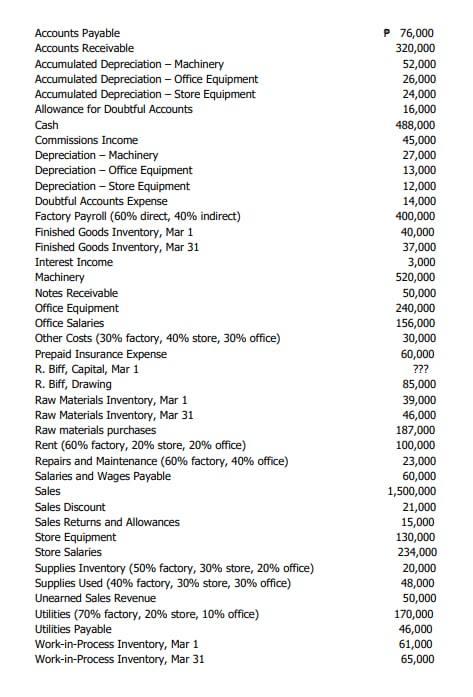

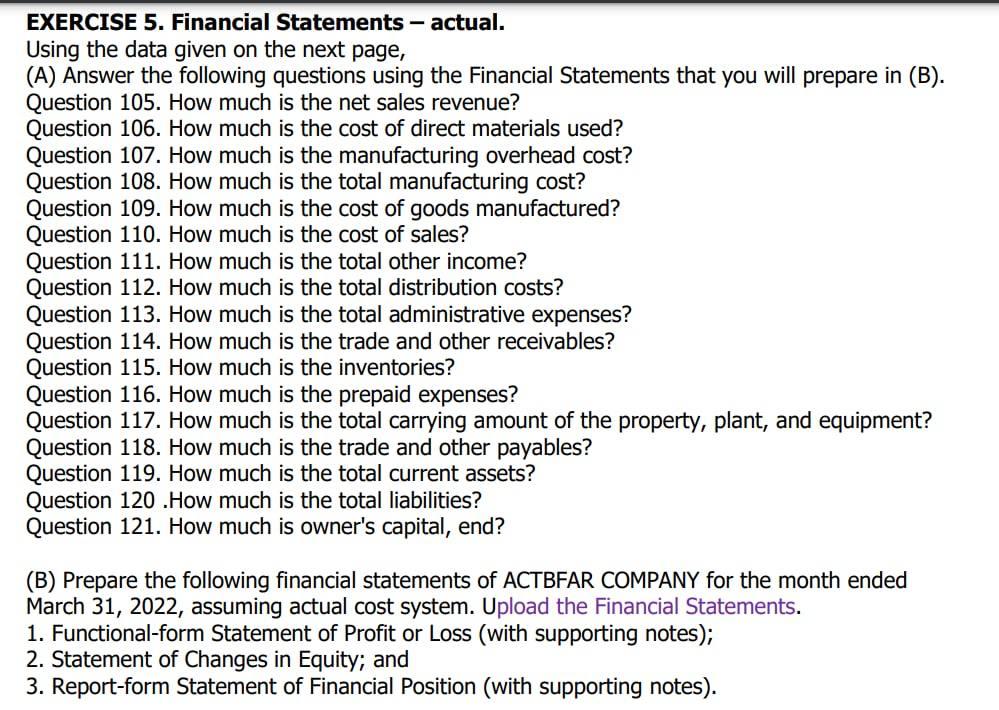

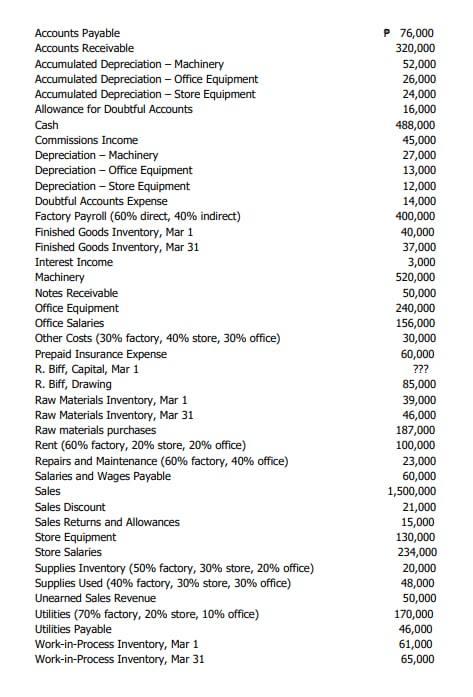

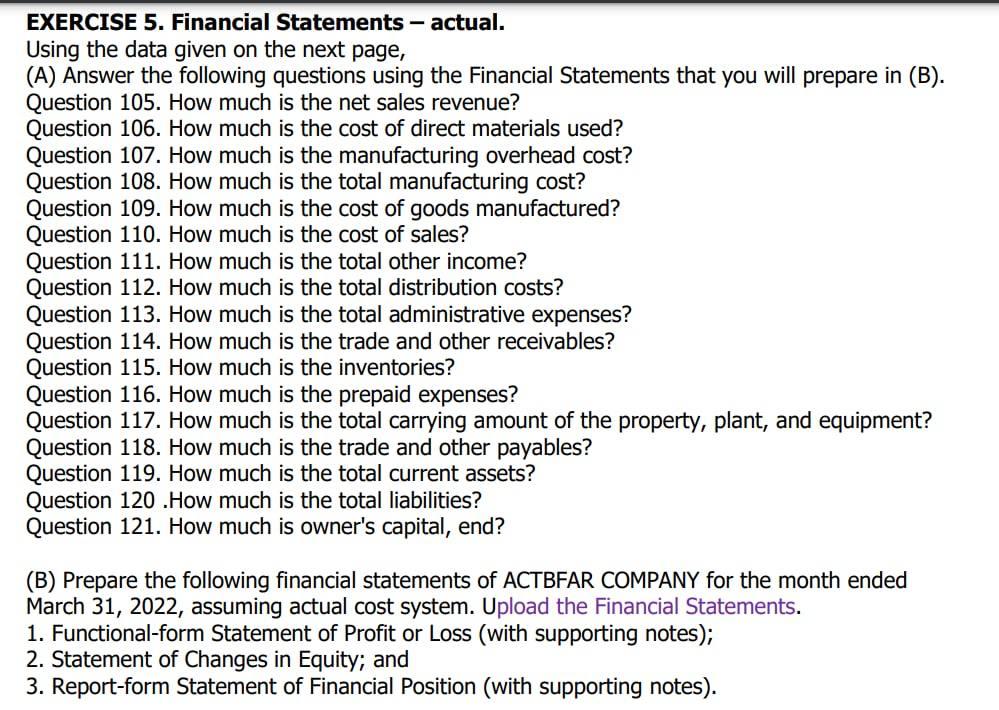

Accounts Payable Accounts Receivable Accumulated Depreciation - Machinery Accumulated Depreciation - Office Equipment Accumulated Depreciation - Store Equipment Allowance for Doubtful Accounts Cash Commissions Income Depreciation - Machinery Depreciation - Office Equipment Depreciation - Store Equipment Doubtful Accounts Expense Factory Payroll (60% direct, 40% indirect) Finished Goods Inventory, Mar 1 Finished Goods Inventory, Mar 31 Interest Income Machinery Notes Receivable Office Equipment Office Salaries Other Costs (30% factory, 40% store, 30% office) Prepaid Insurance Expense R. Biff, Capital, Mar 1 R. Biff, Drawing Raw Materials Inventory, Mar 1 Raw Materials Inventory, Mar 31 Raw materials purchases Rent (60% factory, 20% store, 20% office) Repairs and Maintenance (60% factory, 40% office) Salaries and Wages Payable Sales Sales Discount Sales Returns and Allowances Store Equipment Store Salaries Supplies Inventory (50% factory, 30% store, 20% office) Supplies Used (40% factory, 30% store, 30% office) Unearned Sales Revenue Utilities (70% factory, 20% store, 10% office) Utilities Payable Work-in-Process Inventory, Mar 1 Work-in-Process Inventory, Mar 31 P 76,000 320,000 52,000 26,000 24,000 16,000 488,000 45,000 27,000 13,000 12,000 14,000 400,000 40,000 37,000 3,000 520,000 50,000 240,000 156,000 30,000 60,000 ??? 85,000 39,000 46,000 187,000 100,000 23,000 60,000 1,500,000 21,000 15,000 130,000 234,000 20,000 48,000 50,000 170,000 46,000 61,000 65,000 EXERCISE 5. Financial Statements - actual. Using the data given on the next page, (A) Answer the following questions using the Financial Statements that you will prepare in (B). Question 105. How much is the net sales revenue? Question 106. How much is the cost of direct materials used? Question 107. How much is the manufacturing overhead cost? Question 108. How much is the total manufacturing cost? Question 109. How much is the cost of goods manufactured? Question 110. How much is the cost of sales? Question 111. How much is the total other income? Question 112. How much is the total distribution costs? Question 113. How much is the total administrative expenses? Question 114. How much is the trade and other receivables? Question 115. How much is the inventories? Question 116. How much is the prepaid expenses? Question 117. How much is the total carrying amount of the property, plant, and equipment? Question 118. How much is the trade and other payables? Question 119. How much is the total current assets? Question 120 .How much is the total liabilities? Question 121. How much is owner's capital, end? (B) Prepare the following financial statements of ACTBFAR COMPANY for the month ended March 31, 2022, assuming actual cost system. Upload the Financial Statements. 1. Functional-form Statement of Profit or Loss (with supporting notes); 2. Statement of Changes in Equity; and 3. Report-form Statement of Financial Position (with supporting notes). Accounts Payable Accounts Receivable Accumulated Depreciation - Machinery Accumulated Depreciation - Office Equipment Accumulated Depreciation - Store Equipment Allowance for Doubtful Accounts Cash Commissions Income Depreciation - Machinery Depreciation - Office Equipment Depreciation - Store Equipment Doubtful Accounts Expense Factory Payroll (60% direct, 40% indirect) Finished Goods Inventory, Mar 1 Finished Goods Inventory, Mar 31 Interest Income Machinery Notes Receivable Office Equipment Office Salaries Other Costs (30% factory, 40% store, 30% office) Prepaid Insurance Expense R. Biff, Capital, Mar 1 R. Biff, Drawing Raw Materials Inventory, Mar 1 Raw Materials Inventory, Mar 31 Raw materials purchases Rent (60% factory, 20% store, 20% office) Repairs and Maintenance (60% factory, 40% office) Salaries and Wages Payable Sales Sales Discount Sales Returns and Allowances Store Equipment Store Salaries Supplies Inventory (50% factory, 30% store, 20% office) Supplies Used (40% factory, 30% store, 30% office) Unearned Sales Revenue Utilities (70% factory, 20% store, 10% office) Utilities Payable Work-in-Process Inventory, Mar 1 Work-in-Process Inventory, Mar 31 P 76,000 320,000 52,000 26,000 24,000 16,000 488,000 45,000 27,000 13,000 12,000 14,000 400,000 40,000 37,000 3,000 520,000 50,000 240,000 156,000 30,000 60,000 ??? 85,000 39,000 46,000 187,000 100,000 23,000 60,000 1,500,000 21,000 15,000 130,000 234,000 20,000 48,000 50,000 170,000 46,000 61,000 65,000 EXERCISE 5. Financial Statements - actual. Using the data given on the next page, (A) Answer the following questions using the Financial Statements that you will prepare in (B). Question 105. How much is the net sales revenue? Question 106. How much is the cost of direct materials used? Question 107. How much is the manufacturing overhead cost? Question 108. How much is the total manufacturing cost? Question 109. How much is the cost of goods manufactured? Question 110. How much is the cost of sales? Question 111. How much is the total other income? Question 112. How much is the total distribution costs? Question 113. How much is the total administrative expenses? Question 114. How much is the trade and other receivables? Question 115. How much is the inventories? Question 116. How much is the prepaid expenses? Question 117. How much is the total carrying amount of the property, plant, and equipment? Question 118. How much is the trade and other payables? Question 119. How much is the total current assets? Question 120 .How much is the total liabilities? Question 121. How much is owner's capital, end? (B) Prepare the following financial statements of ACTBFAR COMPANY for the month ended March 31, 2022, assuming actual cost system. Upload the Financial Statements. 1. Functional-form Statement of Profit or Loss (with supporting notes); 2. Statement of Changes in Equity; and 3. Report-form Statement of Financial Position (with supporting notes)