Question

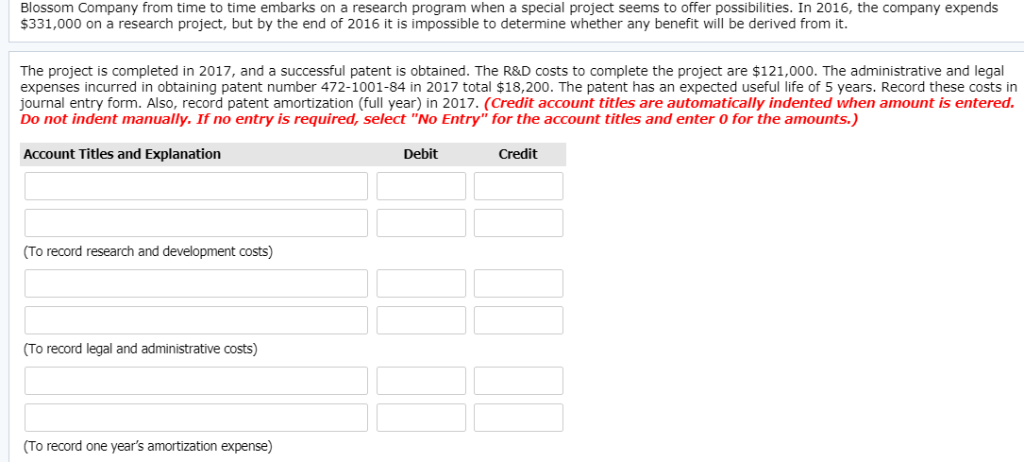

Accounts Payable Accounts Receivable Advertising Expense Amortization Expense Buildings Cash Computer Software Costs Copyrights Discount on Bonds Payable Equipment Franchises Goodwill Income Summary Intangible Assets

Accounts Payable Accounts Receivable Advertising Expense Amortization Expense Buildings Cash Computer Software Costs Copyrights Discount on Bonds Payable Equipment Franchises Goodwill Income Summary Intangible Assets Interest Expense Inventory Land Legal Fees Expense Loss on Impairment Long-term Notes Payable No Entry Notes Payable Organization Expense Paid-in Capital in Excess of Par - Common Stock Patents Patent Expense Prepaid Rent Recovery of Loss from Impairment Rent Expense Rent Receivable Rent Revenue Research and Development Expense Retained Earnings Trade Names Trademarks

Accounts Payable Accounts Receivable Advertising Expense Amortization Expense Buildings Cash Computer Software Costs Copyrights Discount on Bonds Payable Equipment Franchises Goodwill Income Summary Intangible Assets Interest Expense Inventory Land Legal Fees Expense Loss on Impairment Long-term Notes Payable No Entry Notes Payable Organization Expense Paid-in Capital in Excess of Par - Common Stock Patents Patent Expense Prepaid Rent Recovery of Loss from Impairment Rent Expense Rent Receivable Rent Revenue Research and Development Expense Retained Earnings Trade Names Trademarks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started