Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Accounts payable is actually $64,450) - Prepare an unadjusted trial balance at year end for the month . - Record the adjustments required at the

(Accounts payable is actually $64,450) - Prepare an unadjusted trial balance at year end for the month . - Record the adjustments required at the year end. Post the adjusting entries in the T Accounts created and update the account balances as required.

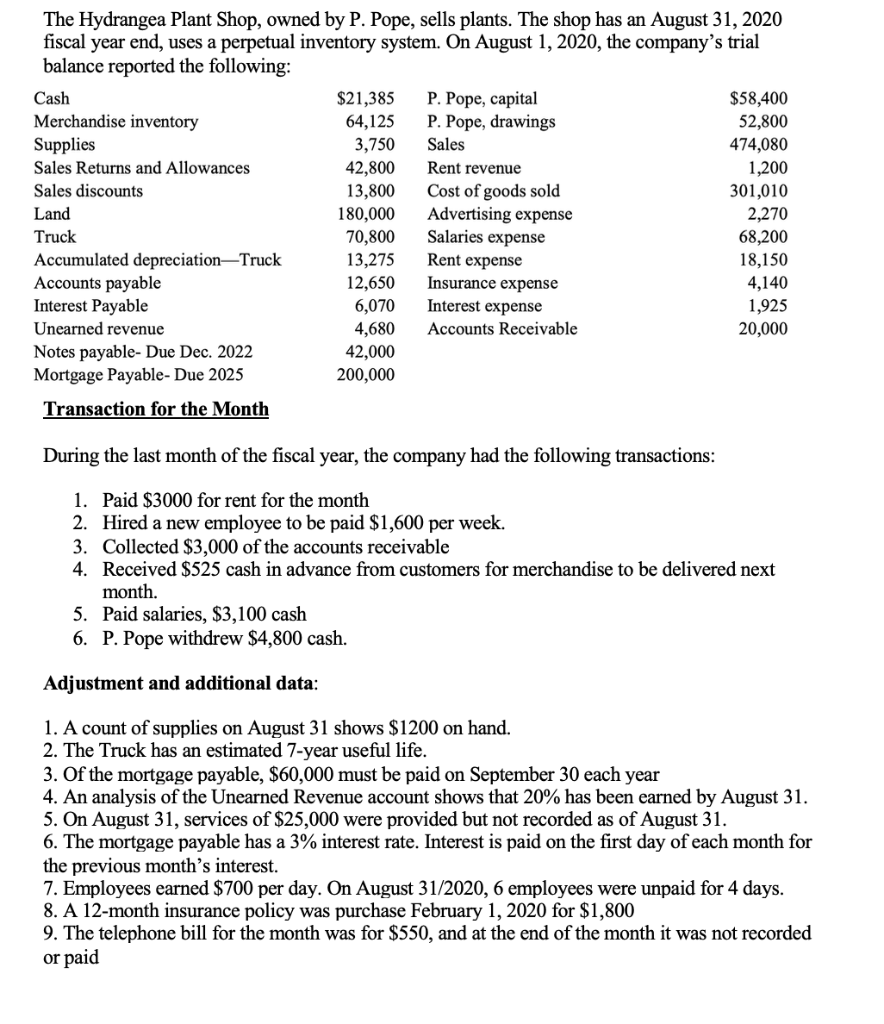

The Hydrangea Plant Shop, owned by P. Pope, sells plants. The shop has an August 31, 2020 fiscal year end, uses a perpetual inventory system. On August 1, 2020, the company's trial balance reported the following: Cash $21,385 P. Pope, capital $58,400 Merchandise inventory 64,125 P. Pope, drawings 52,800 Supplies 3,750 Sales 474,080 Sales Returns and Allowances 42,800 Rent revenue 1,200 Sales discounts 13,800 Cost of goods sold 301,010 Land 180,000 Advertising expense 2,270 Truck 70,800 Salaries expense 68,200 Accumulated depreciation-Truck 13,275 Rent expense 18,150 Accounts payable 12,650 Insurance expense 4,140 Interest Payable 6,070 Interest expense 1,925 Unearned revenue 4,680 Accounts Receivable 20,000 Notes payable-Due Dec. 2022 42,000 Mortgage Payable-Due 2025 200,000 Transaction for the Month During the last month of the fiscal year, the company had the following transactions: 1. Paid $3000 for rent for the month 2. Hired a new employee to be paid $1,600 per week. 3. Collected $3,000 of the accounts receivable 4. Received $525 cash in advance from customers for merchandise to be delivered next month. 5. Paid salaries, $3,100 cash 6. P. Pope withdrew $4,800 cash. Adjustment and additional data: 1. A count of supplies on August 31 shows $1200 on hand. 2. The Truck has an estimated 7-year useful life. 3. Of the mortgage payable, $60,000 must be paid on September 30 each year 4. An analysis of the Unearned Revenue account shows that 20% has been earned by August 31. 5. On August 31, services of $25,000 were provided but not recorded as of August 31. 6. The mortgage payable has a 3% interest rate. Interest is paid on the first day of each month for the previous month's interest. 7. Employees earned $700 per day. On August 31/2020, 6 employees were unpaid for 4 days. 8. A 12-month insurance policy was purchase February 1, 2020 for $1,800 9. The telephone bill for the month was for $550, and at the end of the month it was not recorded or paid The Hydrangea Plant Shop, owned by P. Pope, sells plants. The shop has an August 31, 2020 fiscal year end, uses a perpetual inventory system. On August 1, 2020, the company's trial balance reported the following: Cash $21,385 P. Pope, capital $58,400 Merchandise inventory 64,125 P. Pope, drawings 52,800 Supplies 3,750 Sales 474,080 Sales Returns and Allowances 42,800 Rent revenue 1,200 Sales discounts 13,800 Cost of goods sold 301,010 Land 180,000 Advertising expense 2,270 Truck 70,800 Salaries expense 68,200 Accumulated depreciation-Truck 13,275 Rent expense 18,150 Accounts payable 12,650 Insurance expense 4,140 Interest Payable 6,070 Interest expense 1,925 Unearned revenue 4,680 Accounts Receivable 20,000 Notes payable-Due Dec. 2022 42,000 Mortgage Payable-Due 2025 200,000 Transaction for the Month During the last month of the fiscal year, the company had the following transactions: 1. Paid $3000 for rent for the month 2. Hired a new employee to be paid $1,600 per week. 3. Collected $3,000 of the accounts receivable 4. Received $525 cash in advance from customers for merchandise to be delivered next month. 5. Paid salaries, $3,100 cash 6. P. Pope withdrew $4,800 cash. Adjustment and additional data: 1. A count of supplies on August 31 shows $1200 on hand. 2. The Truck has an estimated 7-year useful life. 3. Of the mortgage payable, $60,000 must be paid on September 30 each year 4. An analysis of the Unearned Revenue account shows that 20% has been earned by August 31. 5. On August 31, services of $25,000 were provided but not recorded as of August 31. 6. The mortgage payable has a 3% interest rate. Interest is paid on the first day of each month for the previous month's interest. 7. Employees earned $700 per day. On August 31/2020, 6 employees were unpaid for 4 days. 8. A 12-month insurance policy was purchase February 1, 2020 for $1,800 9. The telephone bill for the month was for $550, and at the end of the month it was not recorded or paidStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started