Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounts payable, March 1 Work in process, March 1 Finished goods, March 1 Materials, March 31 Accounts payable, March 31 Finished goods, March 31

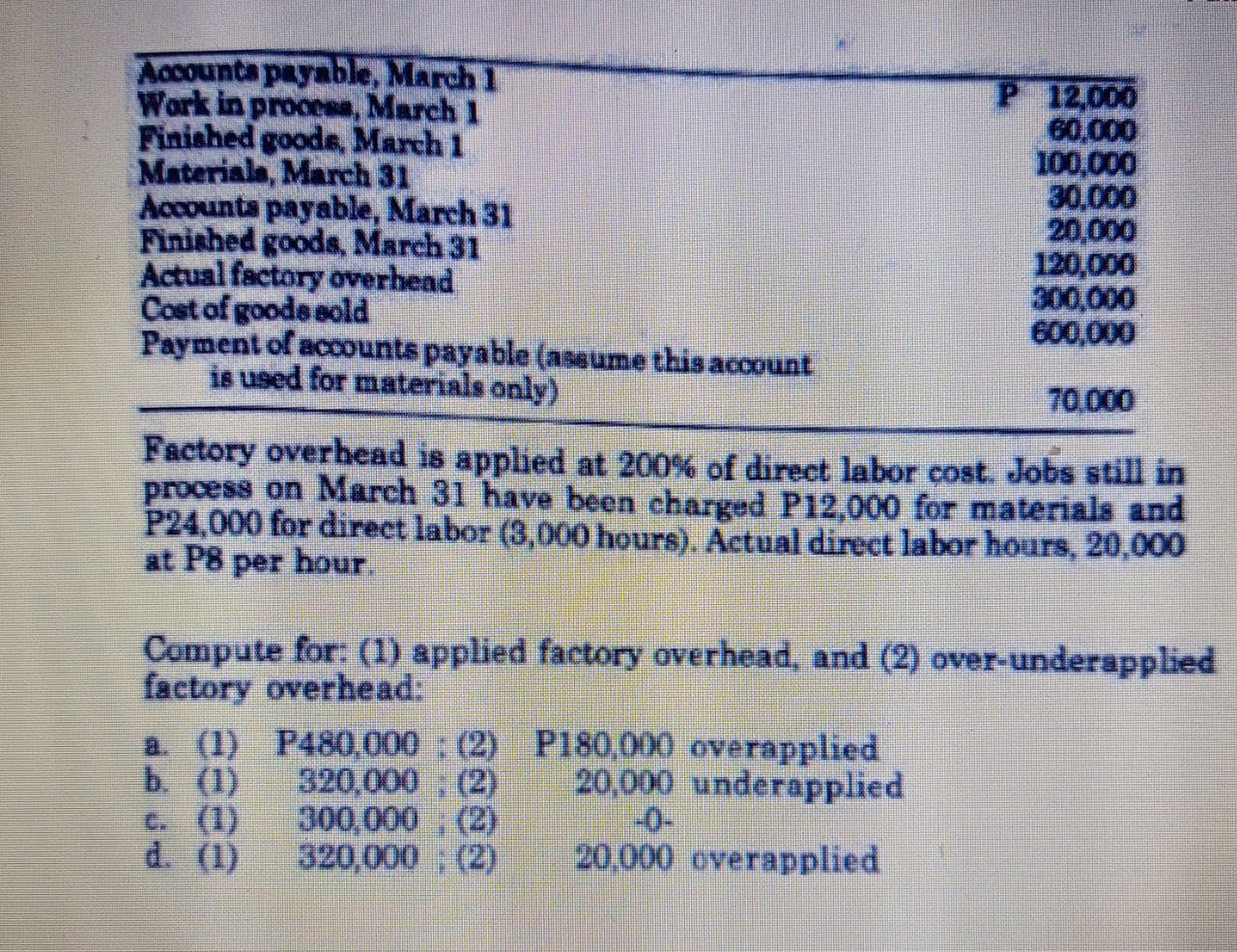

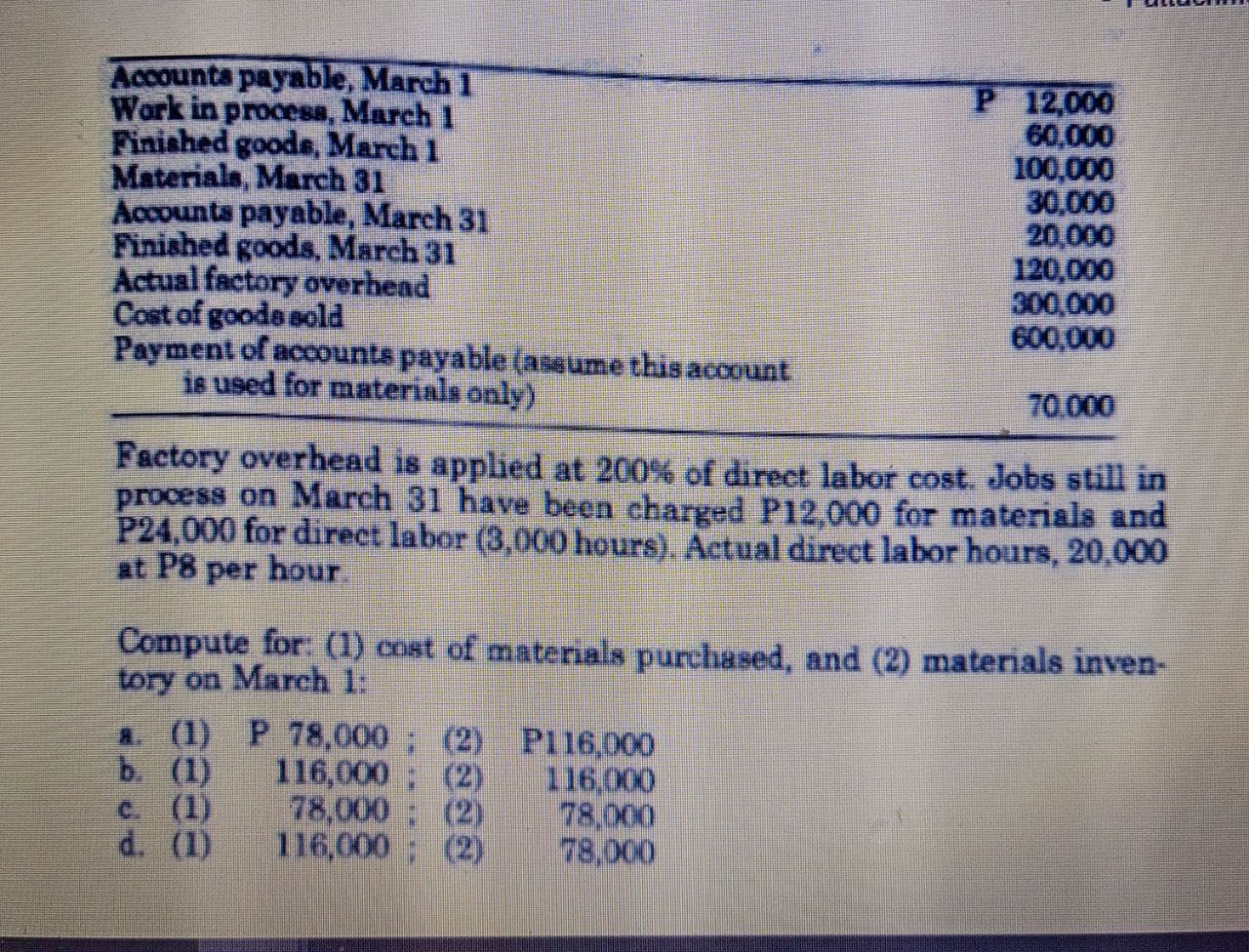

Accounts payable, March 1 Work in process, March 1 Finished goods, March 1 Materials, March 31 Accounts payable, March 31 Finished goods, March 31 Actual factory overhead Cost of goods sold Payment of accounts payable (assume this account is used for materials only) P 12,000 60,000 100,000 30,000 20,000 120,000 300,000 600,000 70.000 Factory overhead is applied at 200% of direct labor cost. Jobs still in process on March 31 have been charged P12,000 for materials and P24,000 for direct labor (3,000 hours). Actual direct labor hours, 20,000 at P8 per hour. Compute for: (1) applied factory overhead, and (2) over-underapplied factory overhead: a. (1) P480,000 (2) P180,000 overapplied b. (1) 320,000 (2) 20,000 underapplied c. (1) 300,000 (2) -0- d. (1) 320,000 (2) 20,000 overapplied Accounts payable, March 1 Work in process, March 1 Finished goods, March 1 Materials, March 31 Accounts payable, March 31 Finished goods, March 31 Actual factory overhead Cost of goods sold Payment of accounts payable (assume this account is used for materials only) P 12,000 60,000 100,000 30,000 20,000 120,000 300,000 600,000 70.000 Factory overhead is applied at 200% of direct labor cost. Jobs still in process on March 31 have been charged P12,000 for materials and P24,000 for direct labor (3,000 hours). Actual direct labor hours, 20,000 at P8 per hour Compute for: (1) cost of materials purchased, and (2) materials inven- tory on March 1: a. (1) P 78,000; (2) P116,000 b. (1) 116,000 (2) 116,000 C (1) 78,000 (2) 78,000 d. (1) 116,000 (2) 78,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the applied factory overhead and the overunderapplied fac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started