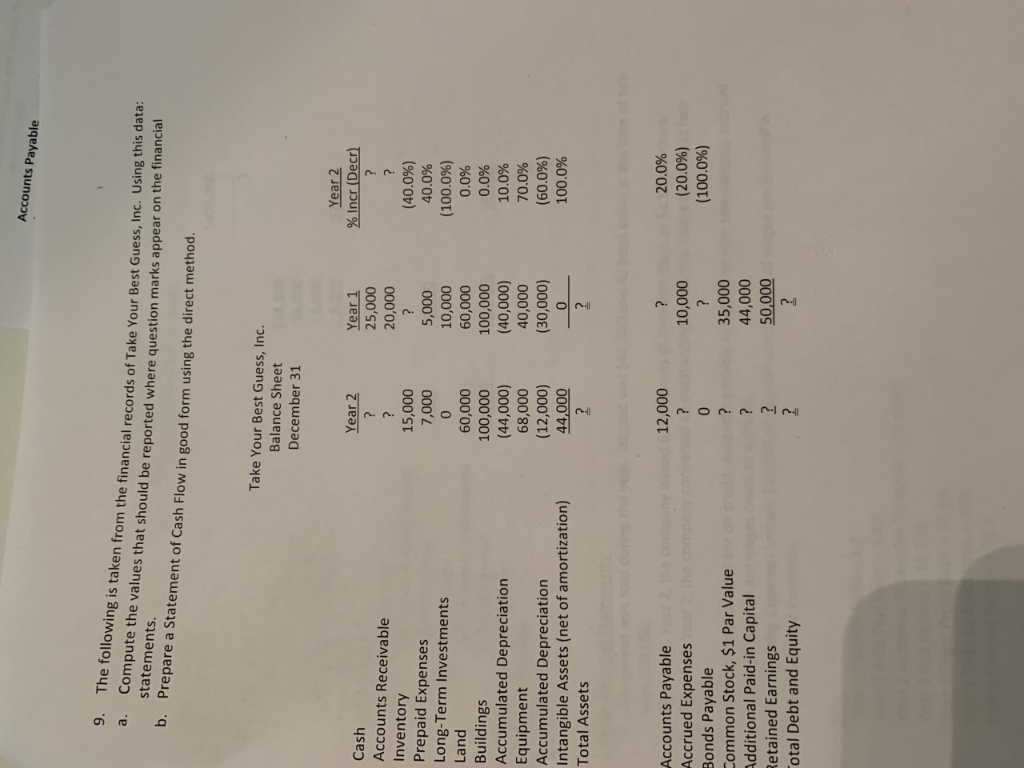

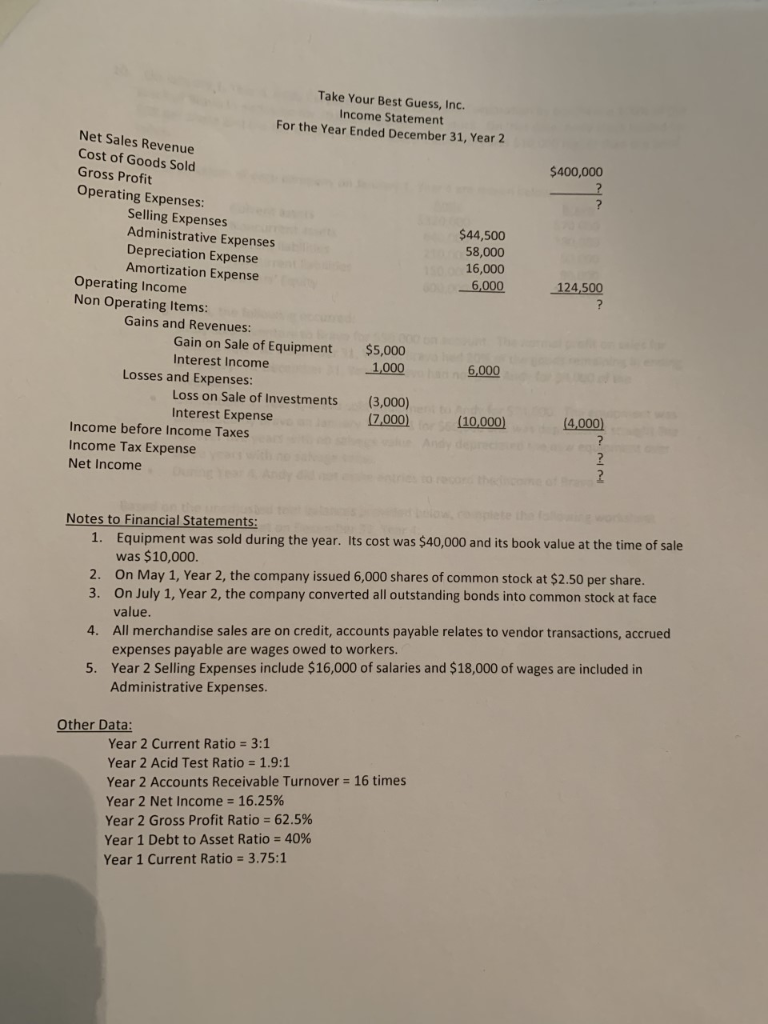

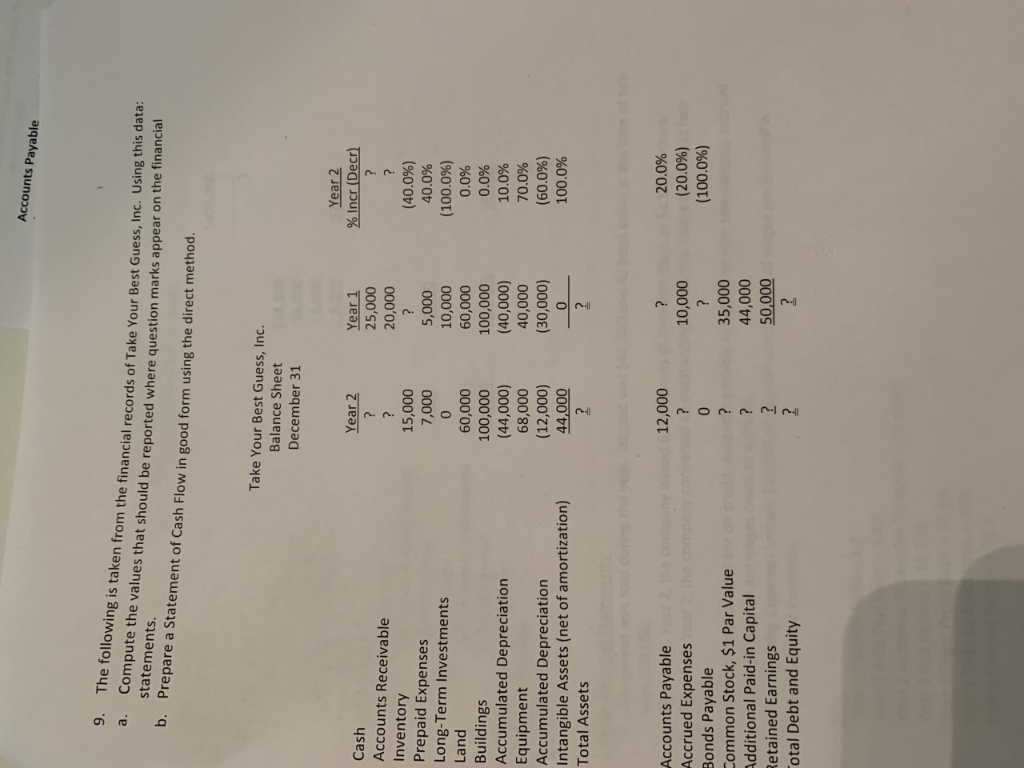

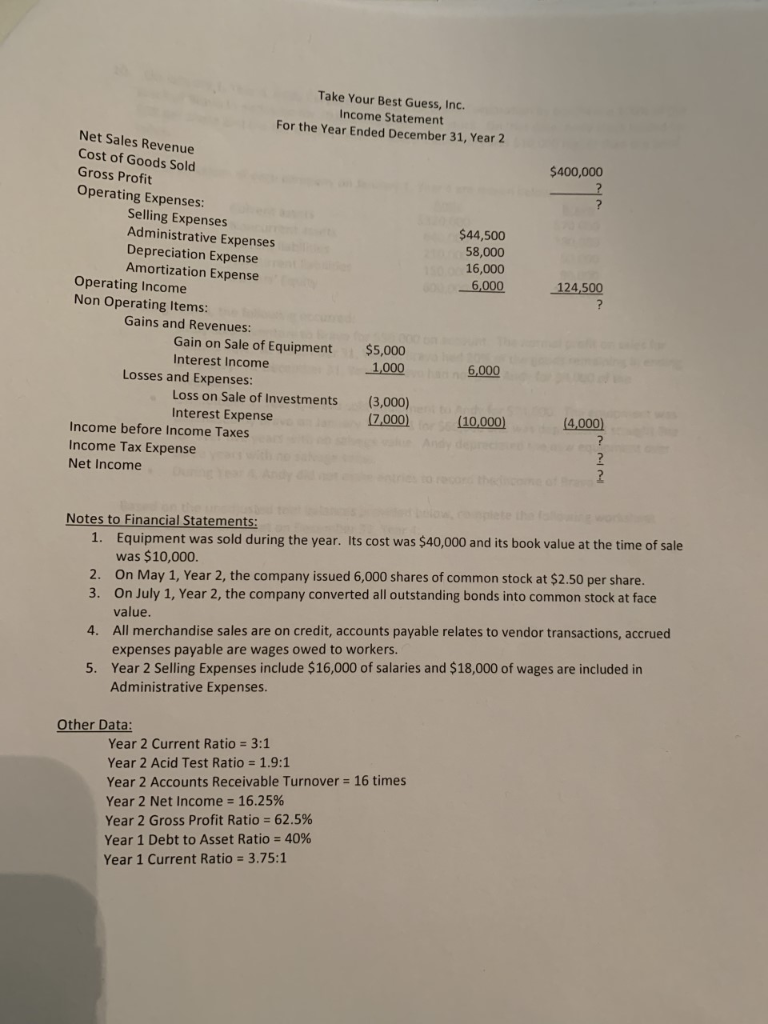

Accounts Payable The following is taken from the finan Compute the values that should be reported where question marks app statements. Prepare a Statement of Cash Flow in good form using the direct method cial records of Take Your Best Guess, Inc. Using this data: a. ear on the financial b. Take Your Best Guess, Inc. Balance Sheet December 31 Year 2 % Incr (Decr) Year 1 25,000 20,000 Year Cash Accounts Receivable Inventory Prepaid Expenses Long-Term Investments Land Buildings Accumulated Depreciation Equipment Accumulated Depreciation Intangible Assets (net of amortization) Total Assets (40.0%) 40.0% 15,000 7,000 (100.0%) 10,000 60,000 100,000 (40,000) 40,000 (30,000) 0.0% 0.0% 10.0% 70.0% (60.0%) 100.0% 60,000 100,000 (44,000) 68,000 (12,000) 2 20.0% (20.0%) (100.0%) 12,000 Accounts Payable Accrued Expenses Bonds Payable Common Stock, $1 Par Value dditional Paid-in Capital Retained Earnings otal Debt and Equity 10,000 35,000 44,000 Take Your Best Guess, Inc. Income Statement For the Year Ended December 31, Year 2 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses $400,000 Selling Expenses Administrative Expenses Depreciation Expense Amortization Expense $44,500 58,000 16,000 -6000 124,500 Operating Income Non Operating Items: Gains and Revenues: Gain on Sale of Equipment Interest Income $5,000 1,000 6,000 Losses and Expenses Loss on Sale of Investments Interest Expense (3,000) (7,000) (4,000 (10.000) Income before Income Taxes ncome Tax Expense Net Income Notes to Financial Statements: Equipment was sold during the year. Its cost was $40,000 and its book value at the time of sale was $10,000. On May 1, Year 2, the company issued 6,000 shares of common stock at $2.50 per share. On July 1, Year 2, the company converted all outstanding bonds into common stock at face value. All merchandise sales are on credit, accounts payable relates to vendor transactions, accrued expenses payable are wages owed to workers. Year 2 Selling Expenses include $16,000 of salaries and $18,000 of wages are included in Administrative Expenses 1. 2. 3. 4. 5. Other Data Year 2 Current Ratio = 3:1 Year 2 Acid Test Ratio 1.9:1 Year 2 Accounts Receivable Turnover = 16 times Year 2 Net Income-16.25% Year 2 Gross Profit Ratio = 62.5% Year 1 Debt to Asset Ratio = 40% Year 1 Current Ratio 3.75:1