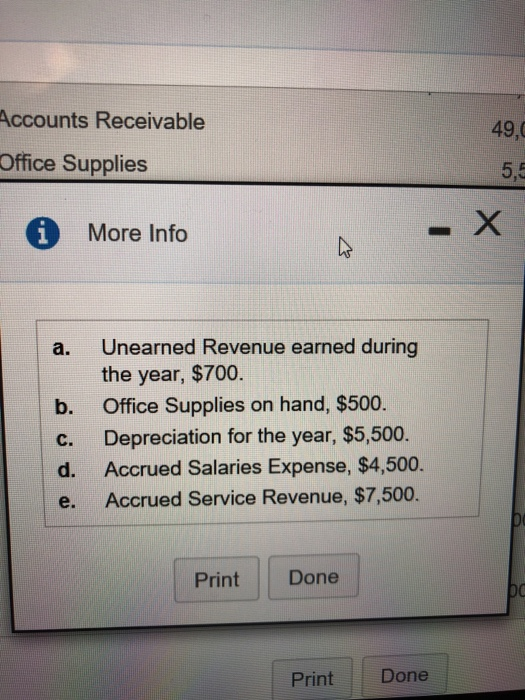

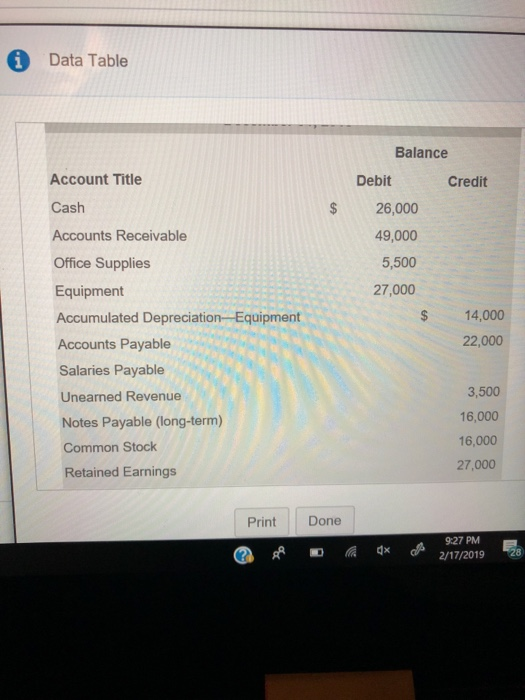

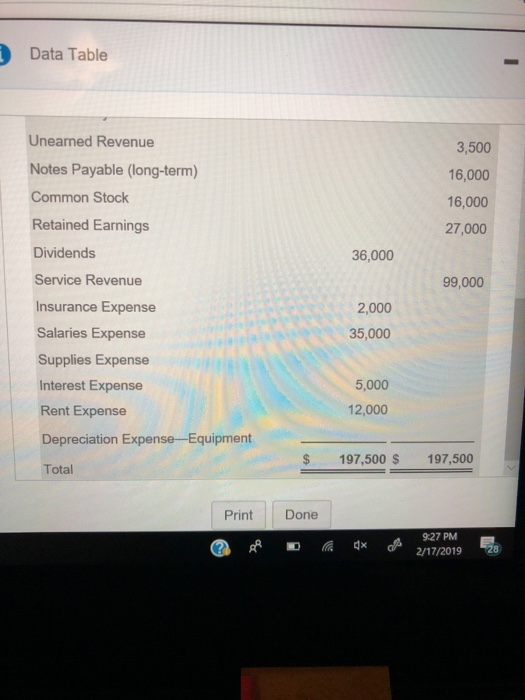

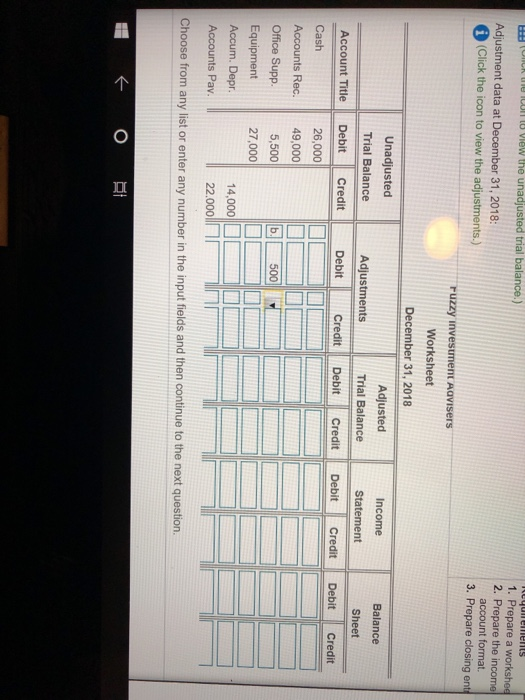

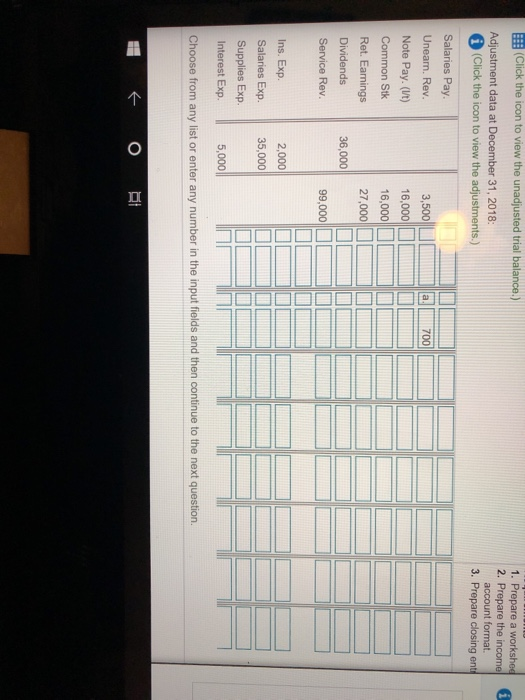

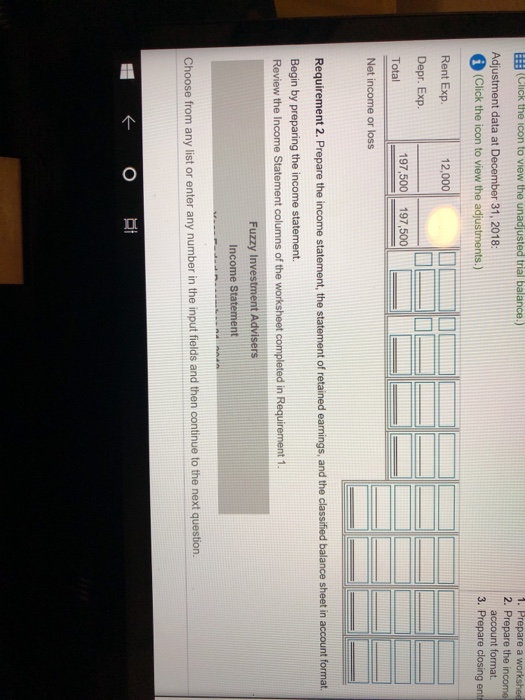

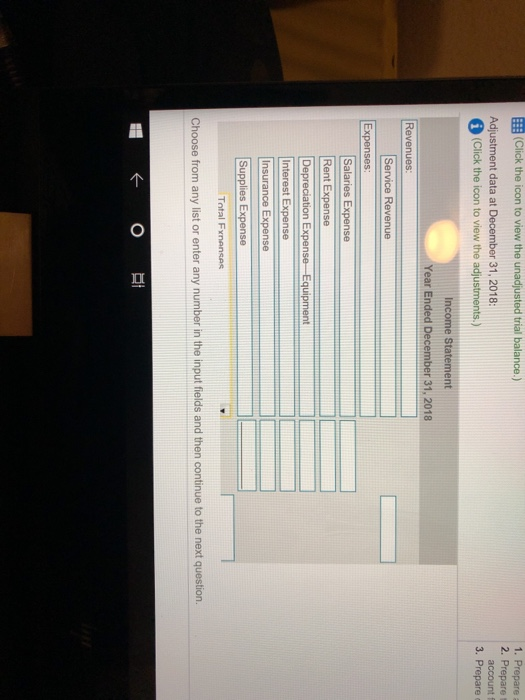

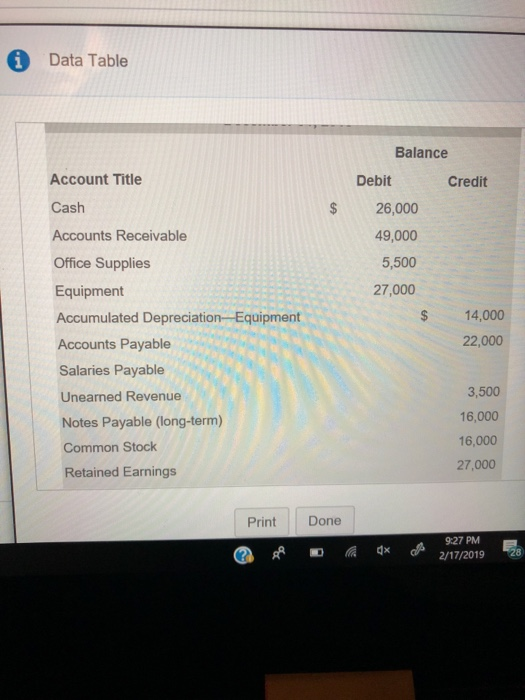

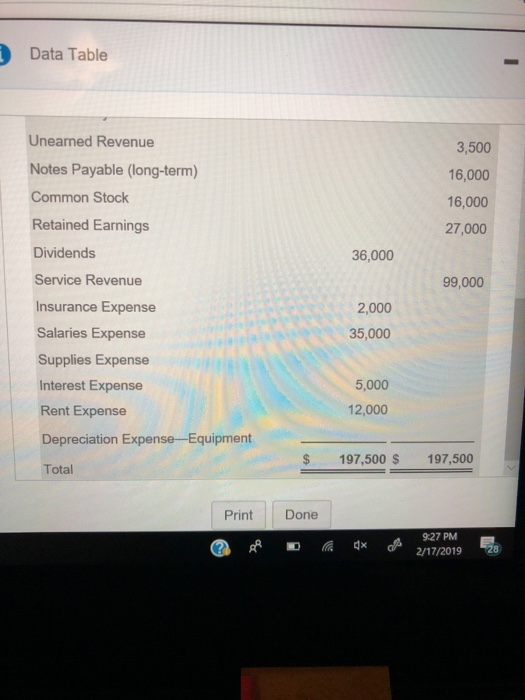

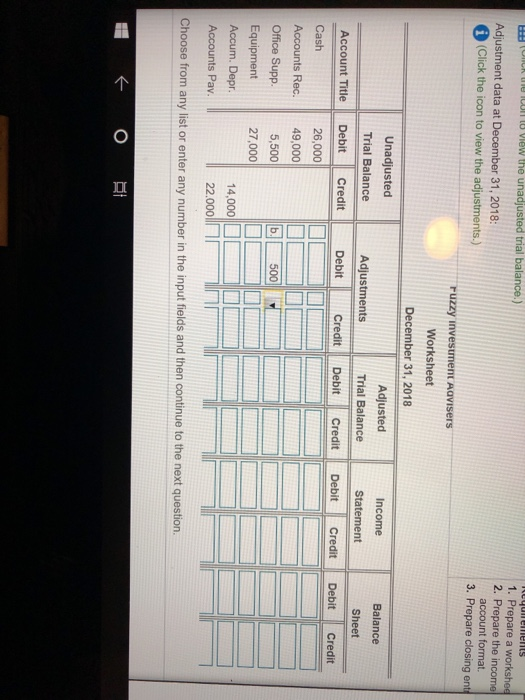

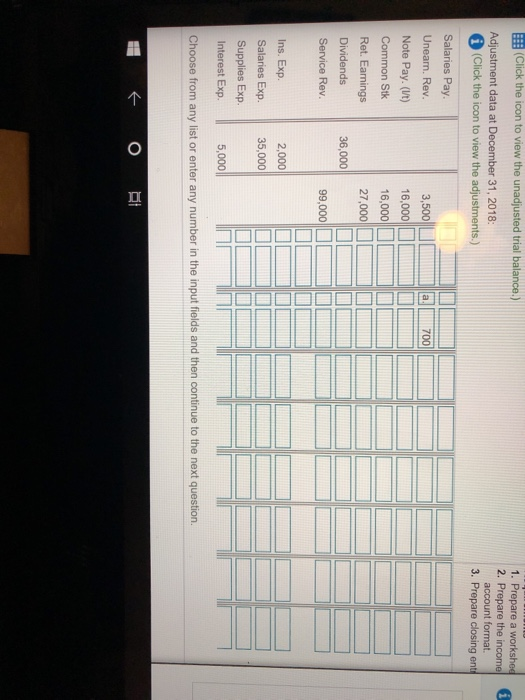

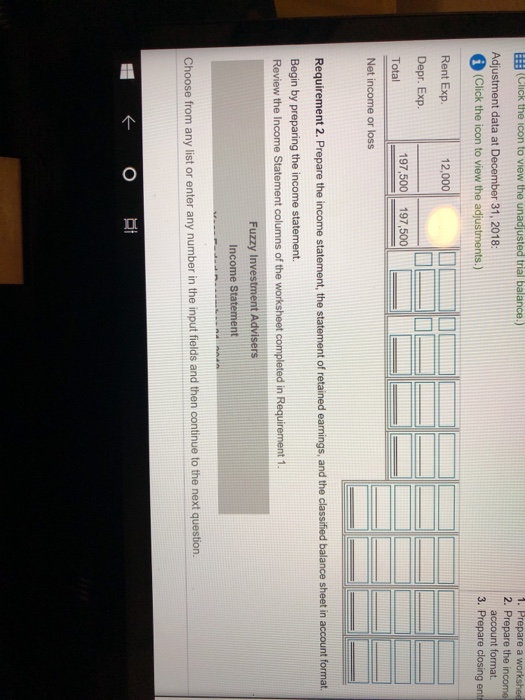

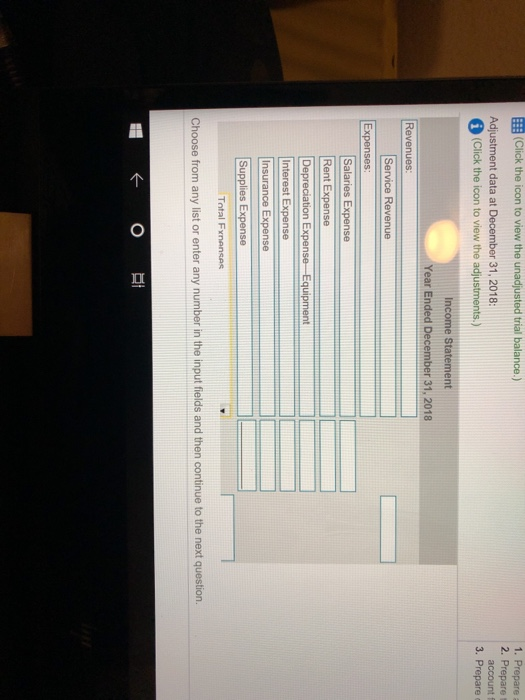

Accounts Receivable 49,0 Office Supplies 5,5 i More Info Unearned Revenue earned during the year, $700. a. b. Office Supplies on hand, $500. c. Depreciation for the year, $5,500. d. Accrued Salaries Expense, $4,500. e. Accrued Service Revenue, $7,500. Print Done Print Done Data Table Balance Account Title Debit Credit Cash Accounts Receivable Office Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Common Stock $ 26,000 49,000 5,500 27,000 $14,000 22,000 3,500 16,000 16,000 27,000 Retained Earnings Print Done 9:27 PM 2/17/2019 28 Data Table Unearned Revenue Notes Payable (long-term) Common Stock Retained Earnings Dividends Service Revenue 3,500 16,000 16,000 27,000 36,000 99,000 2,000 nsurance Expense Salaries Expense Supplies Expense nterest Expense Rent Expense Depreciation Expense-Equipment Total 35,000 5,000 12,000 197,500 $197,500 Print Done 9:27 PM 1. Prepare a workshee 2. Prepare the income account format. 3. Prepare closing ent Adjustment data at December 31, 2018 (Click the icon to view the adjustments.) ruzzy investment Aavisers Worksheet December 31, 2018 Unadjusted Trial Balance Adjusted Trial Balance Income Adjustments StatementBalance Sheet Credit Debit CreditDebit Credit Debit Credit Account Title Debit Credit Cash Accounts Rec. Debit 26,000 49,000 5,500 27,000 500 Equipment Accum. Depr. Accounts Pav 14,00 111 22.000 Choose from any list or enter any number in the input fields and then continue to the next question. (Click the icon to view the unadjusted trial balance.) 1. Prepare a 2. Prepare the income account format. 3. Prepare closing ent Adjustment data at December 31, 2018: (Click the icon to view the adjustments.) Salaries Pay. Uneam. Rev. Note Pay. (Ut) Common Stk Ret. Eamings Dividends Service Rev 16,000 16,000 2,000 Ins. Exp. Salaries Exp.35,000 Supplies Exp. Interest Exp. 5,000 Choose from any list or enter any number in the input fields and then continue to the next question. Accounts Receivable 49,0 Office Supplies 5,5 i More Info Unearned Revenue earned during the year, $700. a. b. Office Supplies on hand, $500. c. Depreciation for the year, $5,500. d. Accrued Salaries Expense, $4,500. e. Accrued Service Revenue, $7,500. Print Done Print Done Data Table Balance Account Title Debit Credit Cash Accounts Receivable Office Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Common Stock $ 26,000 49,000 5,500 27,000 $14,000 22,000 3,500 16,000 16,000 27,000 Retained Earnings Print Done 9:27 PM 2/17/2019 28 Data Table Unearned Revenue Notes Payable (long-term) Common Stock Retained Earnings Dividends Service Revenue 3,500 16,000 16,000 27,000 36,000 99,000 2,000 nsurance Expense Salaries Expense Supplies Expense nterest Expense Rent Expense Depreciation Expense-Equipment Total 35,000 5,000 12,000 197,500 $197,500 Print Done 9:27 PM 1. Prepare a workshee 2. Prepare the income account format. 3. Prepare closing ent Adjustment data at December 31, 2018 (Click the icon to view the adjustments.) ruzzy investment Aavisers Worksheet December 31, 2018 Unadjusted Trial Balance Adjusted Trial Balance Income Adjustments StatementBalance Sheet Credit Debit CreditDebit Credit Debit Credit Account Title Debit Credit Cash Accounts Rec. Debit 26,000 49,000 5,500 27,000 500 Equipment Accum. Depr. Accounts Pav 14,00 111 22.000 Choose from any list or enter any number in the input fields and then continue to the next question. (Click the icon to view the unadjusted trial balance.) 1. Prepare a 2. Prepare the income account format. 3. Prepare closing ent Adjustment data at December 31, 2018: (Click the icon to view the adjustments.) Salaries Pay. Uneam. Rev. Note Pay. (Ut) Common Stk Ret. Eamings Dividends Service Rev 16,000 16,000 2,000 Ins. Exp. Salaries Exp.35,000 Supplies Exp. Interest Exp. 5,000 Choose from any list or enter any number in the input fields and then continue to the next