Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounts receivable Accrued liabilities payable Additional paid - in - capital Buildings Cash Common stock Dividends payable Intangibles Inventories Land Long - term investments Long

Accounts receivable

Accrued liabilities payable

Additional paidincapital

Buildings Cash

Common stock

Dividends payable

Intangibles

Inventories Land

Longterm investments

Longterm lease liabilities

Note receivable

Notes payableOperating lease rightofuse assets

Other current assets

Other noncurrent assets

Retained earnings

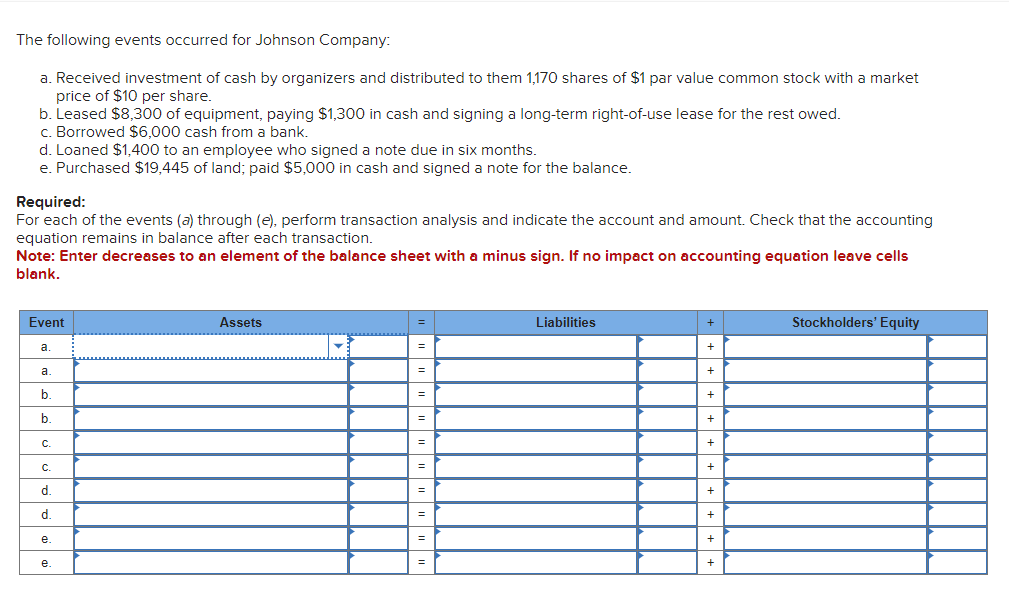

Shortterm investmentsThe following events occurred for Johnson Company:

a Received investment of cash by organizers and distributed to them shares of $ par value common stock with a market

price of $ per share.

b Leased $ of equipment, paying $ in cash and signing a longterm rightofuse lease for the rest owed.

c Borrowed $ cash from a bank.

d Loaned $ to an employee who signed a note due in six months.

e Purchased $ of land; paid $ in cash and signed a note for the balance.

Required:

For each of the events a through e perform transaction analysis and indicate the account and amount. Check that the accounting

equation remains in balance after each transaction.

Note: Enter decreases to an element of the balance sheet with a minus sign. If no impact on accounting equation leave cells

blank.

Theres two more potenital options that werent included in the screenshots. They are "Store fixtures" and "Treasury stock".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started