Answered step by step

Verified Expert Solution

Question

1 Approved Answer

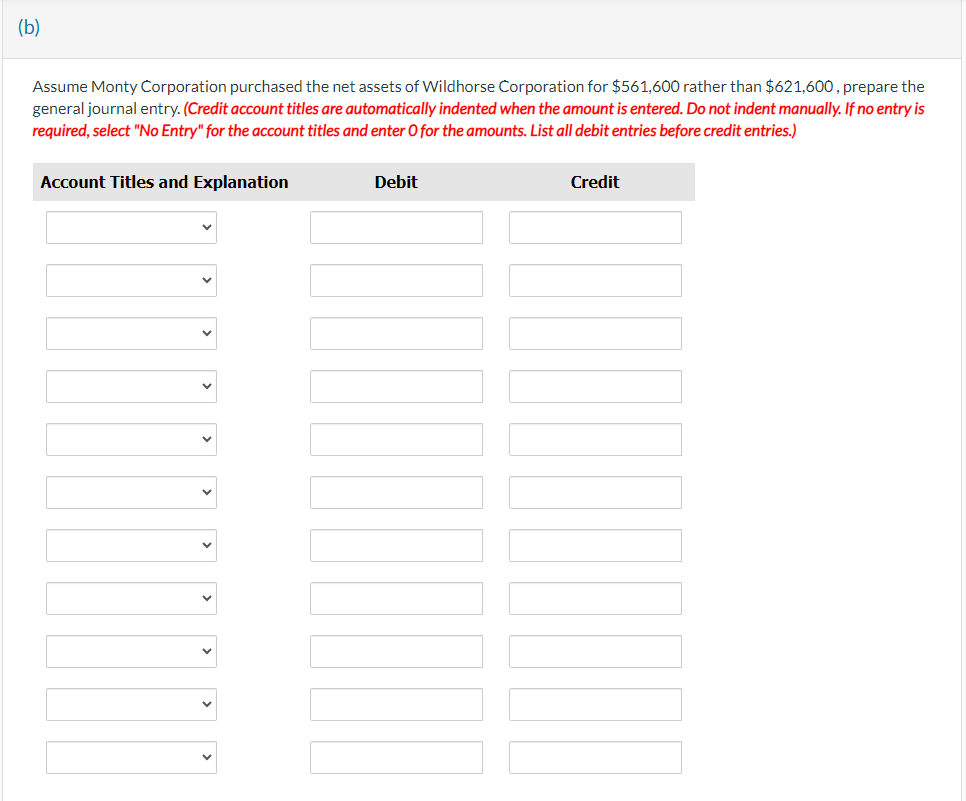

Accounts Receivable Acquisition Expense Building Cash Current Liabilities Equipment Gains on Acquisition Goodwill Inventory Land Long Term Debt Patent MontyCorporation purchased the net assets of

Accounts Receivable

Acquisition Expense

Building

Cash

Current Liabilities

Equipment

Gains on Acquisition

Goodwill

Inventory

Land

Long Term Debt

Patent

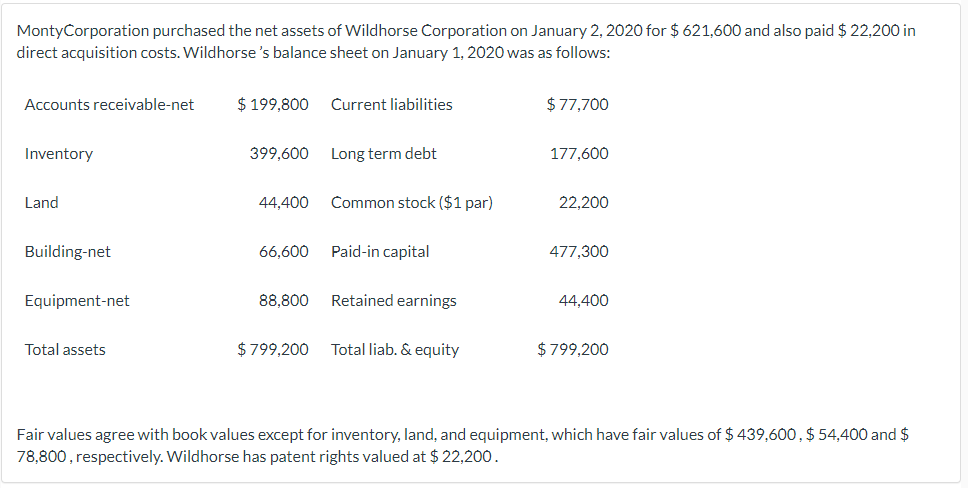

MontyCorporation purchased the net assets of Wildhorse Corporation on January 2, 2020 for $621,600 and also paid $22,200 in direct acquisition costs. Wildhorse's balance sheet on January 1, 2020 was as follows: Fair values agree with book values except for inventory, land, and equipment, which have fair values of $439,600,$54,400 and $ 78,800 , respectively. Wildhorse has patent rights valued at $22,200. Assume Monty Corporation purchased the net assets of Wildhorse Corporation for $561,600 rather than $621,600, prepare the general journal entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started