Answered step by step

Verified Expert Solution

Question

1 Approved Answer

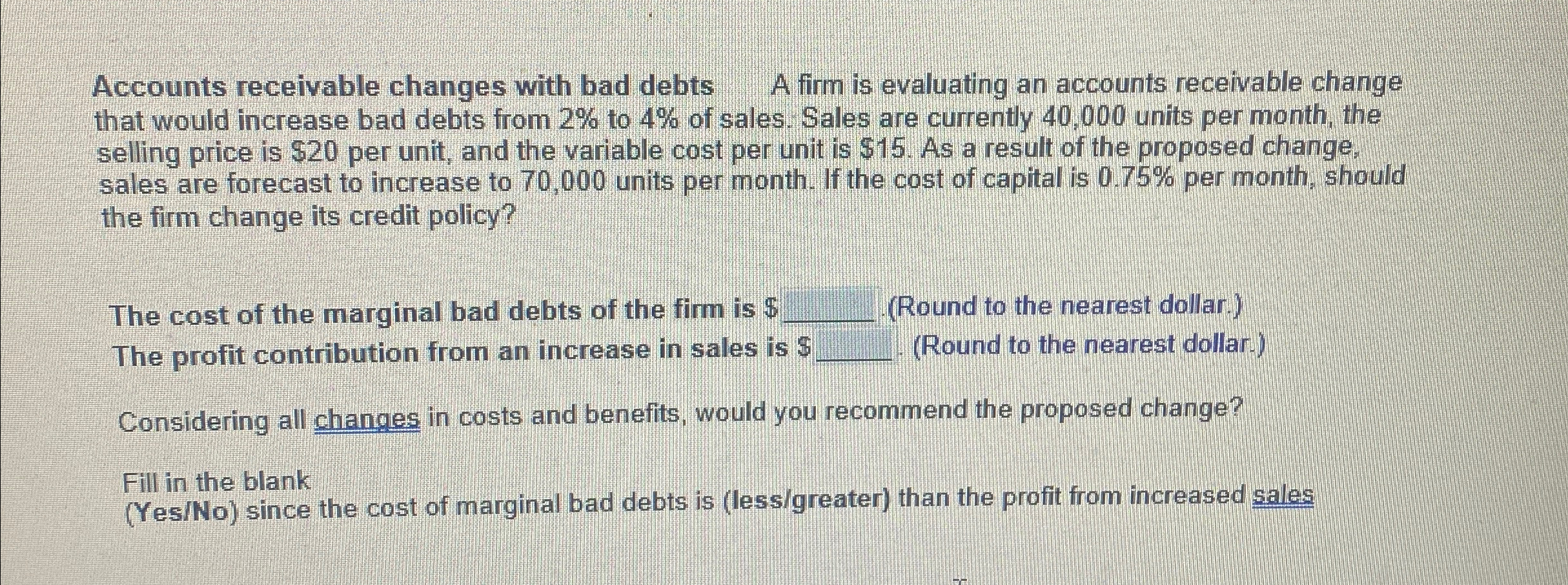

Accounts receivable changes with bad debts A firm is evaluating an accounts receivable change that would increase bad debts from 2 % to 4 %

Accounts receivable changes with bad debts A firm is evaluating an accounts receivable change that would increase bad debts from to of sales. Sales are currently units per month, the selling price is $ per unit, and the variable cost per unit is $ As a result of the proposed change, sales are forecast to increase to units per month. If the cost of capital is per month, should the firm change its credit policy?

The cost of the marginal bad debts of the firm is $ Round to the nearest dollar.

The profit contribution from an increase in sales is $ Round to the nearest dollar.

Considering all changes in costs and benefits, would you recommend the proposed change?

Fill in the blank

YesNo since the cost of marginal bad debts is lessgreater than the profit from increased sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started