Answered step by step

Verified Expert Solution

Question

1 Approved Answer

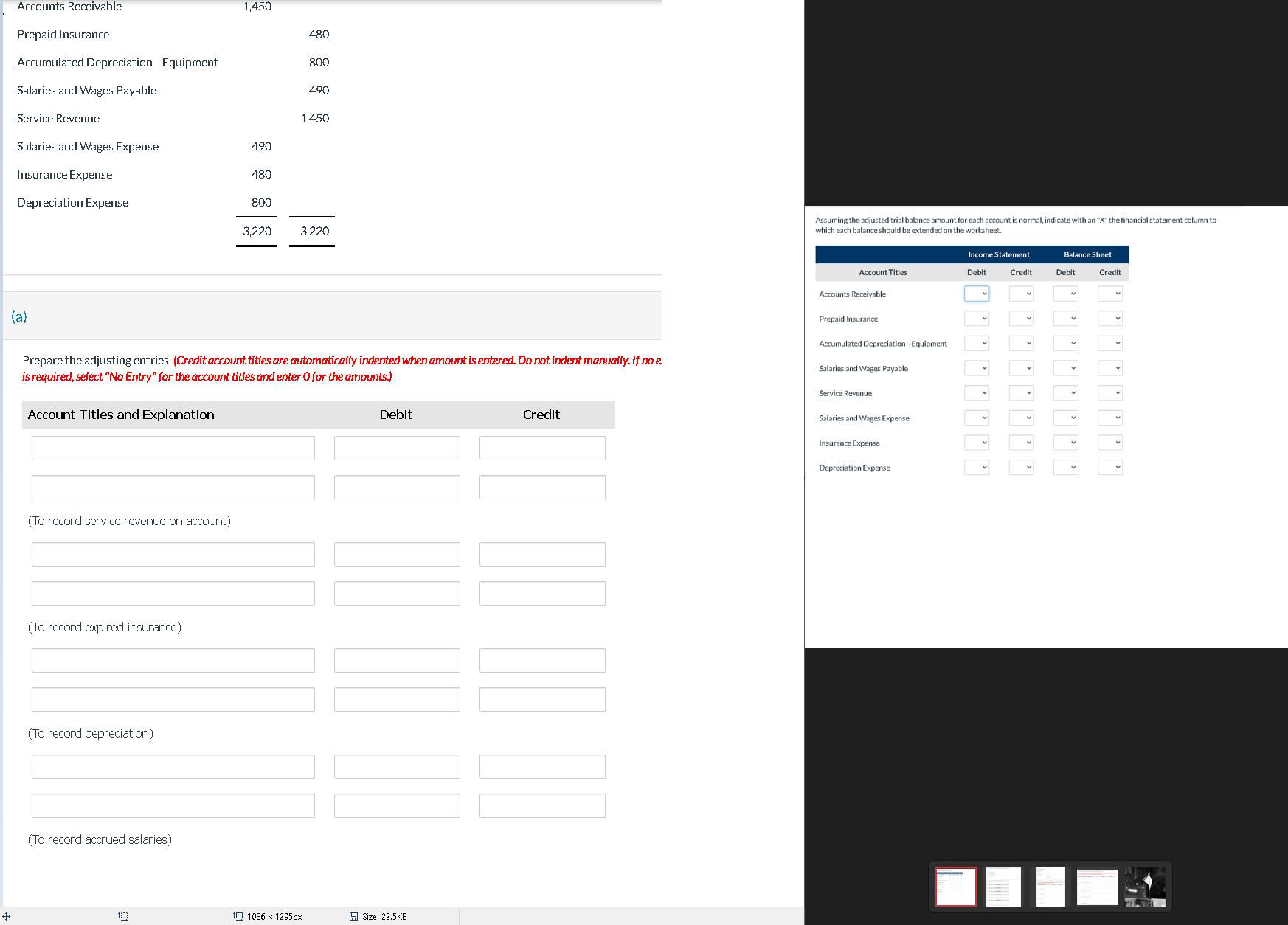

Accounts Receivable Prepaid Insurance Accumulated Depreciation-Equipment Salaries and Wages Payable Service Revenue Salaries and Wages Expense Insurance Expense Depreciation Expense (a) Account Titles and

Accounts Receivable Prepaid Insurance Accumulated Depreciation-Equipment Salaries and Wages Payable Service Revenue Salaries and Wages Expense Insurance Expense Depreciation Expense (a) Account Titles and Explanation (To record service revenue on account) (To record expired insurance) (To record depreciation) (To record accrued salaries) 1,450 10 490 480 800 3,220 Prepare the adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no e is required, select "No Entry" for the account titles and enter O for the amounts.) 480 800 490 1,450 1Q 1086 x 1295px 3,220 Debit Size: 22.5KB Credit Assuming the adjusted trial balance amount for each account is normal, indicate with an "X" the financial statement column to which each balance should be extended on the worksheet. Account Titles Accounts Receivable Prepaid Insurance Accumulated Depreciation-Equipment Salaries and Wages Payable Service Revenue Salaries and Wages Expense Insurance Expense Depreciation Expense Income Statement Debit Credit Balance Sheet Debit V V Credit

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting entries Accounts Receivable Debit Service Revenue 1450 Credit Accounts Receivable 1450 Prepaid Insurance Debit Insurance Expense 480 Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started