Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCOUNTS RECEIVABLE-UNCOLLECTIBLE ACCOUNTS Instructions Present the journal entries specified below; show supporting calculations. Each item should be considered independently. The trial balance of Brinkly Company

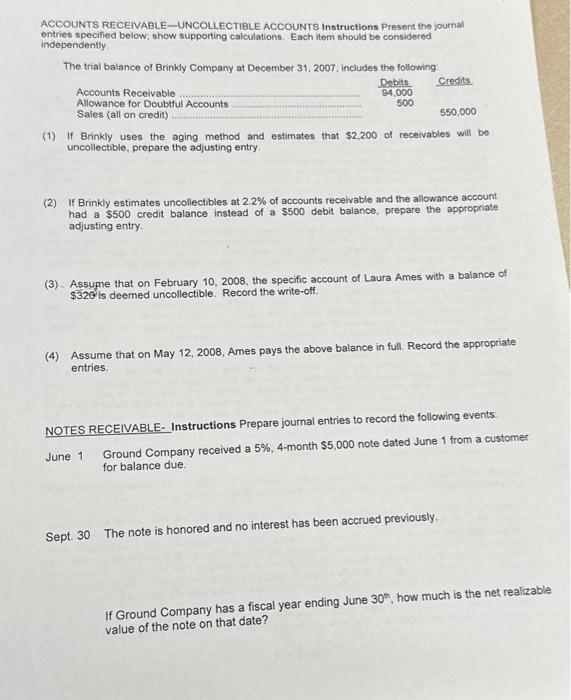

ACCOUNTS RECEIVABLE-UNCOLLECTIBLE ACCOUNTS Instructions Present the journal entries specified below; show supporting calculations. Each item should be considered independently. The trial balance of Brinkly Company at December 31, 2007, includes the following: Debits 94,000 500 Accounts Receivable Allowance for Doubtful Accounts Sales (all on credit) 550,000 (1) If Brinkly uses the aging method and estimates that $2,200 of receivables will be uncollectible, prepare the adjusting entry. Credits (2) If Brinkly estimates uncollectibles at 2.2% of accounts receivable and the allowance account had a $500 credit balance instead of a $500 debit balance, prepare the appropriate adjusting entry. (3) - Assume that on February 10, 2008, the specific account of Laura Ames with a balance of $320 is deemed uncollectible. Record the write-off. (4) Assume that on May 12, 2008, Ames pays the above balance in full. Record the appropriate entries. NOTES RECEIVABLE- Instructions Prepare journal entries to record the following events: Ground Company received a 5%, 4-month $5,000 note dated June 1 from a customer for balance due. June 1 Sept. 30 The note is honored and no interest has been accrued previously. If Ground Company has a fiscal year ending June 30th, how much is the net realizable value of the note on that date?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started