Answered step by step

Verified Expert Solution

Question

1 Approved Answer

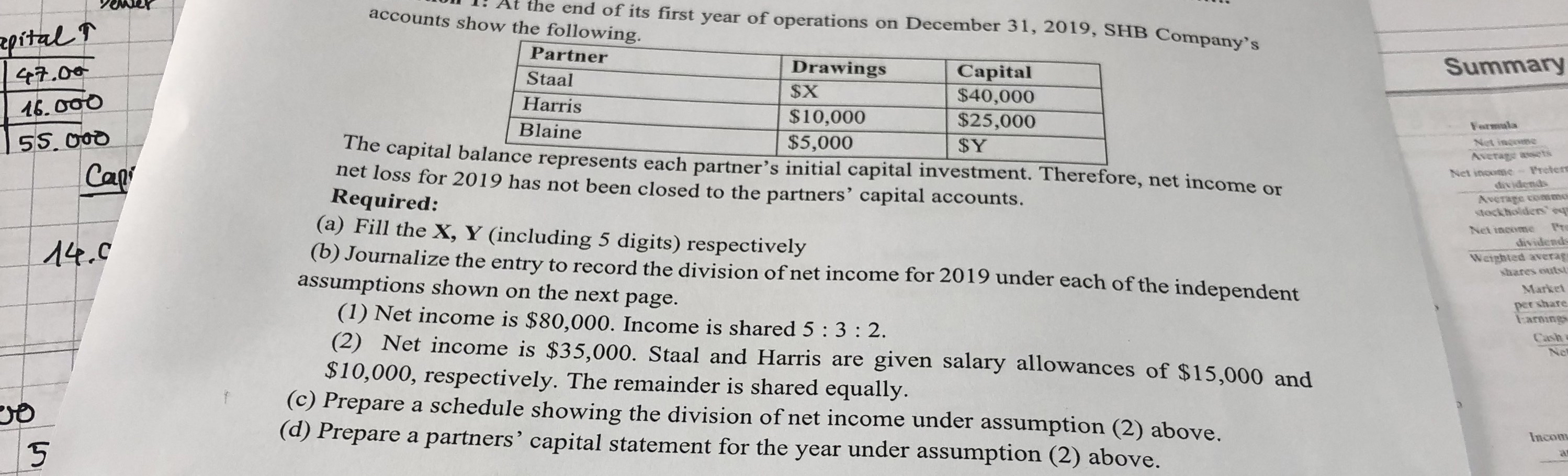

accounts show the end of its first year of operations on December 3 1 , 2 0 1 9 , SHB Company's The capital balance

accounts show the end of its first year of operations on December SHB Company's

The capital balance represents each partner's initial capital investment. Therefore, net income or

net loss for has not been closed to the partners' capital accounts.

Required:

a Fill the including digits respectively

b Journalize the entry to record the division of net income for under each of the independent

assumptions shown on the next page.

Net income is $ Income is shared ::

Net income is $ Staal and Harris are given salary allowances of $ and

$ respectively. The remainder is shared equally.

c Prepare a schedule showing the division of net income under assumption above.

d Prepare a partners' capital statement for the year under assumption above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started