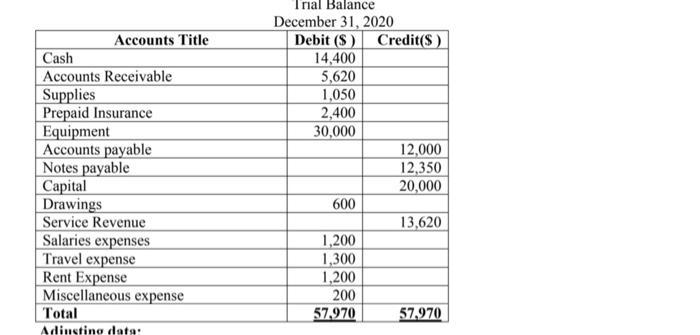

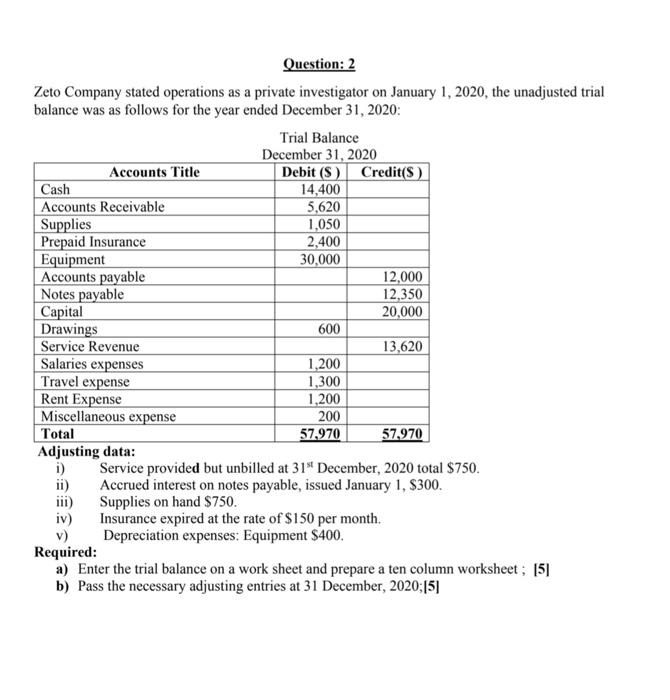

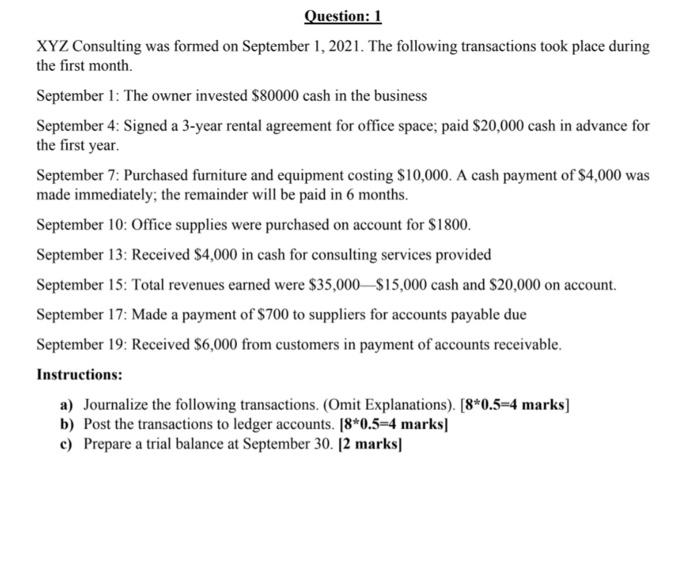

Accounts Title Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts payable Notes payable Capital Drawings Service Revenue Salaries expenses Travel expense Rent Expense Miscellaneous expense Total Adinstino data: rial Balance December 31, 2020 Debit ($) Credit($ ) 14,400 5,620 1,050 2,400 30,000 12,000 12,350 20,000 600 13,620 1,200 1,300 1,200 200 57,970 57.970 Question: 2 Zeto Company stated operations as a private investigator on January 1, 2020, the unadjusted trial balance was as follows for the year ended December 31, 2020: Trial Balance December 31, 2020 Accounts Title Debit (S) Credit(S) Cash 14,400 Accounts Receivable 5,620 Supplies 1,050 Prepaid Insurance 2,400 Equipment 30,000 Accounts payable 12,000 Notes payable 12,350 Capital 20,000 Drawings 600 Service Revenue 13,620 Salaries expenses 1,200 Travel expense 1,300 Rent Expense 1,200 Miscellaneous expense 200 Total 57.970 57,970 Adjusting data: i) Service provided but unbilled at 31 December, 2020 total $750. ii) Accrued interest on notes payable, issued January 1, $300. iii) Supplies on hand $750. iv) Insurance expired at the rate of $150 per month. v) Depreciation expenses: Equipment $400. Required: a) Enter the trial balance on a work sheet and prepare a ten column worksheet; 151 b) Pass the necessary adjusting entries at 31 December, 2020;151 Question: 1 XYZ Consulting was formed on September 1, 2021. The following transactions took place during the first month. September 1: The owner invested $80000 cash in the business September 4: Signed a 3-year rental agreement for office space; paid $20,000 cash in advance for the first year. September 7: Purchased furniture and equipment costing $10,000. A cash payment of $4,000 was made immediately; the remainder will be paid in 6 months. September 10: Office supplies were purchased on account for $1800. September 13: Received $4,000 in cash for consulting services provided September 15: Total revenues earned were $35,000 $15,000 cash and $20,000 on account. September 17: Made a payment of $700 to suppliers for accounts payable due September 19: Received $6,000 from customers in payment of accounts receivable. Instructions: a) Journalize the following transactions. (Omit Explanations). [8*0.5=4 marks] b) Post the transactions to ledger accounts. [8*0.5=4 marks] c) Prepare a trial balance at September 30. [2 marks]