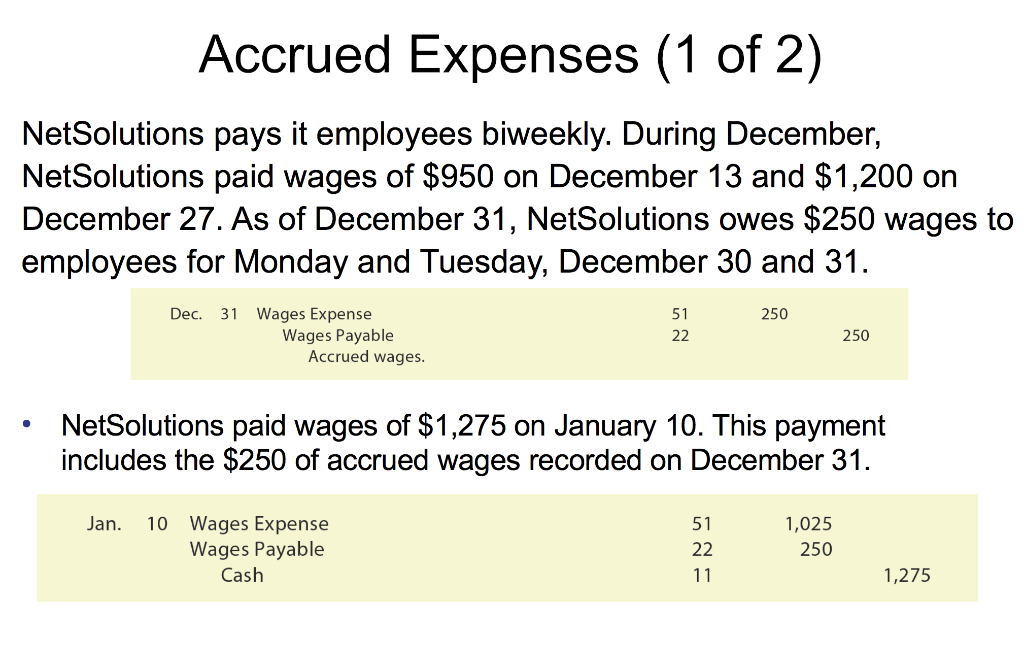

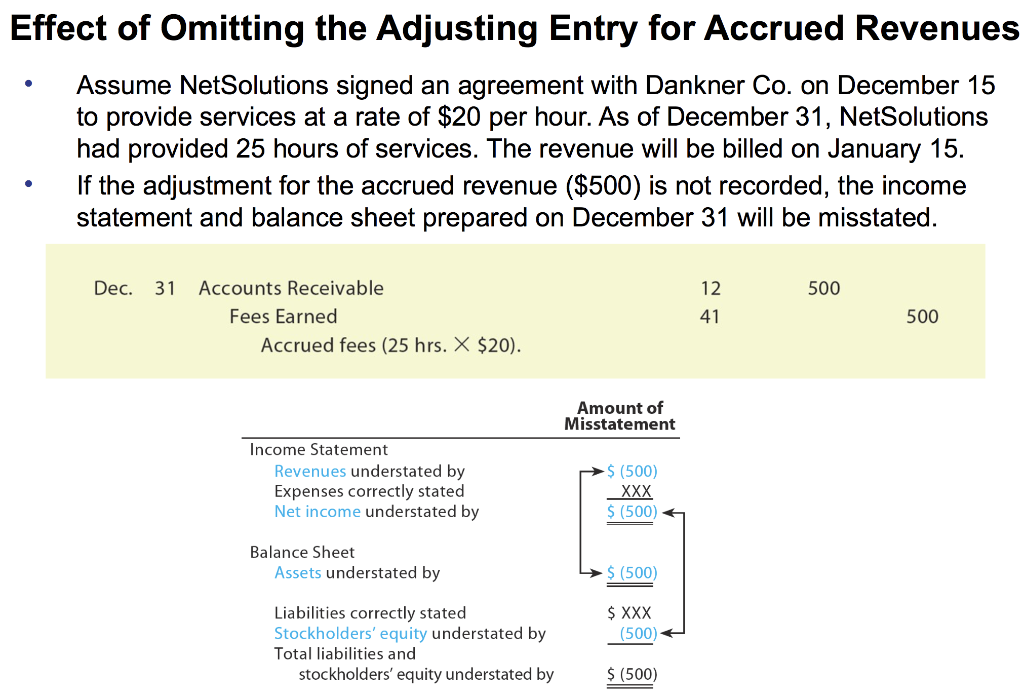

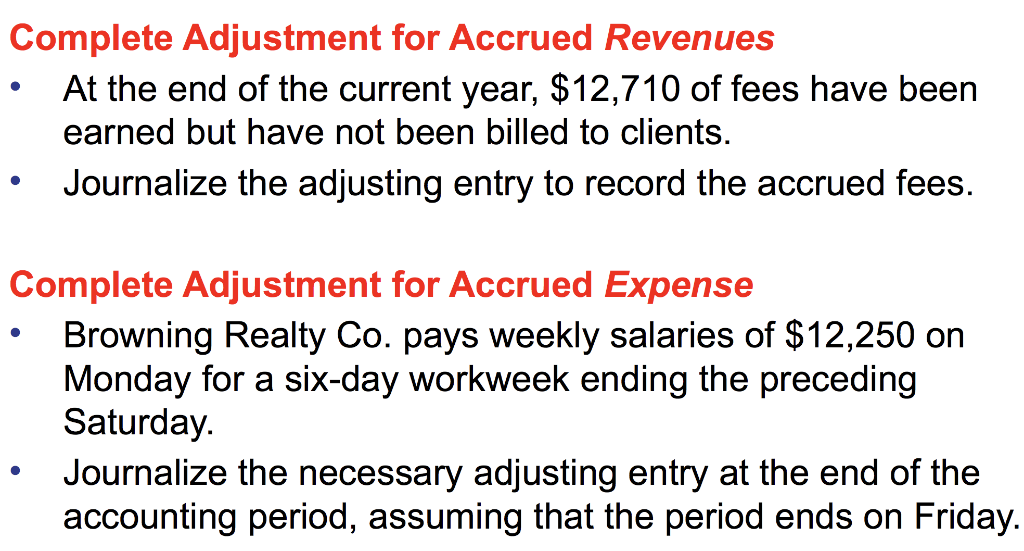

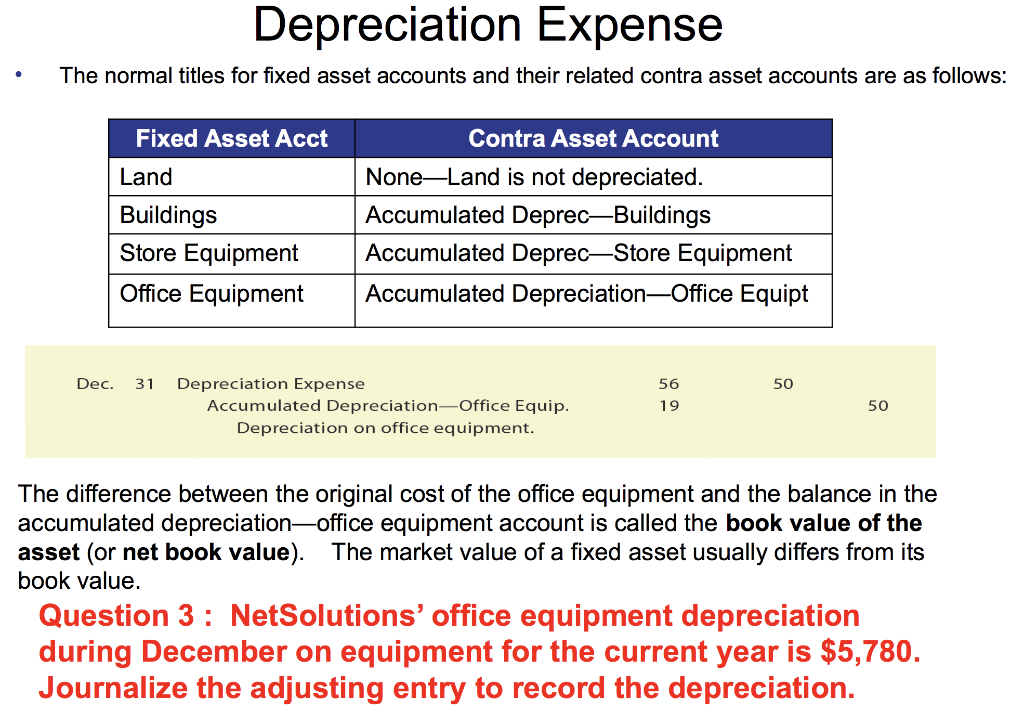

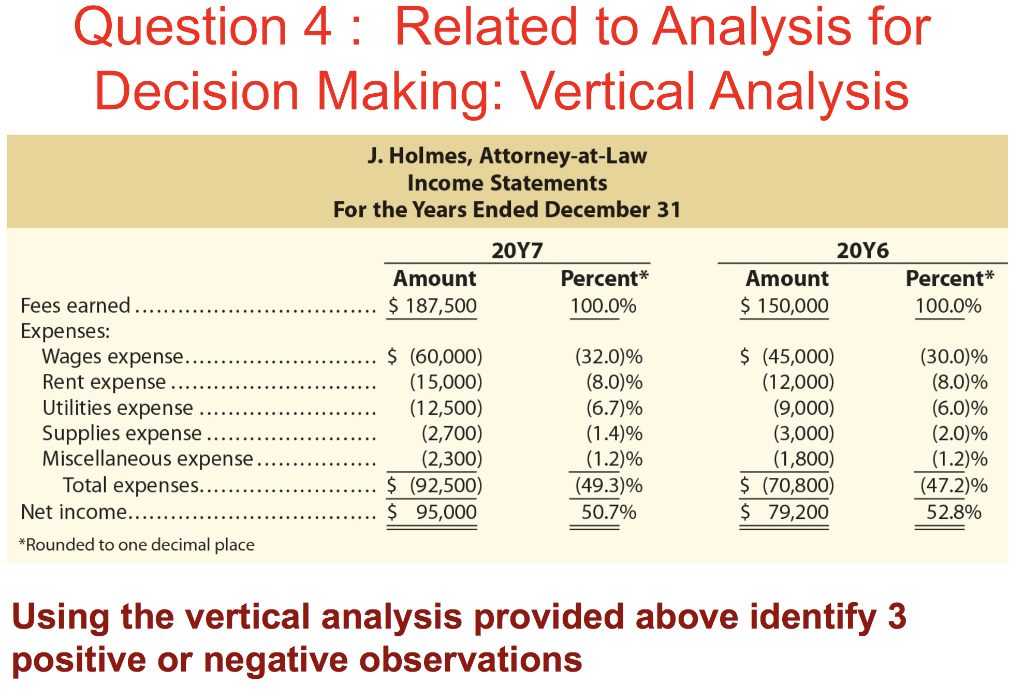

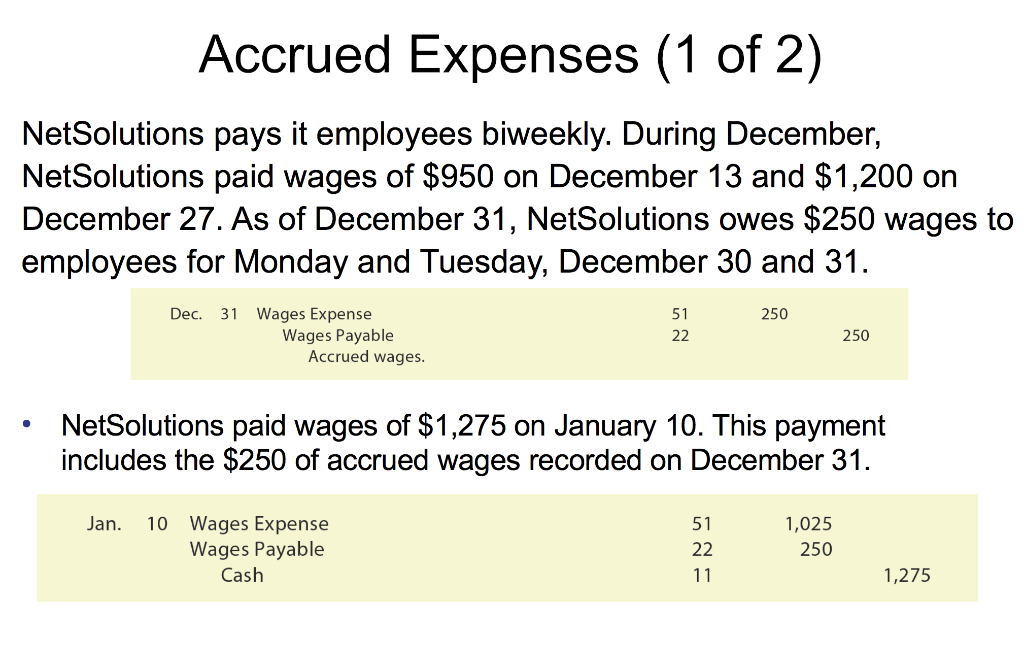

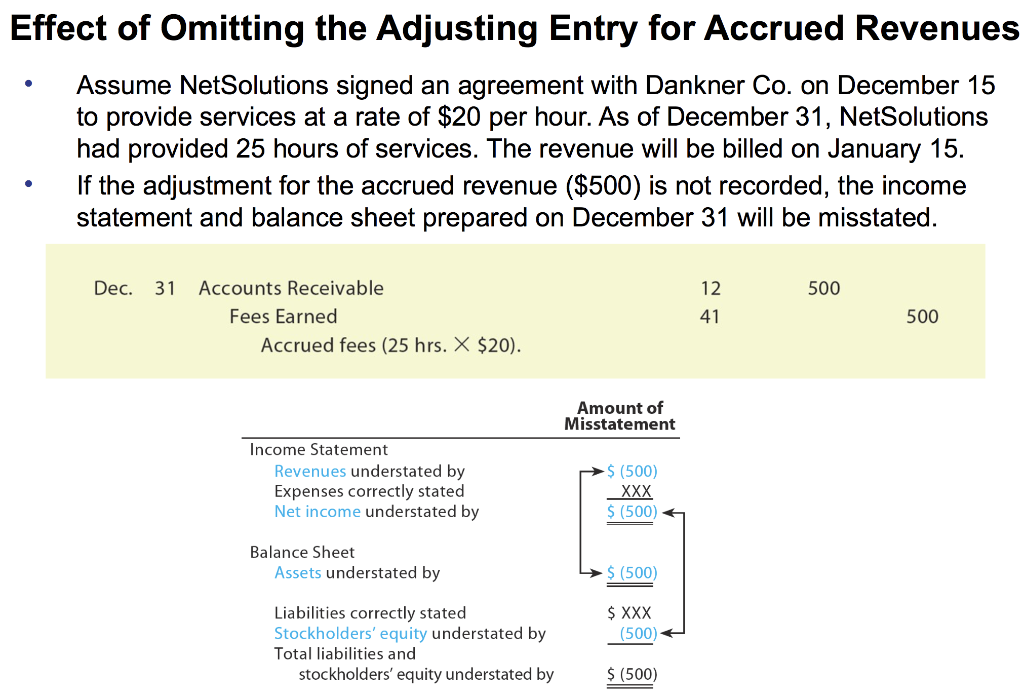

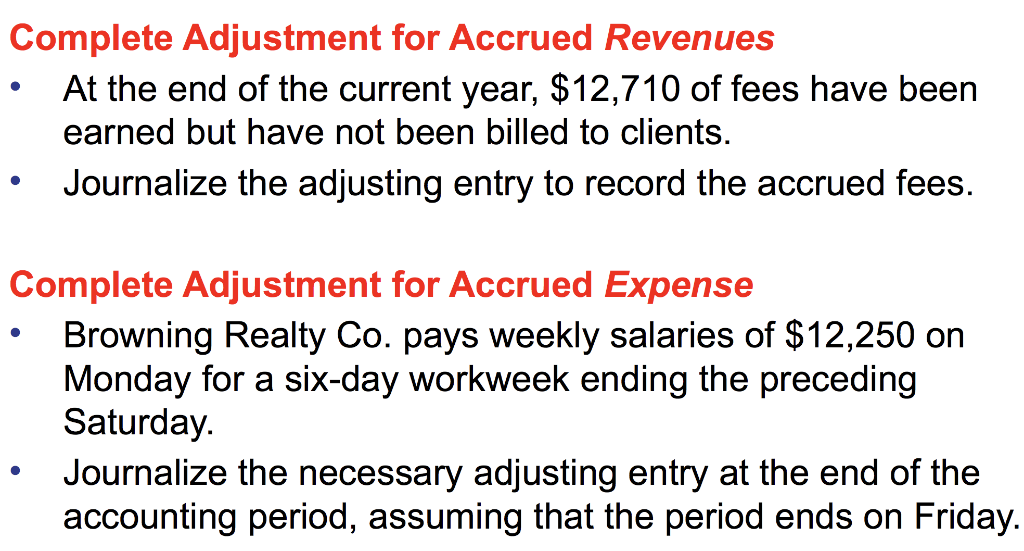

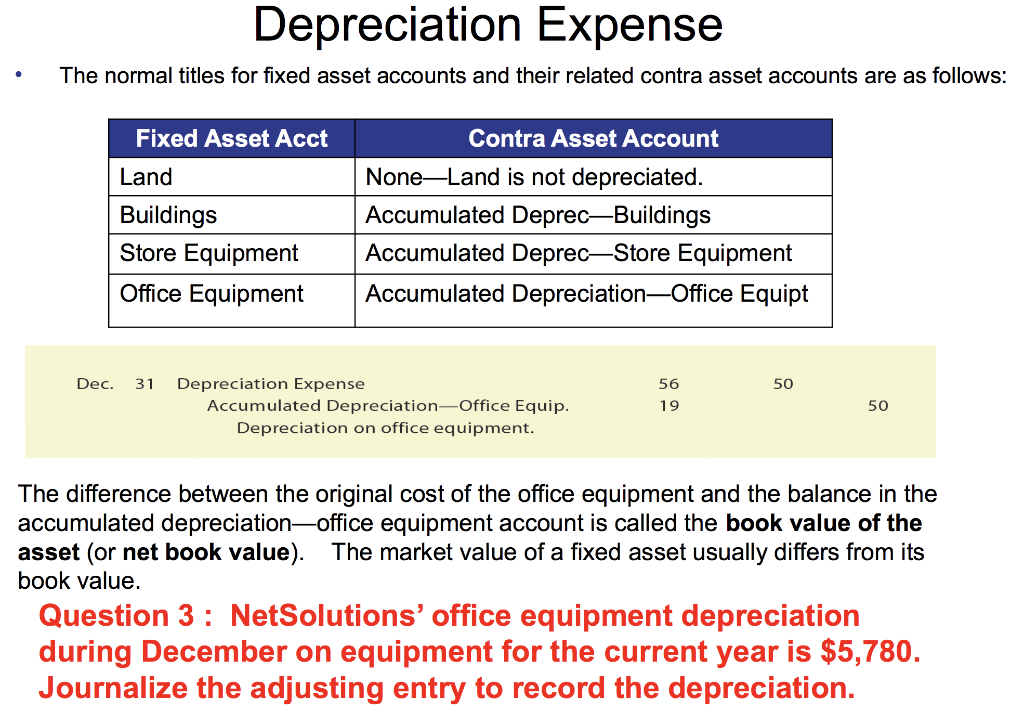

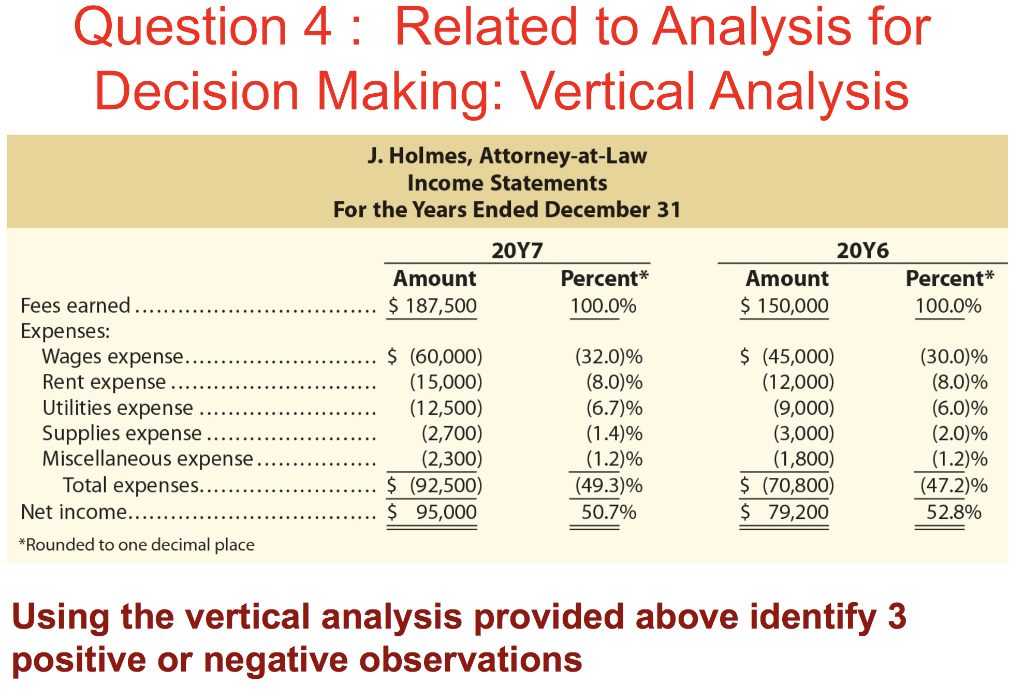

Accrued Expenses (1 of 2) NetSolutions pays it employees biweekly. During December, NetSolutions paid wages of $950 on December 13 and $1,200 on December 27. As of December 31, NetSolutions owes $250 wages to employees for Monday and Tuesday, December 30 and 31. 250 Dec. 31 Wages Expense Wages Payable Accrued wages. 51 22 250 O NetSolutions paid wages of $1,275 on January 10. This payment includes the $250 of accrued wages recorded on December 31. Jan. 10 Wages Expense Wages Payable Cash 51 22 11 1,025 250 1,275 Effect of Omitting the Adjusting Entry for Accrued Revenues Assume NetSolutions signed an agreement with Dankner Co. on December 15 to provide services at a rate of $20 per hour. As of December 31, NetSolutions had provided 25 hours of services. The revenue will be billed on January 15. If the adjustment for the accrued revenue ($500) is not recorded, the income statement and balance sheet prepared on December 31 will be misstated. Dec. 31 500 Accounts Receivable Fees Earned Accrued fees (25 hrs. X $20). 12 41 500 Amount of Misstatement Income Statement Revenues understated by Expenses correctly stated Net income understated by $ (500) XXX $ (500) Balance Sheet Assets understated by $ (500) $ XXX (500) Liabilities correctly stated Stockholders' equity understated by Total liabilities and stockholders' equity understated by $ (500) . Complete Adjustment for Accrued Revenues At the end of the current year, $12,710 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees. . . Complete Adjustment for Accrued Expense Browning Realty Co. pays weekly salaries of $12,250 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday. Depreciation Expense The normal titles for fixed asset accounts and their related contra asset accounts are as follows: Fixed Asset Acct Land Buildings Store Equipment Office Equipment Contra Asset Account NoneLand is not depreciated. Accumulated DeprecBuildings Accumulated DeprecStore Equipment Accumulated Depreciation-Office Equipt Dec. 31 50 Depreciation Expense Accumulated Depreciation Office Equip. Depreciation on office equipment. 56 19 50 The difference between the original cost of the office equipment and the balance in the accumulated depreciation-office equipment account is called the book value of the asset (or net book value). The market value of a fixed asset usually differs from its book value. Question 3: NetSolutions' office equipment depreciation during December on equipment for the current year is $5,780. Journalize the adjusting entry to record the depreciation. Question 4: Related to Analysis for Decision Making: Vertical Analysis J. Holmes, Attorney-at-Law Income Statements For the Years Ended December 31 2017 Amount $ 187,500 Percent* 100.0% 2016 Amount $ 150,000 Percent* 100.0% Fees earned Expenses: Wages expense. Rent expense Utilities expense Supplies expense Miscellaneous expense Total expenses..... Net income... *Rounded to one decimal place $ 160,000) (15,000) (12,500) (2,700) (2,300) $ (92,500) $ 95,000 (32.0)% (8.0% (6.7)% (1.4)% (1.2)% (49.3)% 50.7% $ (45,000) (12,000) (9,000) (3,000) (1,800) $ (70,800) $ 79,200 (30.0)% (8.0)% (6.0)% (2.0)% (1.2)% (47.2)% 52.8% Using the vertical analysis provided above identify 3 positive or negative observations