Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCS15 201960 Assessment 3 soins Part B Cost of Capital (Show all workings 50 marks) Grainwaves Lid is an Australian firm which is publicly listed

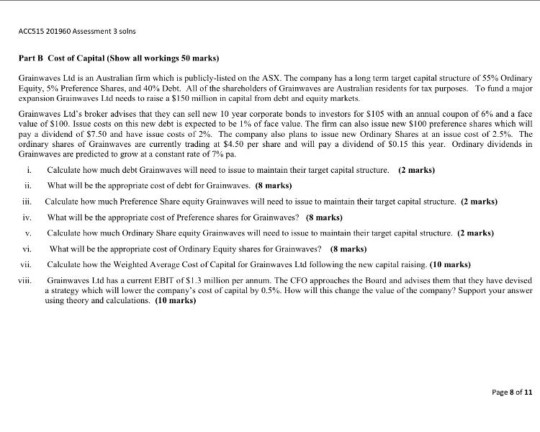

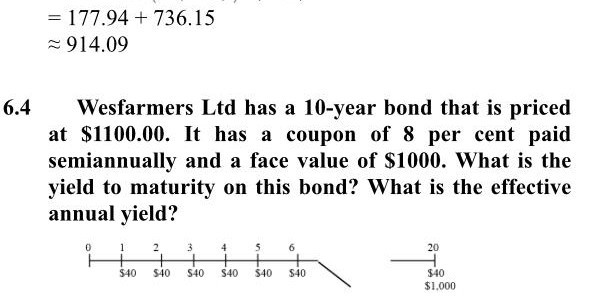

ACCS15 201960 Assessment 3 soins Part B Cost of Capital (Show all workings 50 marks) Grainwaves Lid is an Australian firm which is publicly listed on the ASX. The company has a long term target capital structure of 55% Ordinary Equity, 5% Preference Shares, and 40% Deht. All of the shareholders of rainwaves are Australian residents for tax purposes. To fund a major expansion Grunwaves Lad needs to raise a $150 million in capital from debt and equity markets. Grainwaves Lid's broker advises that they can sellew 10 year corporate bonds to investors for SiOS with an annual coupon of 6% and a face value of $100. Issue costs on this new debt is expected to be 1% of face value. The firm can also issue new S100 preference shares which will pay a dividend of $7.50 and have issue costs of 2%. The company also plans to issue new Ordinary Shares at an issue cost of 2.5%. The ordinary shares of Grainwaves are currently trading at $4.50 per share and will pay a dividend of SO.15 this year. Ordinary dividends in Grainwaves are predicted to grow at a constant rate of 7% pa i. Calculate how much debt Grainwaves will need to issue to maintain their target capital structure. (2 marks) ii. What will be the appropriate cost of debt for Grainwaves. (8 marks) iii. Calculate how much Preference Share equity Grainwaves will need to issue to maintain their target capital structure. (2 marks) iv. What will be the appropriate cost of Preference shares for Grainwaves? (8 marks) V. Calculate how much Ordinary Share equity Grainwaves will need to issue to maintain their target capital structure. (2 marks) vi. What will be the appropriate cost of Ordinary Equity shares for Grainwaves? (8 marks) vii. Calculate how the weighted Average Cost of Capital for Grainwaves Ltd following the new capital raising (10 marks) vili. Grainwaves Lid has a current EBIT of $1.3 million per annum. The CFO approaches the Board and advises them that they have devised strateey which will lower the company's cost of capital by 0.5% How will this change the value of the company Support your answer using theory and calculations. (10 marks) = 177.94 + 736.15 914.09 6.4 Wesfarmers Ltd has a 10-year bond that is priced at $1100.00. It has a coupon of 8 per cent paid semiannually and a face value of $1000. What is the yield to maturity on this bond? What is the effective annual yield? 0 1 2 3 4 5 6 S40 S40 S40 S40 S40 S40 $40 $1.000 ACCS15 201960 Assessment 3 soins Part B Cost of Capital (Show all workings 50 marks) Grainwaves Lid is an Australian firm which is publicly listed on the ASX. The company has a long term target capital structure of 55% Ordinary Equity, 5% Preference Shares, and 40% Deht. All of the shareholders of rainwaves are Australian residents for tax purposes. To fund a major expansion Grunwaves Lad needs to raise a $150 million in capital from debt and equity markets. Grainwaves Lid's broker advises that they can sellew 10 year corporate bonds to investors for SiOS with an annual coupon of 6% and a face value of $100. Issue costs on this new debt is expected to be 1% of face value. The firm can also issue new S100 preference shares which will pay a dividend of $7.50 and have issue costs of 2%. The company also plans to issue new Ordinary Shares at an issue cost of 2.5%. The ordinary shares of Grainwaves are currently trading at $4.50 per share and will pay a dividend of SO.15 this year. Ordinary dividends in Grainwaves are predicted to grow at a constant rate of 7% pa i. Calculate how much debt Grainwaves will need to issue to maintain their target capital structure. (2 marks) ii. What will be the appropriate cost of debt for Grainwaves. (8 marks) iii. Calculate how much Preference Share equity Grainwaves will need to issue to maintain their target capital structure. (2 marks) iv. What will be the appropriate cost of Preference shares for Grainwaves? (8 marks) V. Calculate how much Ordinary Share equity Grainwaves will need to issue to maintain their target capital structure. (2 marks) vi. What will be the appropriate cost of Ordinary Equity shares for Grainwaves? (8 marks) vii. Calculate how the weighted Average Cost of Capital for Grainwaves Ltd following the new capital raising (10 marks) vili. Grainwaves Lid has a current EBIT of $1.3 million per annum. The CFO approaches the Board and advises them that they have devised strateey which will lower the company's cost of capital by 0.5% How will this change the value of the company Support your answer using theory and calculations. (10 marks) = 177.94 + 736.15 914.09 6.4 Wesfarmers Ltd has a 10-year bond that is priced at $1100.00. It has a coupon of 8 per cent paid semiannually and a face value of $1000. What is the yield to maturity on this bond? What is the effective annual yield? 0 1 2 3 4 5 6 S40 S40 S40 S40 S40 S40 $40 $1.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started