Answered step by step

Verified Expert Solution

Question

1 Approved Answer

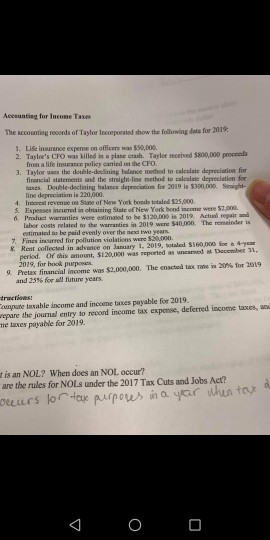

Accsunting for Income Taxes The accounting reoords of Taylor Incorporated show the following dats for 2019 1. Life insurance expense on officers was $50.000. 2.

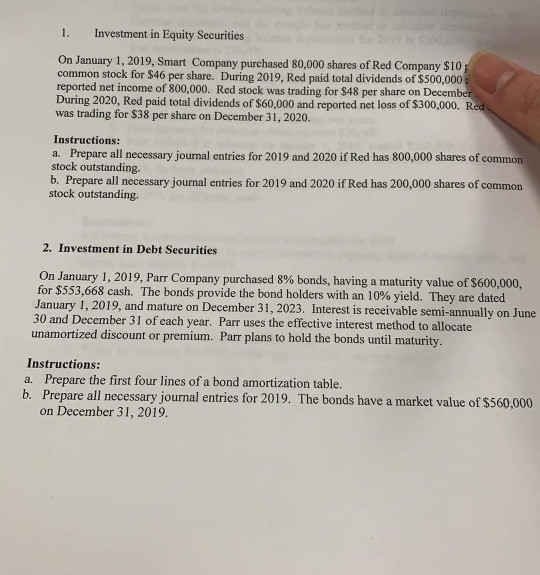

Accsunting for Income Taxes The accounting reoords of Taylor Incorporated show the following dats for 2019 1. Life insurance expense on officers was $50.000. 2. Tayloe's CFO was killed in a plane erash. Taylor received $800,000 proceods from a life insurance policy carried on the CFD 3. Taylor uses the double-decining belance method to caleslate depreciation for financial statements and the straight-line method to calculate depreciation for ves. Double-declining balsnce depeeciatio for 2019 is $300,000 Sight- line depreciation is 220,000, 4. Intoest revense on Stne of New York bonds totaled $25,000 S. Expesses incurmd in obaining State of New Yerk bent9 Actual regair and 6. Product wernties were etimaled to be SO 000, The remeinder is Jabor costs related to the warranies n estimaled to be peid evenly over the aexs two years 7 Fines incurred for pollution violaticns 2019, sotaled $i60,000 So &4-y 8 Reat collected in advaice on period. Of dhis amount, S20,000 was repoeted as unermed at December 31, 2019, for baok purposs 9 Pretax financial income was $2.000,000, The enacted tax rote j 20% for 2019 and 25% for all future years were $2.000. tractions Compute taxalhle income and income taxes payable for 2019 wepare the jourmal entry to record income tax expense, deferred income taxes, ane ne taxes payable for 2019. t is an NOL? When does an NOL occur? are the rules for NOLS under the 2017 Tax Cuts and Jobs Act? lorda purpous in a yar wun tax ceuurs 1. Investment in Equity Securities On January 1, 2019, Smart Company purchased 80,000 shares of Red Company $10 common stock for $46 per share. During 2019, Red paid total dividends of $500,000 a reported net income of 800,000. Red stock was trading for $48 per share on December During 2020, Red paid total dividends of $60,000 and reported net loss of $300,000. Red. was trading for $38 per share on December 31, 2020. Instructions: a. Prepare all necessary journal entries for 2019 and 2020 if Red has 800,000 shares of common stock outstanding. b. Prepare all necessary journal entries for 2019 and 2020 if Red has 200,000 shares of common stock outstanding. 2. Investment in Debt Securities On January 1, 2019, Parr Company purchased 8 % bonds, having a maturity value of $600,000, for $553,668 cash. The bonds provide the bond holders with an 10 % yield. They January 1, 2019, and mature on December 31, 2023. Interest is receivable semi-annually 30 and December 31 of each year. Parr uses the effective interest method to allocate unamortized discount or premium. Parr plans to hold the bonds until maturity. are dated on June Instructions: Prepare the first four lines ofa bond amortization table. b. Prepare all necessary journal entries for 2019. The bonds have a market value of $560,000 on December 31, 2019. a. Accsunting for Income Taxes The accounting reoords of Taylor Incorporated show the following dats for 2019 1. Life insurance expense on officers was $50.000. 2. Tayloe's CFO was killed in a plane erash. Taylor received $800,000 proceods from a life insurance policy carried on the CFD 3. Taylor uses the double-decining belance method to caleslate depreciation for financial statements and the straight-line method to calculate depreciation for ves. Double-declining balsnce depeeciatio for 2019 is $300,000 Sight- line depreciation is 220,000, 4. Intoest revense on Stne of New York bonds totaled $25,000 S. Expesses incurmd in obaining State of New Yerk bent9 Actual regair and 6. Product wernties were etimaled to be SO 000, The remeinder is Jabor costs related to the warranies n estimaled to be peid evenly over the aexs two years 7 Fines incurred for pollution violaticns 2019, sotaled $i60,000 So &4-y 8 Reat collected in advaice on period. Of dhis amount, S20,000 was repoeted as unermed at December 31, 2019, for baok purposs 9 Pretax financial income was $2.000,000, The enacted tax rote j 20% for 2019 and 25% for all future years were $2.000. tractions Compute taxalhle income and income taxes payable for 2019 wepare the jourmal entry to record income tax expense, deferred income taxes, ane ne taxes payable for 2019. t is an NOL? When does an NOL occur? are the rules for NOLS under the 2017 Tax Cuts and Jobs Act? lorda purpous in a yar wun tax ceuurs 1. Investment in Equity Securities On January 1, 2019, Smart Company purchased 80,000 shares of Red Company $10 common stock for $46 per share. During 2019, Red paid total dividends of $500,000 a reported net income of 800,000. Red stock was trading for $48 per share on December During 2020, Red paid total dividends of $60,000 and reported net loss of $300,000. Red. was trading for $38 per share on December 31, 2020. Instructions: a. Prepare all necessary journal entries for 2019 and 2020 if Red has 800,000 shares of common stock outstanding. b. Prepare all necessary journal entries for 2019 and 2020 if Red has 200,000 shares of common stock outstanding. 2. Investment in Debt Securities On January 1, 2019, Parr Company purchased 8 % bonds, having a maturity value of $600,000, for $553,668 cash. The bonds provide the bond holders with an 10 % yield. They January 1, 2019, and mature on December 31, 2023. Interest is receivable semi-annually 30 and December 31 of each year. Parr uses the effective interest method to allocate unamortized discount or premium. Parr plans to hold the bonds until maturity. are dated on June Instructions: Prepare the first four lines ofa bond amortization table. b. Prepare all necessary journal entries for 2019. The bonds have a market value of $560,000 on December 31, 2019. a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started