Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acct 101 project part 1 This project will be completed in two parts. The instructions and list of daily business transactions are listed in the

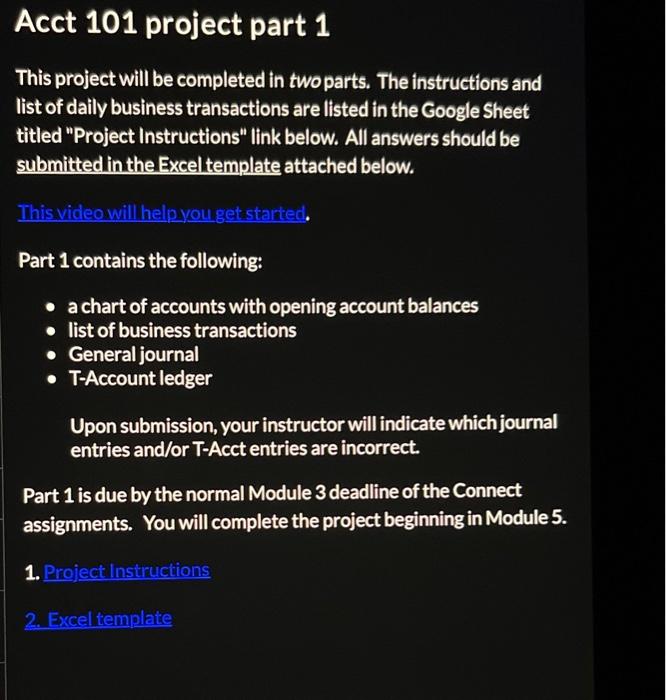

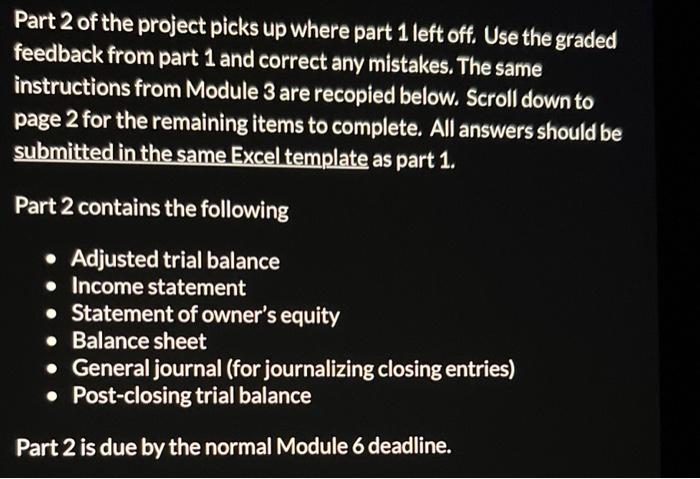

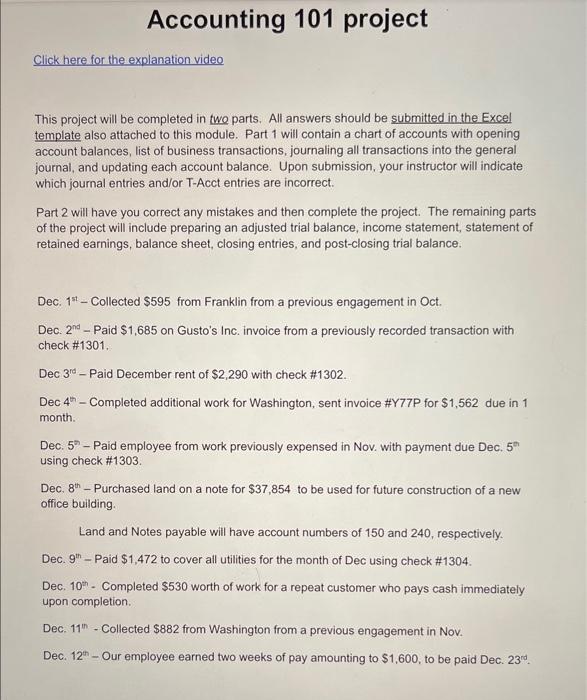

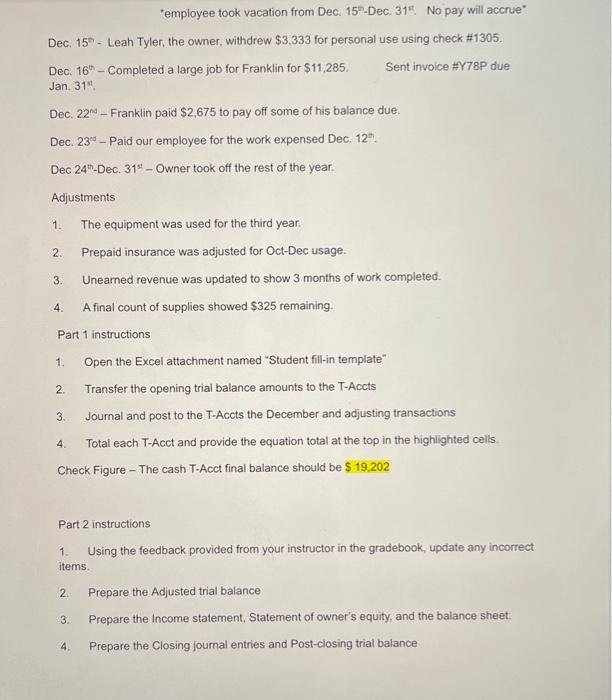

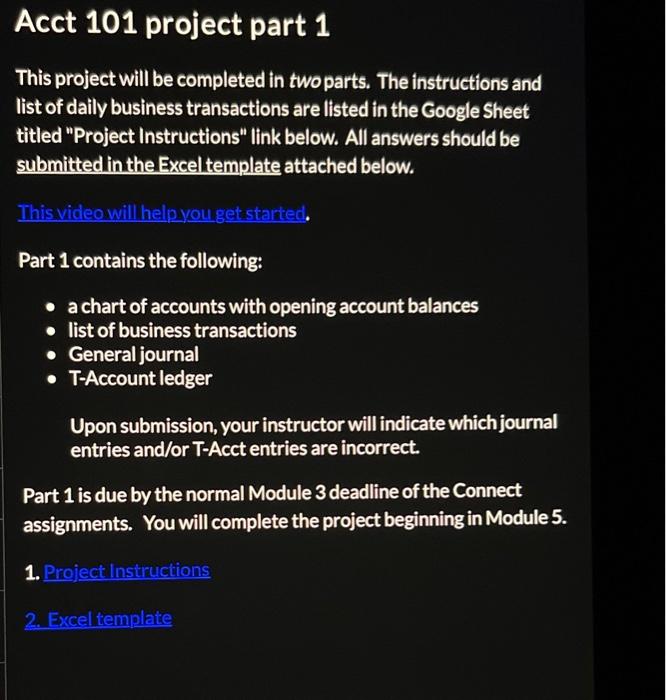

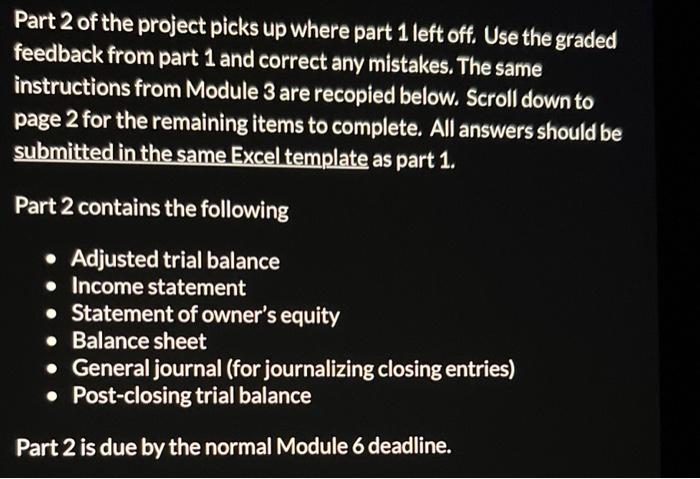

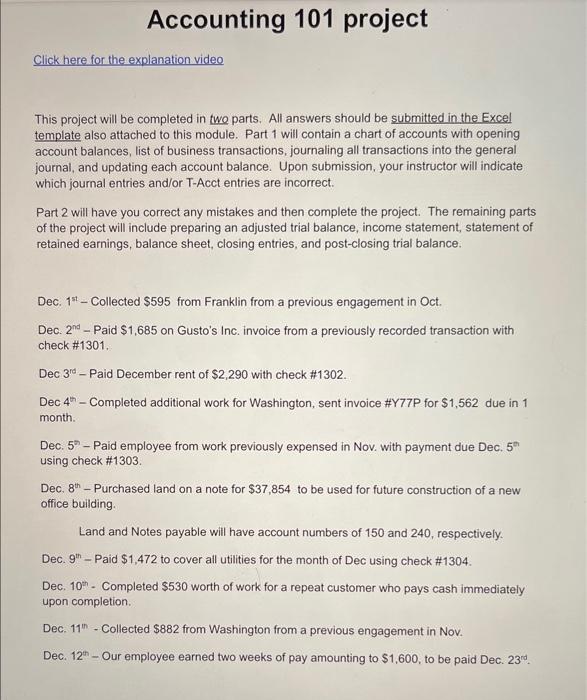

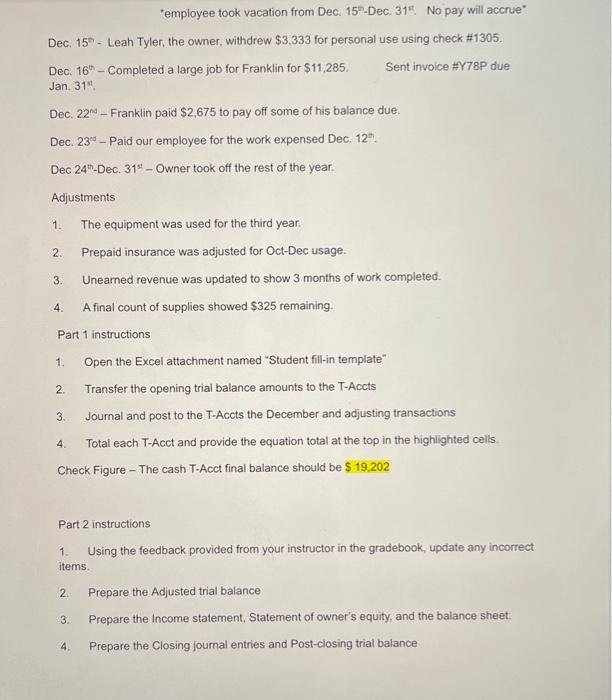

Acct 101 project part 1 This project will be completed in two parts. The instructions and list of daily business transactions are listed in the Google Sheet titled "Project Instructions" link below. All answers should be submitted in the Excel template attached below. This video will help you get started. Part 1 contains the following: - a chart of accounts with opening account balances - list of business transactions - General journal - T-Account ledger Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 1 is due by the normal Module 3 deadline of the Connect assignments. You will complete the project beginning in Module 5. 1. Project Instructions 2. Excel template Part 2 of the project picks up where part 1 left off, Use the graded feedback from part 1 and correct any mistakes. The same instructions from Module 3 are recopied below. Scroll down to page 2 for the remaining items to complete. All answers should be submitted in the same Excel template as part 1. Part 2 contains the following - Adjusted trial balance - Income statement - Statement of owner's equity - Balance sheet - General journal (for journalizing closing entries) - Post-closing trial balance Part 2 is due by the normal Module 6 deadline. This project will be completed in two parts. All answers should be submitted in the Excel template also attached to this module. Part 1 will contain a chart of accounts with opening account balances, list of business transactions, journaling all transactions into the general journal, and updating each account balance. Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 2 will have you correct any mistakes and then complete the project. The remaining parts of the project will include preparing an adjusted trial balance, income statement, statement of retained earnings, balance sheet, closing entries, and post-closing trial balance. Dec. 1st - Collected $595 from Franklin from a previous engagement in Oct. Dec. 2nd - Paid $1,685 on Gusto's Inc. invoice from a previously recorded transaction with check #1301. Dec 3ra - Paid December rent of $2,290 with check #1302. Dec 4th - Completed additional work for Washington, sent invoice #Y77P for $1,562 due in 1 month. Dec. 5n - Paid employee from work previously expensed in Nov. with payment due Dec. 5n using check #1303. Dec. 8th - Purchased land on a note for $37,854 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240, respectively. Dec. 9m - Paid $1,472 to cover all utilities for the month of Dec using check #1304. Dec. 10n - Completed $530 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11m - Collected $882 from Washington from a previous engagement in Nov. Dec. 12th - Our employee earned two weeks of pay amounting to $1,600, to be paid Dec. 23id. temployee took vacation from Dec. 15-Dec. 31th.. No pay will accrue" Dec. 15 - Leah Tyler, the owner, withdrew $3,333 for personal use using check #1305. Dec. 16th - Completed a large job for Franklin for $11,285. Sent invoice #Y78P due Jan, 31st, Dec. 22nd - Franklin paid $2,675 to pay off some of his balance due. Dec. 23d - Paid our employee for the work expensed Dec. 12th. Dec 24th Dec. 31st - Owner took off the rest of the year. Adjustments 1. The equipment was used for the third year. 2. Prepaid insurance was adjusted for Oct-Dec usage. 3. Unearned revenue was updated to show 3 months of work completed. 4. A final count of supplies showed $325 remaining. Part 1 instructions 1. Open the Excel attachment named "Student fill-in template" 2. Transfer the opening trial balance amounts to the T-Accts 3. Journal and post to the T-Accts the December and adjusting transactions 4. Total each T-Acct and provide the equation total at the top in the highlighted cells. Check Figure - The cash T-Acct final balance should be $19,202 Part 2 instructions 1. Using the feedback provided from your instructor in the gradebook, update any incorrect items. 2. Prepare the Adjusted trial balance 3. Prepare the income statement, Statement of owner's equity, and the balance sheet. 4. Prepare the Closing journal entries and Post-closing trial balance Acct 101 project part 1 This project will be completed in two parts. The instructions and list of daily business transactions are listed in the Google Sheet titled "Project Instructions" link below. All answers should be submitted in the Excel template attached below. This video will help you get started. Part 1 contains the following: - a chart of accounts with opening account balances - list of business transactions - General journal - T-Account ledger Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 1 is due by the normal Module 3 deadline of the Connect assignments. You will complete the project beginning in Module 5. 1. Project Instructions 2. Excel template Part 2 of the project picks up where part 1 left off, Use the graded feedback from part 1 and correct any mistakes. The same instructions from Module 3 are recopied below. Scroll down to page 2 for the remaining items to complete. All answers should be submitted in the same Excel template as part 1. Part 2 contains the following - Adjusted trial balance - Income statement - Statement of owner's equity - Balance sheet - General journal (for journalizing closing entries) - Post-closing trial balance Part 2 is due by the normal Module 6 deadline. This project will be completed in two parts. All answers should be submitted in the Excel template also attached to this module. Part 1 will contain a chart of accounts with opening account balances, list of business transactions, journaling all transactions into the general journal, and updating each account balance. Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 2 will have you correct any mistakes and then complete the project. The remaining parts of the project will include preparing an adjusted trial balance, income statement, statement of retained earnings, balance sheet, closing entries, and post-closing trial balance. Dec. 1st - Collected $595 from Franklin from a previous engagement in Oct. Dec. 2nd - Paid $1,685 on Gusto's Inc. invoice from a previously recorded transaction with check #1301. Dec 3ra - Paid December rent of $2,290 with check #1302. Dec 4th - Completed additional work for Washington, sent invoice #Y77P for $1,562 due in 1 month. Dec. 5n - Paid employee from work previously expensed in Nov. with payment due Dec. 5n using check #1303. Dec. 8th - Purchased land on a note for $37,854 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240, respectively. Dec. 9m - Paid $1,472 to cover all utilities for the month of Dec using check #1304. Dec. 10n - Completed $530 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11m - Collected $882 from Washington from a previous engagement in Nov. Dec. 12th - Our employee earned two weeks of pay amounting to $1,600, to be paid Dec. 23id. temployee took vacation from Dec. 15-Dec. 31th.. No pay will accrue" Dec. 15 - Leah Tyler, the owner, withdrew $3,333 for personal use using check #1305. Dec. 16th - Completed a large job for Franklin for $11,285. Sent invoice #Y78P due Jan, 31st, Dec. 22nd - Franklin paid $2,675 to pay off some of his balance due. Dec. 23d - Paid our employee for the work expensed Dec. 12th. Dec 24th Dec. 31st - Owner took off the rest of the year. Adjustments 1. The equipment was used for the third year. 2. Prepaid insurance was adjusted for Oct-Dec usage. 3. Unearned revenue was updated to show 3 months of work completed. 4. A final count of supplies showed $325 remaining. Part 1 instructions 1. Open the Excel attachment named "Student fill-in template" 2. Transfer the opening trial balance amounts to the T-Accts 3. Journal and post to the T-Accts the December and adjusting transactions 4. Total each T-Acct and provide the equation total at the top in the highlighted cells. Check Figure - The cash T-Acct final balance should be $19,202 Part 2 instructions 1. Using the feedback provided from your instructor in the gradebook, update any incorrect items. 2. Prepare the Adjusted trial balance 3. Prepare the income statement, Statement of owner's equity, and the balance sheet. 4. Prepare the Closing journal entries and Post-closing trial balance

Acct 101 project part 1 This project will be completed in two parts. The instructions and list of daily business transactions are listed in the Google Sheet titled "Project Instructions" link below. All answers should be submitted in the Excel template attached below. This video will help you get started. Part 1 contains the following: - a chart of accounts with opening account balances - list of business transactions - General journal - T-Account ledger Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 1 is due by the normal Module 3 deadline of the Connect assignments. You will complete the project beginning in Module 5. 1. Project Instructions 2. Excel template Part 2 of the project picks up where part 1 left off, Use the graded feedback from part 1 and correct any mistakes. The same instructions from Module 3 are recopied below. Scroll down to page 2 for the remaining items to complete. All answers should be submitted in the same Excel template as part 1. Part 2 contains the following - Adjusted trial balance - Income statement - Statement of owner's equity - Balance sheet - General journal (for journalizing closing entries) - Post-closing trial balance Part 2 is due by the normal Module 6 deadline. This project will be completed in two parts. All answers should be submitted in the Excel template also attached to this module. Part 1 will contain a chart of accounts with opening account balances, list of business transactions, journaling all transactions into the general journal, and updating each account balance. Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 2 will have you correct any mistakes and then complete the project. The remaining parts of the project will include preparing an adjusted trial balance, income statement, statement of retained earnings, balance sheet, closing entries, and post-closing trial balance. Dec. 1st - Collected $595 from Franklin from a previous engagement in Oct. Dec. 2nd - Paid $1,685 on Gusto's Inc. invoice from a previously recorded transaction with check #1301. Dec 3ra - Paid December rent of $2,290 with check #1302. Dec 4th - Completed additional work for Washington, sent invoice #Y77P for $1,562 due in 1 month. Dec. 5n - Paid employee from work previously expensed in Nov. with payment due Dec. 5n using check #1303. Dec. 8th - Purchased land on a note for $37,854 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240, respectively. Dec. 9m - Paid $1,472 to cover all utilities for the month of Dec using check #1304. Dec. 10n - Completed $530 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11m - Collected $882 from Washington from a previous engagement in Nov. Dec. 12th - Our employee earned two weeks of pay amounting to $1,600, to be paid Dec. 23id. temployee took vacation from Dec. 15-Dec. 31th.. No pay will accrue" Dec. 15 - Leah Tyler, the owner, withdrew $3,333 for personal use using check #1305. Dec. 16th - Completed a large job for Franklin for $11,285. Sent invoice #Y78P due Jan, 31st, Dec. 22nd - Franklin paid $2,675 to pay off some of his balance due. Dec. 23d - Paid our employee for the work expensed Dec. 12th. Dec 24th Dec. 31st - Owner took off the rest of the year. Adjustments 1. The equipment was used for the third year. 2. Prepaid insurance was adjusted for Oct-Dec usage. 3. Unearned revenue was updated to show 3 months of work completed. 4. A final count of supplies showed $325 remaining. Part 1 instructions 1. Open the Excel attachment named "Student fill-in template" 2. Transfer the opening trial balance amounts to the T-Accts 3. Journal and post to the T-Accts the December and adjusting transactions 4. Total each T-Acct and provide the equation total at the top in the highlighted cells. Check Figure - The cash T-Acct final balance should be $19,202 Part 2 instructions 1. Using the feedback provided from your instructor in the gradebook, update any incorrect items. 2. Prepare the Adjusted trial balance 3. Prepare the income statement, Statement of owner's equity, and the balance sheet. 4. Prepare the Closing journal entries and Post-closing trial balance Acct 101 project part 1 This project will be completed in two parts. The instructions and list of daily business transactions are listed in the Google Sheet titled "Project Instructions" link below. All answers should be submitted in the Excel template attached below. This video will help you get started. Part 1 contains the following: - a chart of accounts with opening account balances - list of business transactions - General journal - T-Account ledger Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 1 is due by the normal Module 3 deadline of the Connect assignments. You will complete the project beginning in Module 5. 1. Project Instructions 2. Excel template Part 2 of the project picks up where part 1 left off, Use the graded feedback from part 1 and correct any mistakes. The same instructions from Module 3 are recopied below. Scroll down to page 2 for the remaining items to complete. All answers should be submitted in the same Excel template as part 1. Part 2 contains the following - Adjusted trial balance - Income statement - Statement of owner's equity - Balance sheet - General journal (for journalizing closing entries) - Post-closing trial balance Part 2 is due by the normal Module 6 deadline. This project will be completed in two parts. All answers should be submitted in the Excel template also attached to this module. Part 1 will contain a chart of accounts with opening account balances, list of business transactions, journaling all transactions into the general journal, and updating each account balance. Upon submission, your instructor will indicate which journal entries and/or T-Acct entries are incorrect. Part 2 will have you correct any mistakes and then complete the project. The remaining parts of the project will include preparing an adjusted trial balance, income statement, statement of retained earnings, balance sheet, closing entries, and post-closing trial balance. Dec. 1st - Collected $595 from Franklin from a previous engagement in Oct. Dec. 2nd - Paid $1,685 on Gusto's Inc. invoice from a previously recorded transaction with check #1301. Dec 3ra - Paid December rent of $2,290 with check #1302. Dec 4th - Completed additional work for Washington, sent invoice #Y77P for $1,562 due in 1 month. Dec. 5n - Paid employee from work previously expensed in Nov. with payment due Dec. 5n using check #1303. Dec. 8th - Purchased land on a note for $37,854 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240, respectively. Dec. 9m - Paid $1,472 to cover all utilities for the month of Dec using check #1304. Dec. 10n - Completed $530 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11m - Collected $882 from Washington from a previous engagement in Nov. Dec. 12th - Our employee earned two weeks of pay amounting to $1,600, to be paid Dec. 23id. temployee took vacation from Dec. 15-Dec. 31th.. No pay will accrue" Dec. 15 - Leah Tyler, the owner, withdrew $3,333 for personal use using check #1305. Dec. 16th - Completed a large job for Franklin for $11,285. Sent invoice #Y78P due Jan, 31st, Dec. 22nd - Franklin paid $2,675 to pay off some of his balance due. Dec. 23d - Paid our employee for the work expensed Dec. 12th. Dec 24th Dec. 31st - Owner took off the rest of the year. Adjustments 1. The equipment was used for the third year. 2. Prepaid insurance was adjusted for Oct-Dec usage. 3. Unearned revenue was updated to show 3 months of work completed. 4. A final count of supplies showed $325 remaining. Part 1 instructions 1. Open the Excel attachment named "Student fill-in template" 2. Transfer the opening trial balance amounts to the T-Accts 3. Journal and post to the T-Accts the December and adjusting transactions 4. Total each T-Acct and provide the equation total at the top in the highlighted cells. Check Figure - The cash T-Acct final balance should be $19,202 Part 2 instructions 1. Using the feedback provided from your instructor in the gradebook, update any incorrect items. 2. Prepare the Adjusted trial balance 3. Prepare the income statement, Statement of owner's equity, and the balance sheet. 4. Prepare the Closing journal entries and Post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started