ACCT 102, Trying to check! Please Help! Thank you!

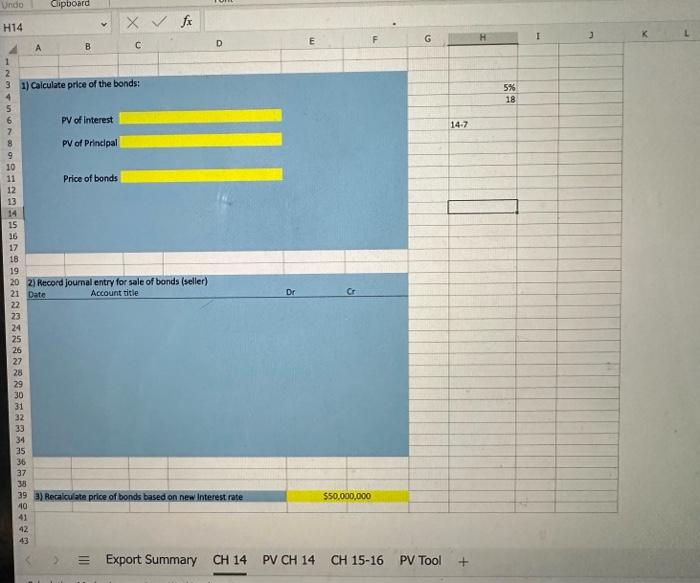

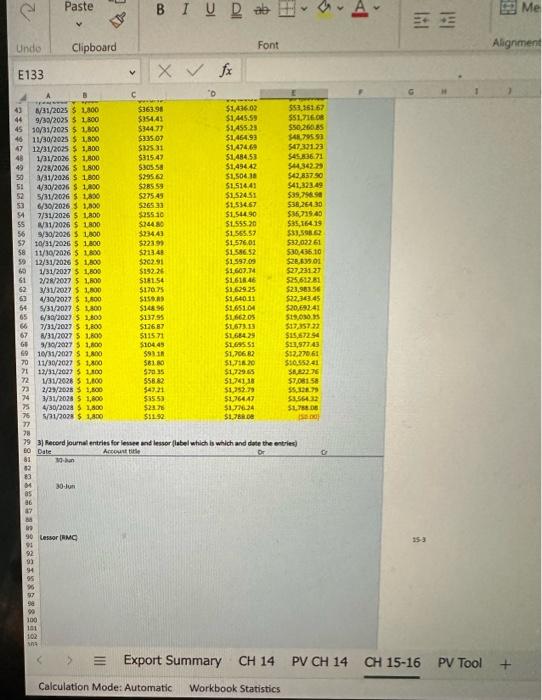

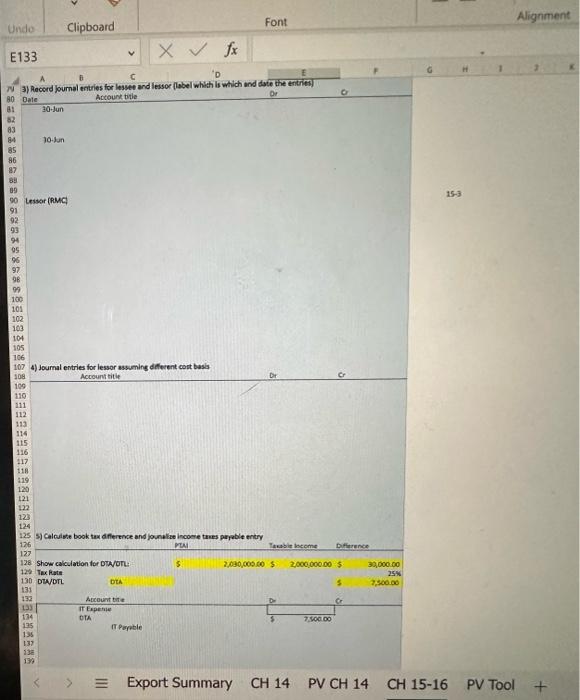

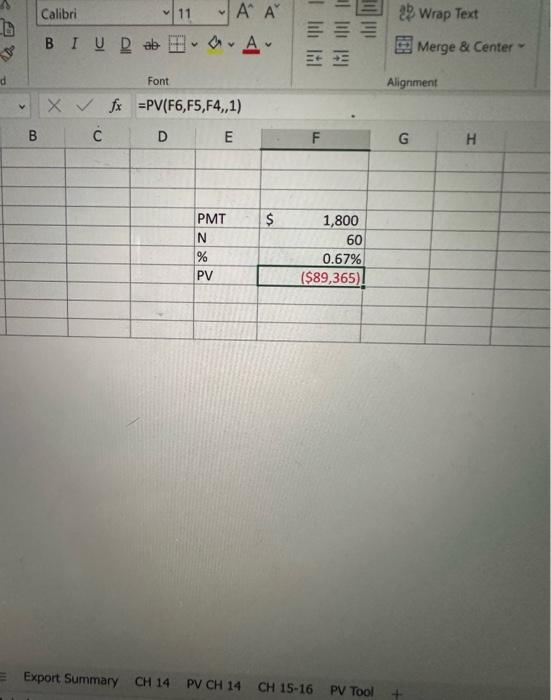

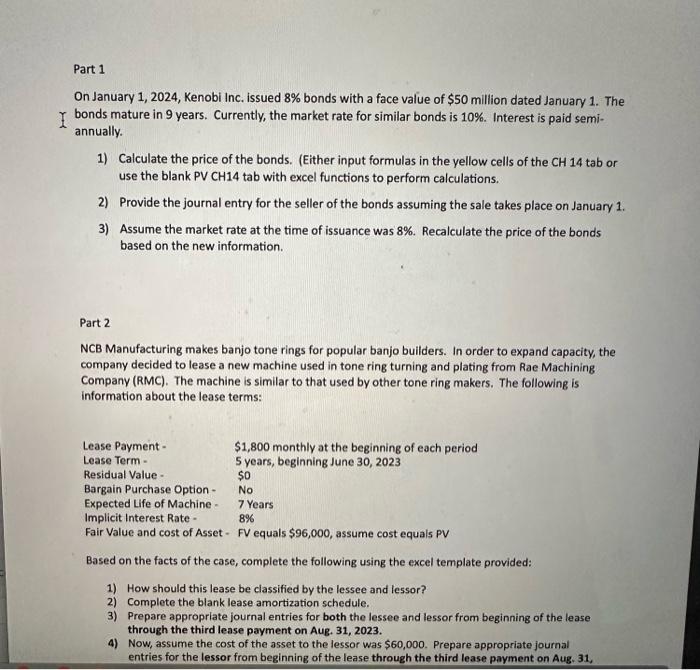

On January 1,2024 , Kenobi Inc. issued 8% bonds with a face value of $50 million dated January 1 . The bonds mature in 9 years. Currently, the market rate for similar bonds is 10%. Interest is paid semiannually. 1) Calculate the price of the bonds. (Either input formulas in the yellow cells of the CH14 tab or use the blank PV CH14 tab with excel functions to perform calculations. 2) Provide the journal entry for the seller of the bonds assuming the sale takes place on January 1. 3) Assume the market rate at the time of issuance was 8%. Recalculate the price of the bonds based on the new information. Part 2 NCB Manufacturing makes banjo tone rings for popular banjo builders. In order to expand capacity, the company decided to lease a new machine used in tone ring turning and plating from Rae Machining Company (RMC). The machine is similar to that used by other tone ring makers. The following is information about the lease terms: Based on the facts of the case, complete the following using the excel template provided: 1) How should this lease be classified by the lessee and lessor? 2) Complete the blank lease amortization schedule. 3) Prepare appropriate journal entries for both the lessee and lessor from beginning of the lease through the third lease payment on Aug. 31, 2023. 4) Now, assume the cost of the asset to the lessor was $60,000. Prepare appropriate journal entries for the lessor from beginning of the lease through the third lease payment on Aug. 31 , 1) Calculate the price of the bonds. (Either input formulas in the yellow cells of the CH14 tab or use the blank PV CH14 tab with excel functions to perform caiculations. 2) Provide the journal entry for the seller of the bonds assuming the sale takes place on January 1. 3) Assume the market rate at the time of issuance was 8%. Recalculate the price of the bonds based on the new information. Part 2 NCB Manufacturing makes banjo tone rings for popular banjo builders. In order to expand capacity, the company decided to lease a new machine used in tone ring turning and plating from Rae Machining Company (RMC). The machine is similar to that used by other tone ring makers. The following is information about the lease terms: Based on the facts of the case, complete the following using the excel template provided: 1) How should this lease be classified by the lessee and lessor? 2) Complete the blank lease amortization schedule. 3) Prepare appropriate journal entries for both the lessee and lessor from beginning of the lease through the third lease payment on Aug. 31, 2023. 4) Now, assume the cost of the asset to the lessor was $60,000. Prepare appropriate journal entries for the lessor from beginning of the lease through the third lease payment on Aug. 31, 2023. 5) Lastly, (independent of all other scenarios) assume the lessee made a warranty claim of $30,000 on the leased asset at the end of 2023 due to an issue with the machine. This warranty claim caused the lessor to book warranty expense in 2023 (although the cash flow did not occur until 2024), creating a temporary book-tax difference for the lessor (this is the only book-tax difference). Using a tax rate of 25%, calculate the amount of the DTA/DTL created for the lessor and prepare the appropriate journal entry to record income taxes at the end of 2023 for the lessor (PTAl of $2.0 million). 1) Calculate price of the bonds: 5% PV of interest 147 PV of Principal Price of bonds 2) Pecord journal entry for sale of bonds (seller) Date Account title Dr Cr 3) Recalculate price of bonds based on new interest rate 3) Fecord journal entribs for levsee and lessor (label which is which and date the entries) Date. Arecaut title s) Calculite book tax dffertnce and jounulbe incoere thes parpable entey > Export Summary CH14 PV CH 14CH1516 PV Tool Export Summary CH 14 PV CH 14 CH 15-16 PV Tool