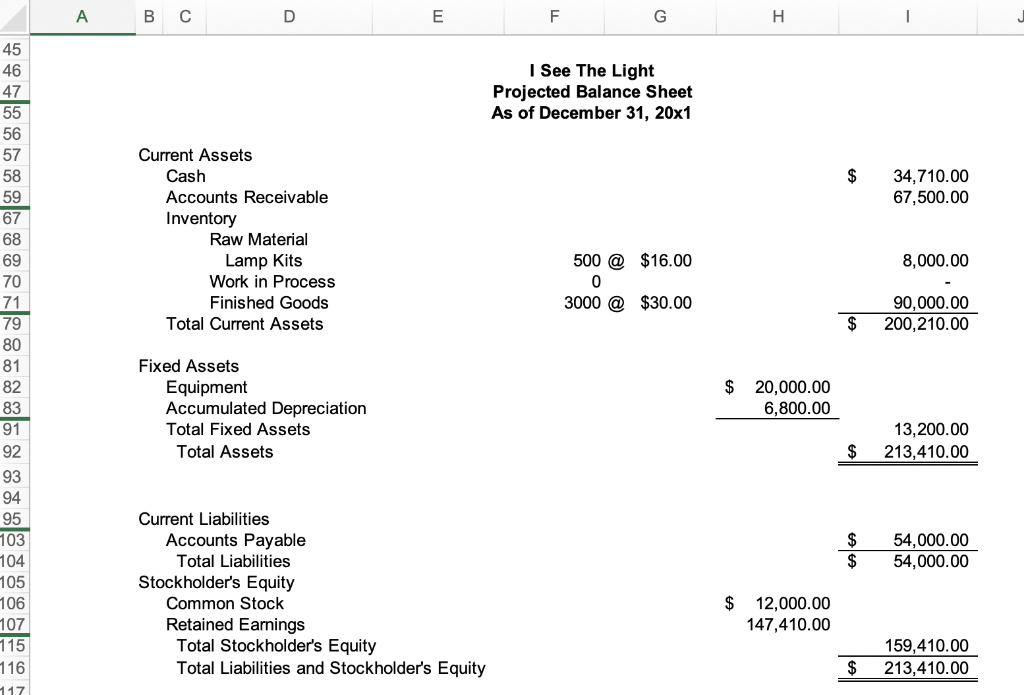

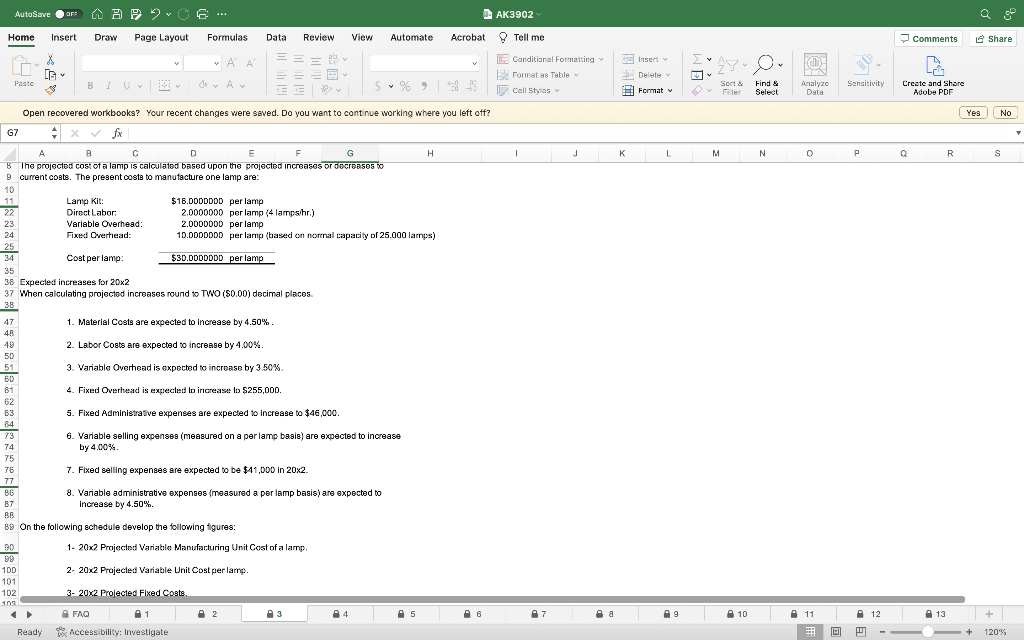

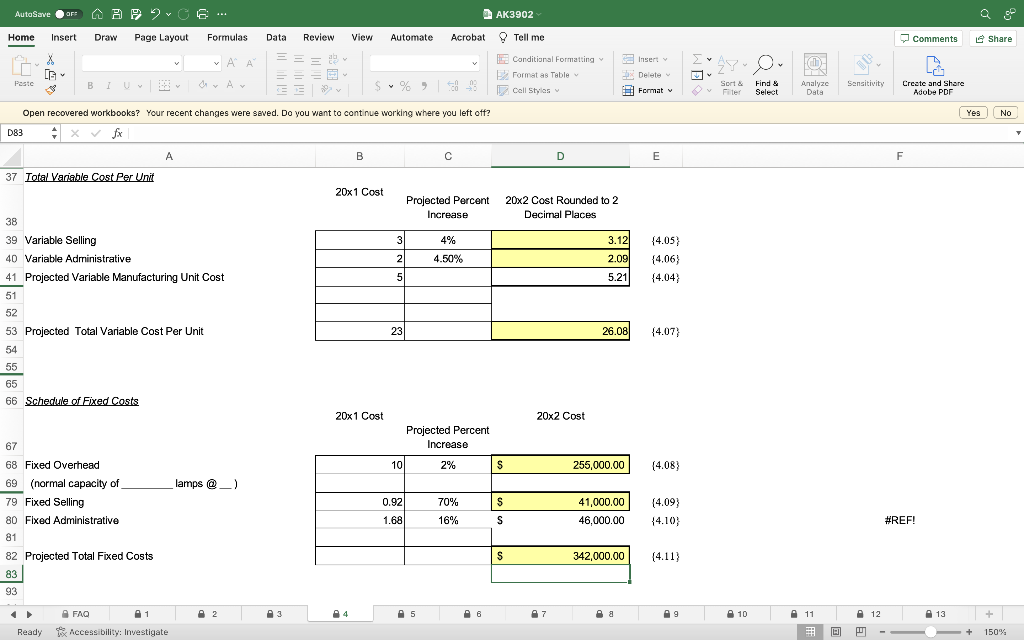

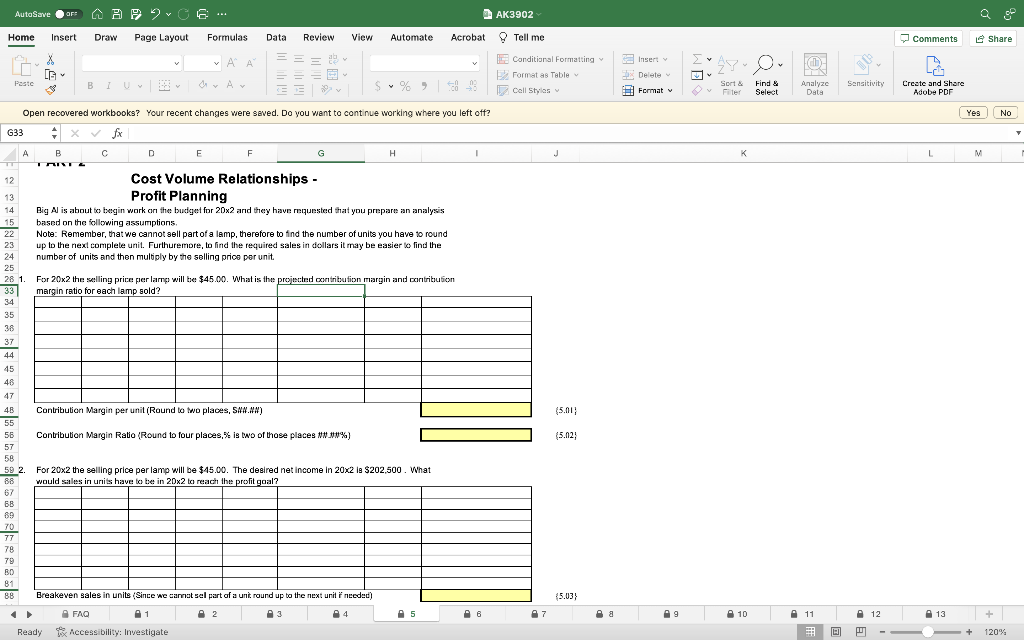

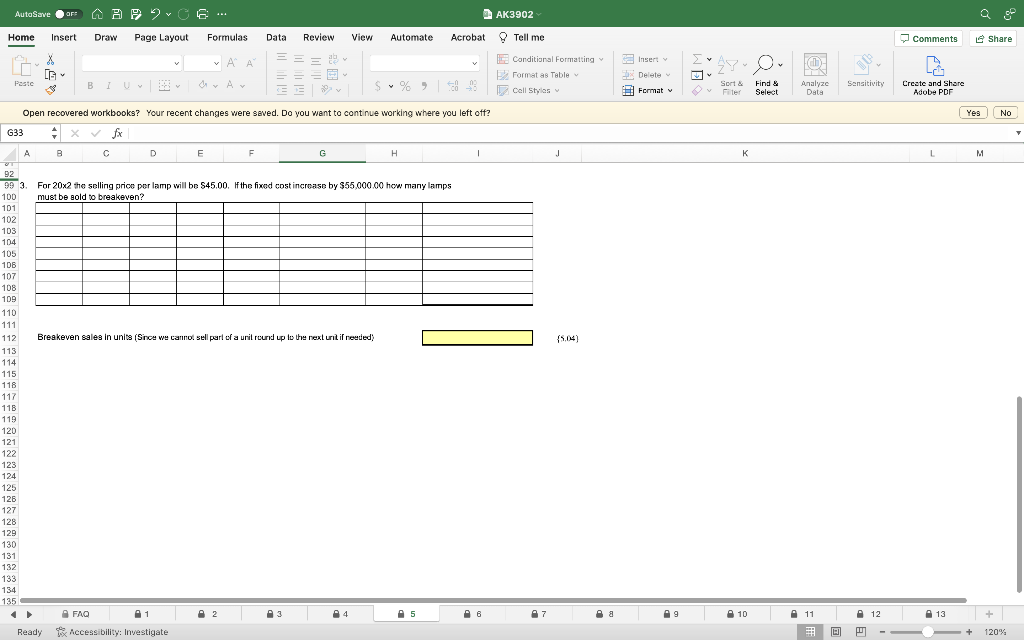

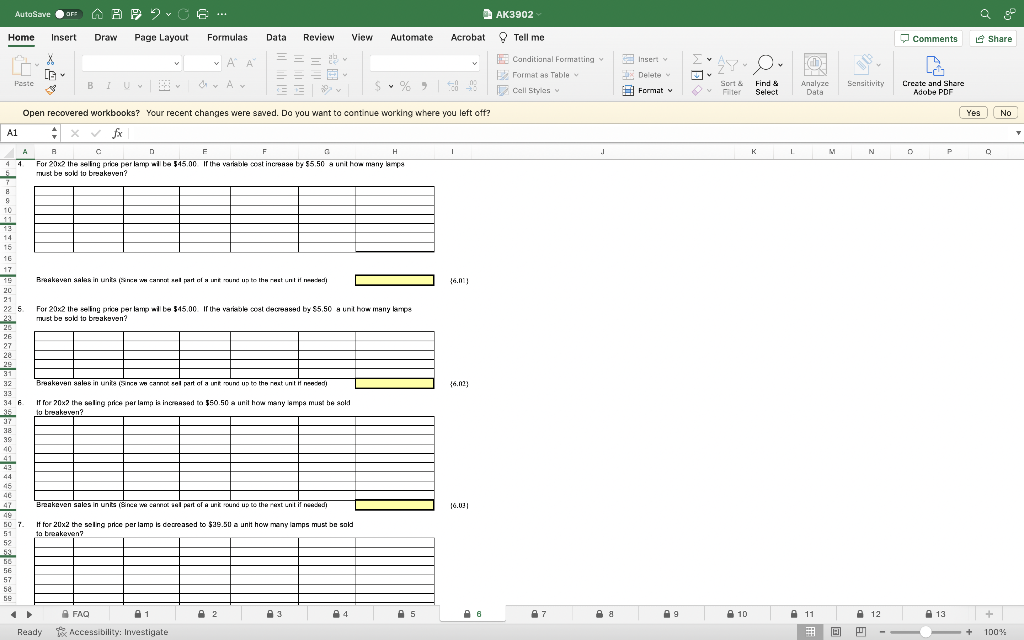

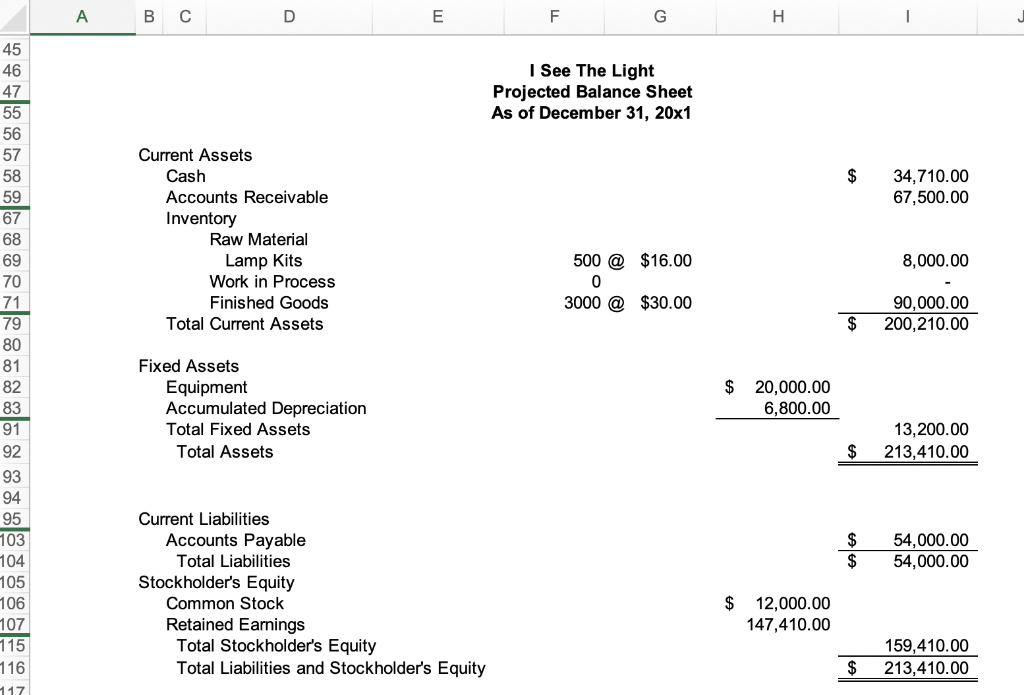

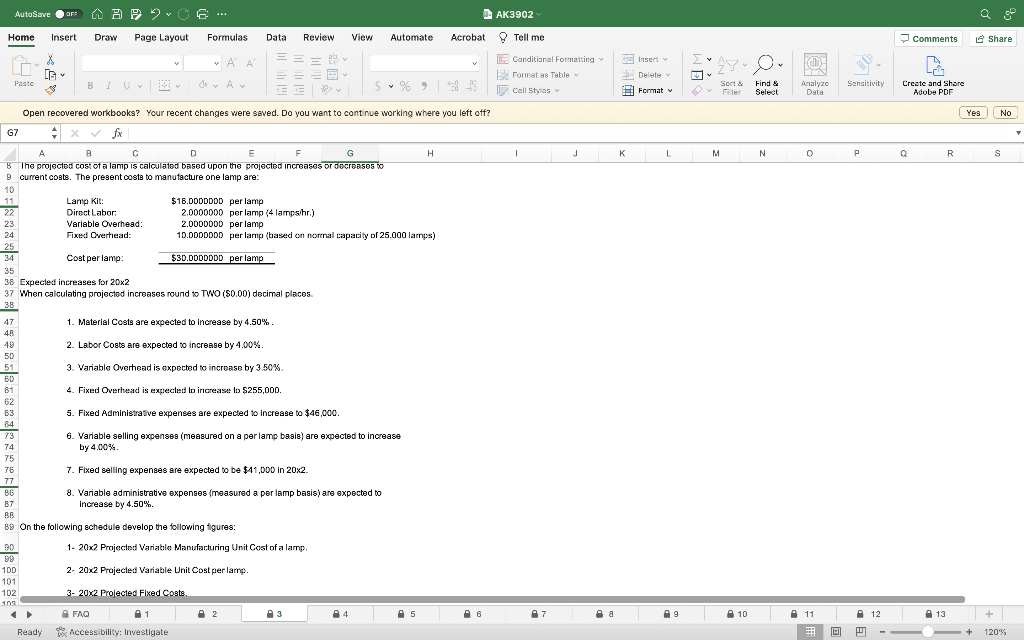

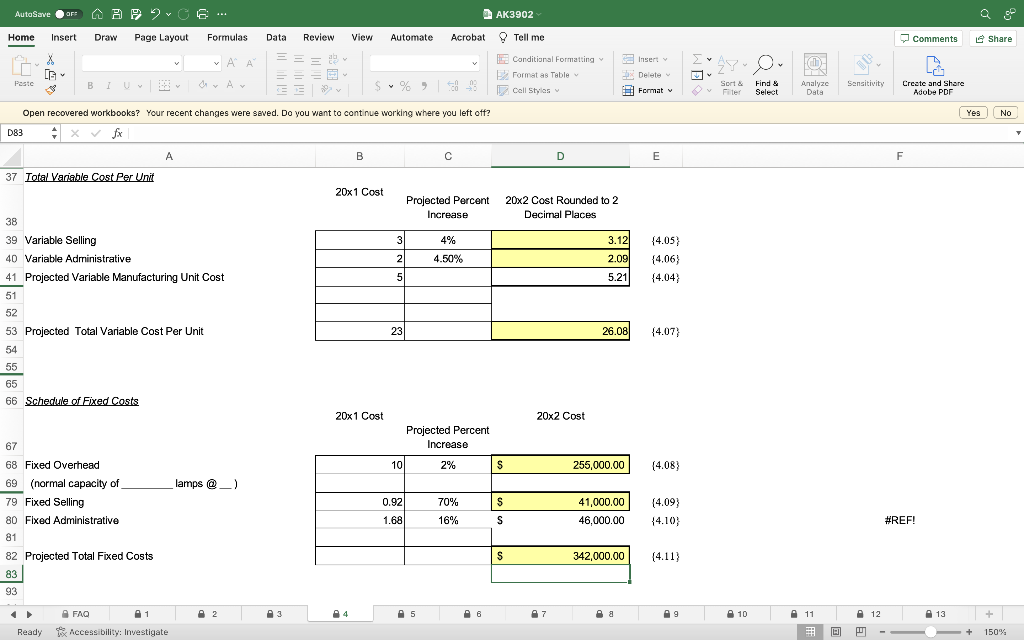

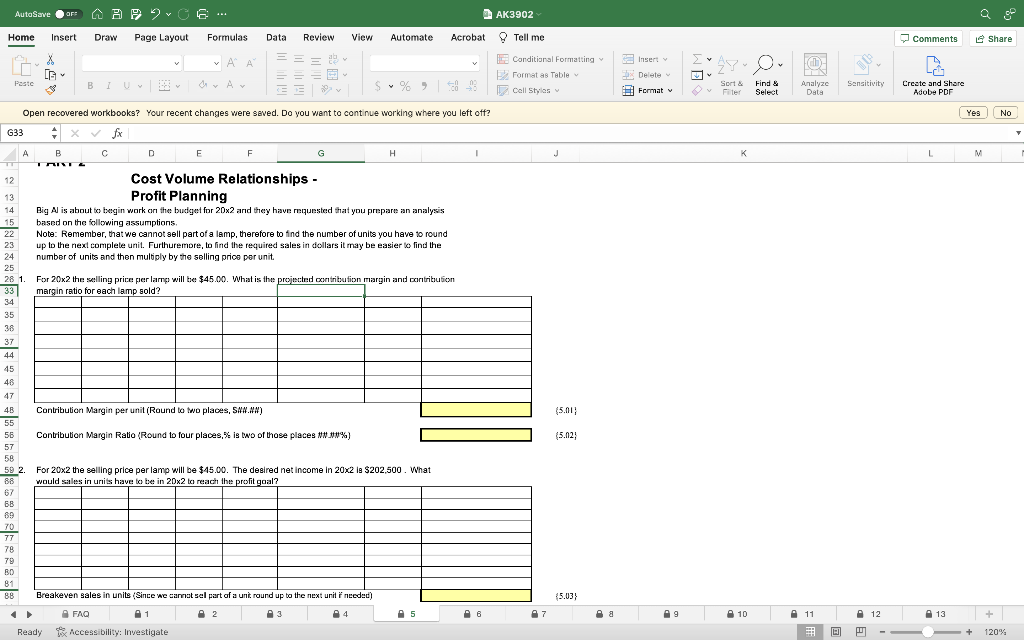

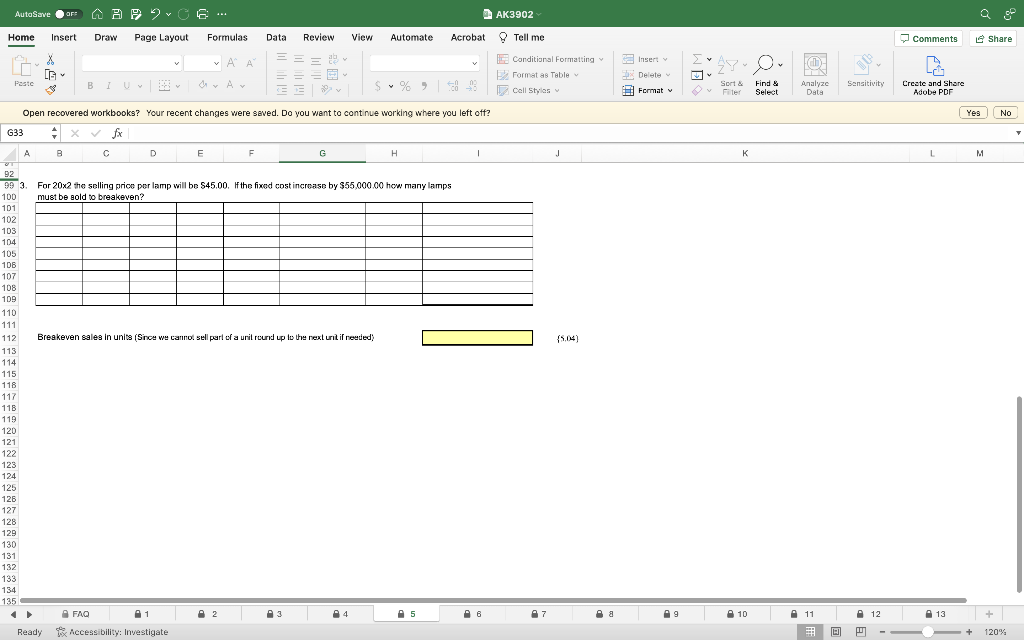

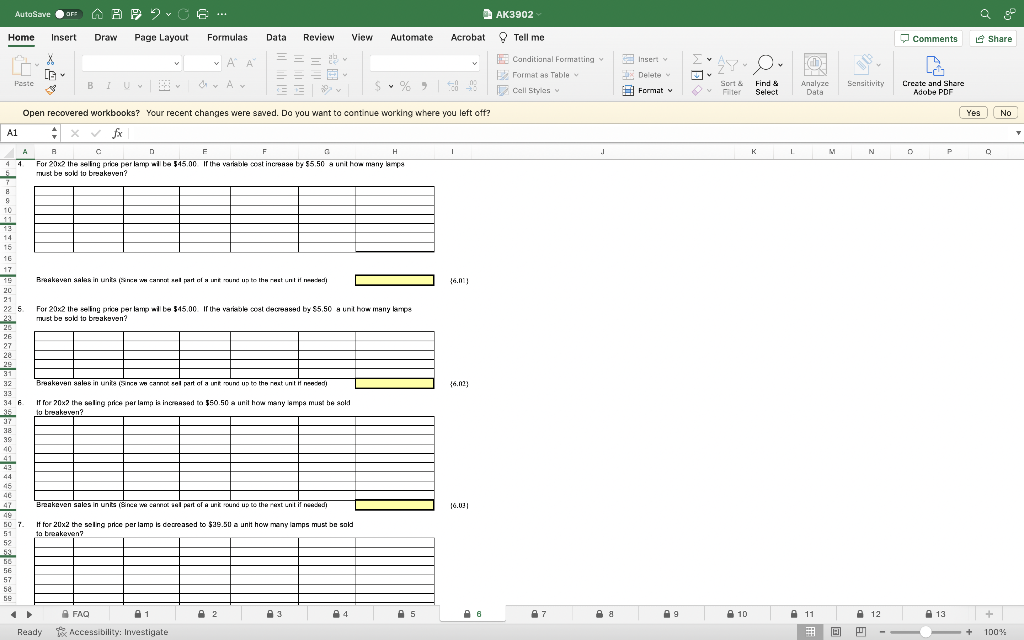

Current Liabilities Accounts Payable Total Liabilities \begin{tabular}{lr} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity \begin{tabular}{rr} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} The projected cost of a lamp is calculated based upon the projected increases or docreases to cument costs. The present costa to manufacture one lamp are: Expecled incresses for 202 When calculating projected incresses round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 4.50%. 2. Labor Costs are expected to increase by 4.00%. 3. Wariable Oyerhead is expected to increase by 3.50%. 4. Fixed Overhead is expecletd to iricrease to $255,000. 5. Fixed Administrafte expenses are expected to increase to $46,000. 6. Varlable selling expenses (measured on a per lamp basis) are expected to increase by 4.00%. 7. Fixed selling expenses are expected to be $41,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 4.50%. On the following schedule develop the following figures: 1- 202 Projected Variable Manufacturing Unit Cost of a lamp. Schedule of Fixed Costs 201 Cost 202 Cost Projected Percent Increase Fixed Overhead {4.08} (normal capacity of lamps @_) 79 Fixed Selling {4.09} 80 Fixed Administrative {4.10} \#REF! 81 82 Projected Total Fixed Costs 83 93 Cost Volume Relationships - Profit Planning Big A is about fo begin wark or the budget for 202 ard they have requested that you prepare an analysis besed on the following assumptions. Note: Remember, that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to lind the number of units and then multiply by the selling price per unit. For 202 the selling price pler larne will be $45.00. What is the projected cort tribufion margin and poritritufion Contribution Margin Ratio [Round to four places, % is wo of those places NNNHW ] For 20x2 the selling price per lamp will be $45.00. The desired net income in 202 is $202,500. What For 202 the selling price per lamp will be $45,00. If the fixed cost increase by $55,000,00 hew manylamps mulet he anlit in hraebravian? Breakeven sales in units (Since we cannot sell porl of a uril rcurd up to the nexi urit if reeded) rmst by wakd to bryskeven? mist be eakd to breskeven? If for 202 tha saling frica par lamp la iotraAsad ta $50.50 a unit how meny ampa must he sold in kruakuicu? It tor 20x2 the selng prise per lamp is cecreased bo $39.50 a untt how meny lamps must be sald Current Liabilities Accounts Payable Total Liabilities \begin{tabular}{lr} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity \begin{tabular}{rr} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} The projected cost of a lamp is calculated based upon the projected increases or docreases to cument costs. The present costa to manufacture one lamp are: Expecled incresses for 202 When calculating projected incresses round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 4.50%. 2. Labor Costs are expected to increase by 4.00%. 3. Wariable Oyerhead is expected to increase by 3.50%. 4. Fixed Overhead is expecletd to iricrease to $255,000. 5. Fixed Administrafte expenses are expected to increase to $46,000. 6. Varlable selling expenses (measured on a per lamp basis) are expected to increase by 4.00%. 7. Fixed selling expenses are expected to be $41,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 4.50%. On the following schedule develop the following figures: 1- 202 Projected Variable Manufacturing Unit Cost of a lamp. Schedule of Fixed Costs 201 Cost 202 Cost Projected Percent Increase Fixed Overhead {4.08} (normal capacity of lamps @_) 79 Fixed Selling {4.09} 80 Fixed Administrative {4.10} \#REF! 81 82 Projected Total Fixed Costs 83 93 Cost Volume Relationships - Profit Planning Big A is about fo begin wark or the budget for 202 ard they have requested that you prepare an analysis besed on the following assumptions. Note: Remember, that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to lind the number of units and then multiply by the selling price per unit. For 202 the selling price pler larne will be $45.00. What is the projected cort tribufion margin and poritritufion Contribution Margin Ratio [Round to four places, % is wo of those places NNNHW ] For 20x2 the selling price per lamp will be $45.00. The desired net income in 202 is $202,500. What For 202 the selling price per lamp will be $45,00. If the fixed cost increase by $55,000,00 hew manylamps mulet he anlit in hraebravian? Breakeven sales in units (Since we cannot sell porl of a uril rcurd up to the nexi urit if reeded) rmst by wakd to bryskeven? mist be eakd to breskeven? If for 202 tha saling frica par lamp la iotraAsad ta $50.50 a unit how meny ampa must he sold in kruakuicu? It tor 20x2 the selng prise per lamp is cecreased bo $39.50 a untt how meny lamps must be sald