Question: Acct 110 Chapter 6 Homework Handout 1 True/False Statements Instructions: Each of the following statements is true or false. Indicate your choice by typing T

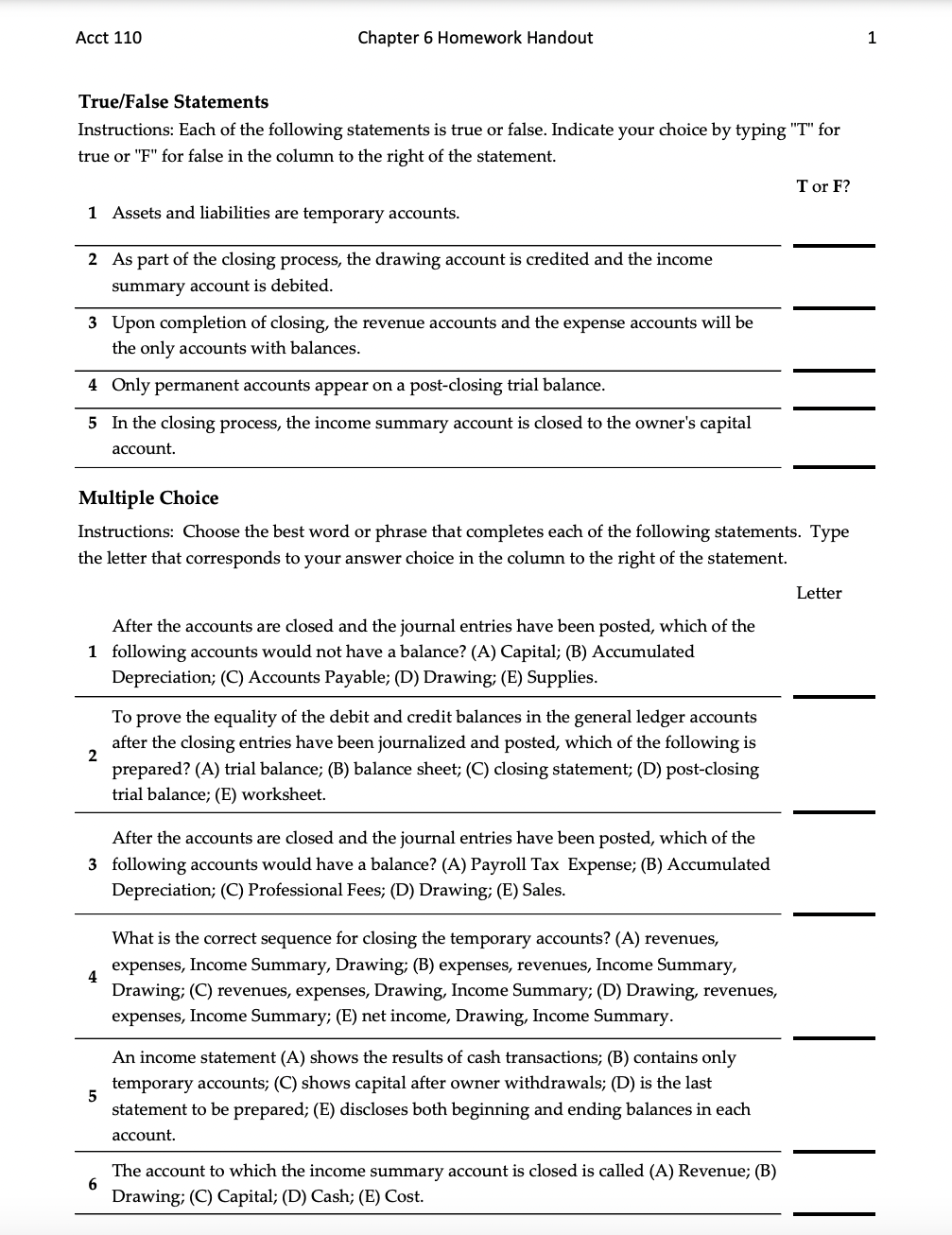

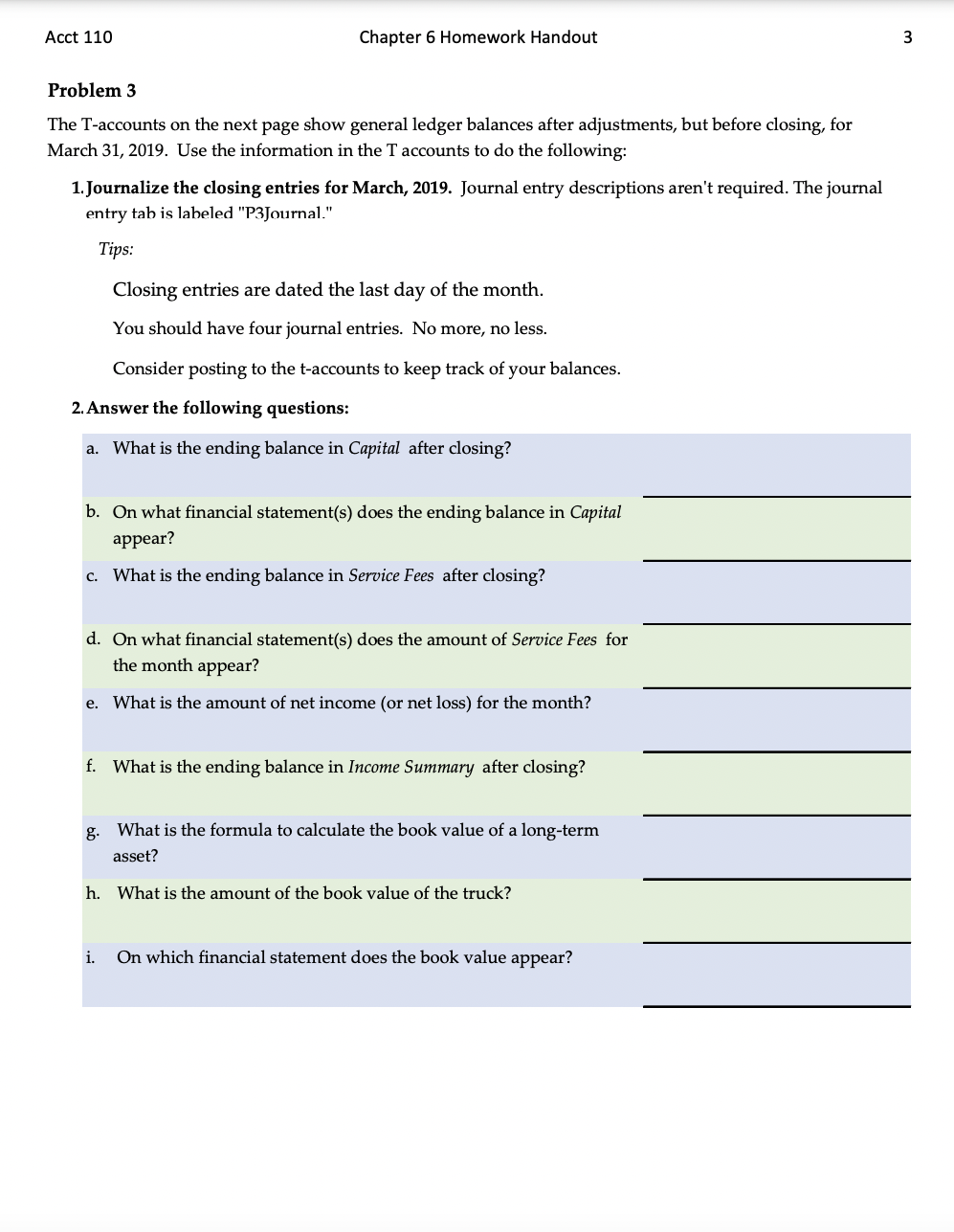

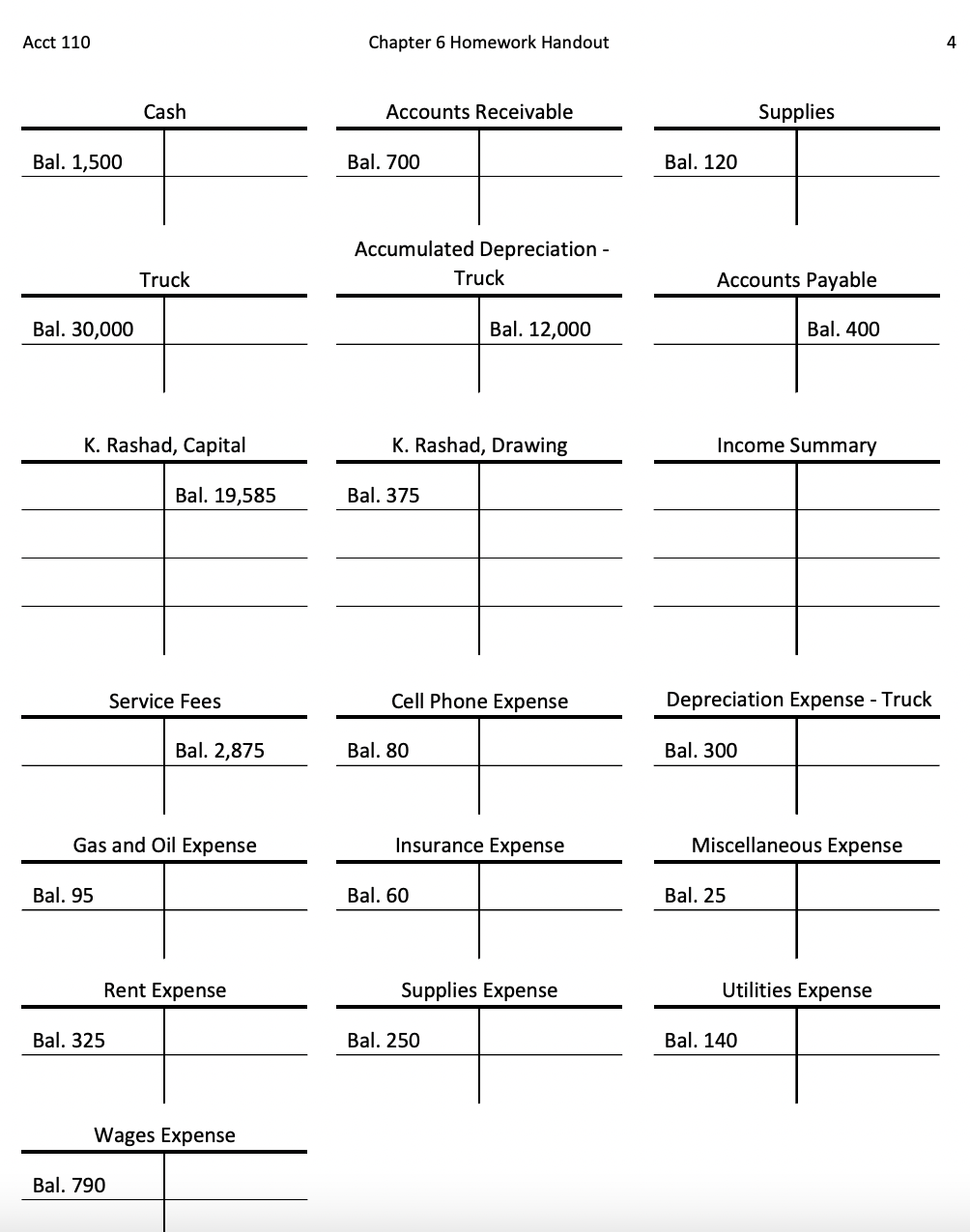

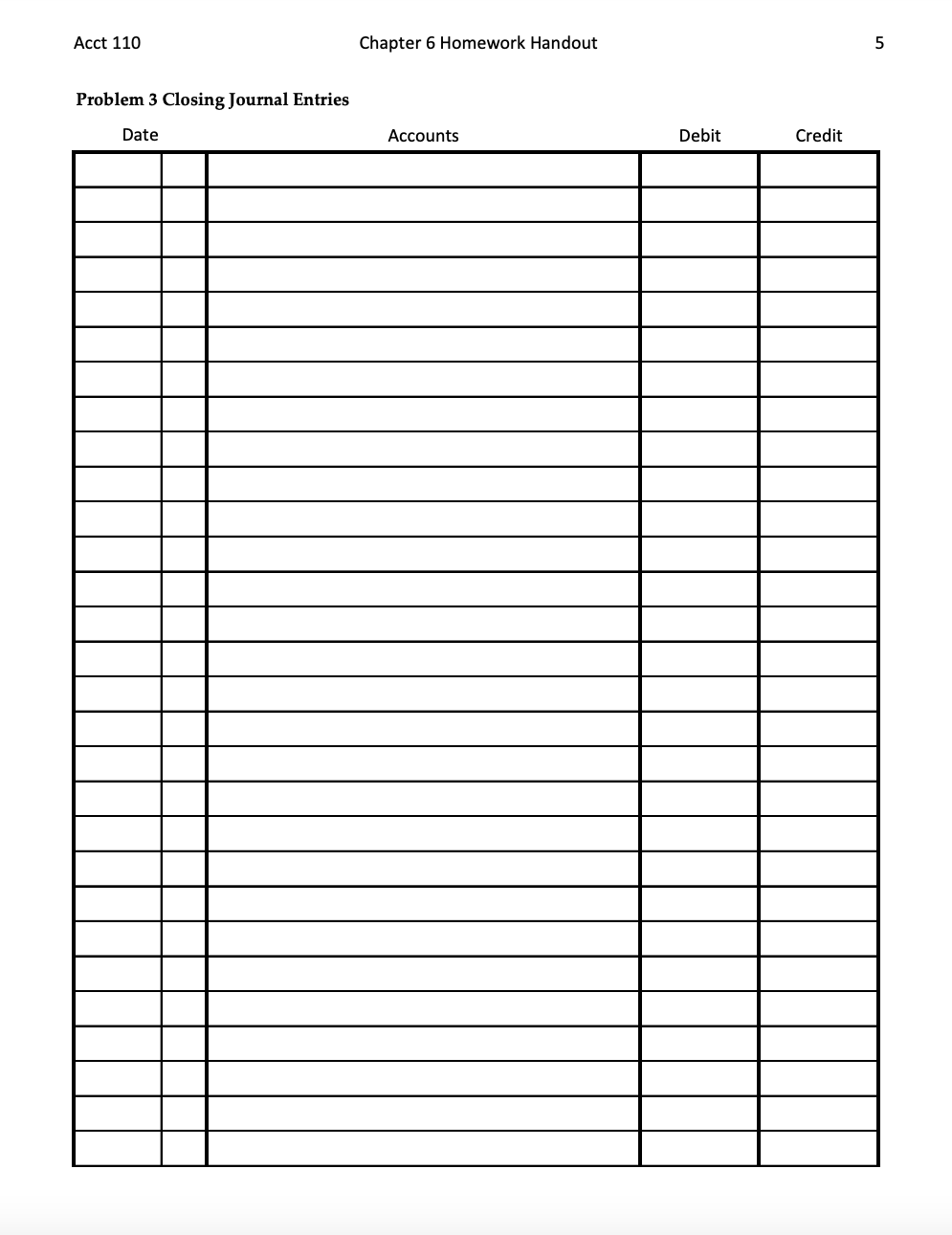

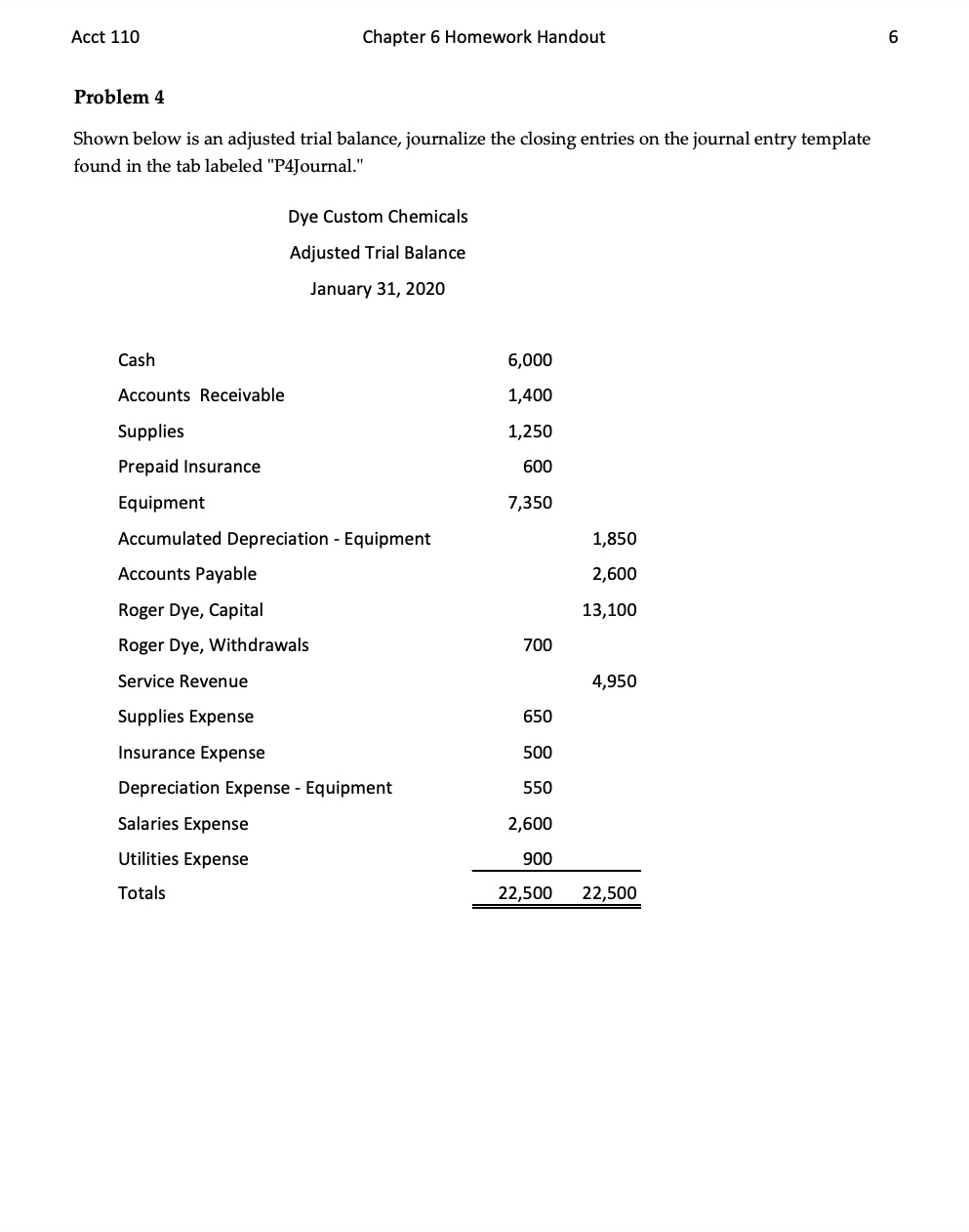

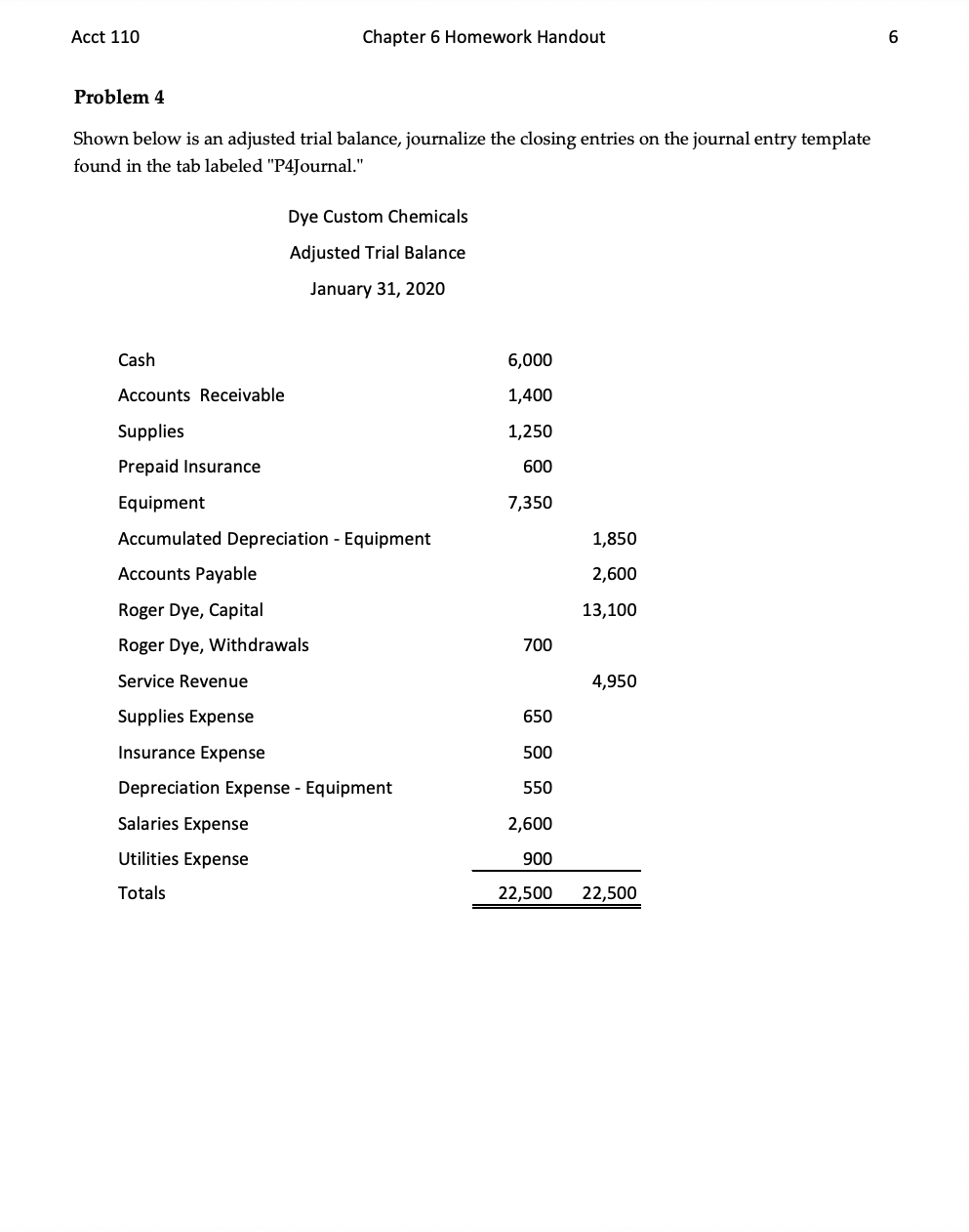

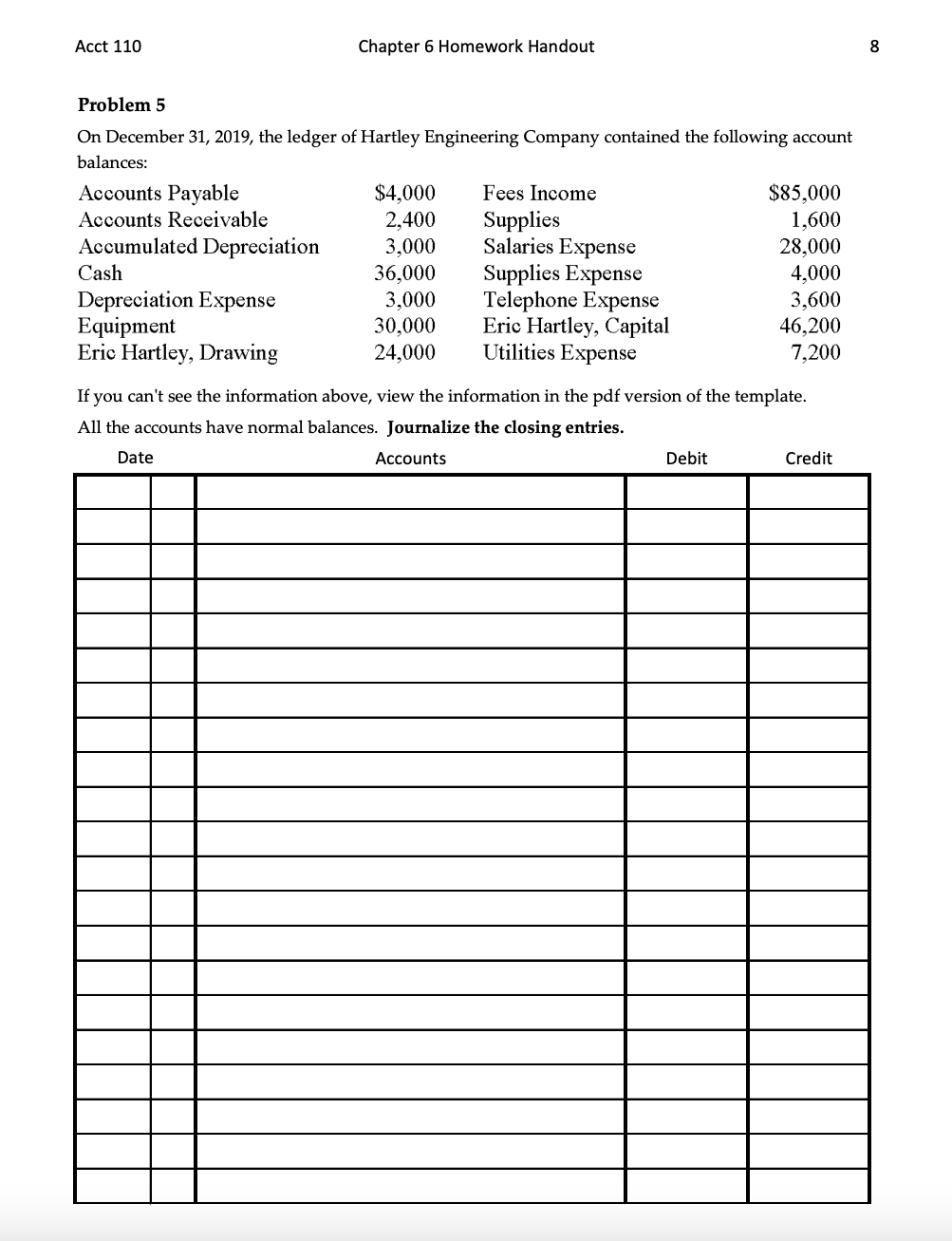

Acct 110 Chapter 6 Homework Handout 1 True/False Statements Instructions: Each of the following statements is true or false. Indicate your choice by typing "T" for true or "F" for false in the column to the right the statement. Tor F? 1 Assets and liabilities are temporary accounts. 2 As part of the closing process, the drawing account is credited and the income summary account is debited. 3 Upon completion of closing, the revenue accounts and the expense accounts will be the only accounts with balances. 4 Only permanent accounts appear on a post-closing trial balance. 5 In the closing process, the income summary account is closed to the owner's capital account. Multiple Choice Instructions: Choose the best word or phrase that completes each of the following statements. Type the letter that corresponds to your answer choice in the column to the right of the statement. Letter After the accounts are closed and the journal entries have been posted, which of the 1 following accounts would not have a balance? (A) Capital; (B) Accumulated Depreciation; (C) Accounts Payable; (D) Drawing; (E) Supplies. 2 To prove the equality of the debit and credit balances in the general ledger accounts after the closing entries have been journalized and posted, which of the following is prepared? (A) trial balance; (B) balance sheet; (C) closing statement; (D) post-closing trial balance; (E) worksheet. After the accounts are closed and the journal entries have been posted, which of the 3 following accounts would have a balance? (A) Payroll Tax Expense; (B) Accumulated Depreciation; (C) Professional Fees; (D) Drawing; (E) Sales. 4 What is the correct sequence for closing the temporary accounts? (A) revenues, expenses, Income Summary, Drawing; (B) expenses, revenues, Income Summary, Drawing; (C) revenues, expenses, Drawing, Income Summary; (D) Drawing, revenues, expenses, Income Summary; (E) net income, Drawing, Income Summary. 5 An income statement (A) shows the results of cash transactions; (B) contains only temporary accounts; (C) shows capital after owner withdrawals; (D) is the last statement to be prepared; (E) discloses both beginning and ending balances in each account. 6 The account to which the income summary account is closed is called (A) Revenue; (B) Drawing; (C) Capital; (D) Cash; (E) Cost. Acct 110 Chapter 6 Homework Handout 3 Problem 3 The T-accounts on the next page show general ledger balances after adjustments, but before closing, for March 31, 2019. Use the information in the T accounts to do the following: 1. Journalize the closing entries for March, 2019. Journal entry descriptions aren't required. The journal entry tab is labeled "P3Journal." Tips: Closing entries are dated the last day of the month. You should have four journal entries. No more, no less. Consider posting to the t-accounts to keep track of your balances. 2. Answer the following questions: a. What is the ending balance in Capital after closing? b. On what financial statement(s) does the ending balance in Capital appear? c. What is the ending balance in Service Fees after closing? d. On what financial statement(s) does the amount of Service Fees for the month appear? e. What is the amount of net income (or net loss) for the month? f. What is the ending balance in Income Summary after closing? g. What is the formula to calculate the book value of a long-term asset? h. What is the amount of the book value of the truck? i. On which financial statement does the book value appear? Acct 110 Chapter 6 Homework Handout 4 Cash Accounts Receivable Supplies Bal. 1,500 Bal. 700 Bal. 120 Accumulated Depreciation - Truck Truck Accounts Payable Bal. 30,000 Bal. 12,000 Bal. 400 K. Rashad, Capita K. Rashad, Drawing Income Summary Bal. 19,585 Bal. 375 Service Fees Cell Phone Expense Depreciation Expense - Truck Bal. 2,875 Bal. 80 Bal. 300 Gas and Oil Expense Insurance Expense cellaneous Expense Bal. 95 Bal. 60 Bal. 25 Rent Expense Supplies Expense Utilities Expense Bal. 325 Bal. 250 Bal. 140 Wages Expense Bal. 790 Acct 110 Chapter 6 Homework Handout 5 Problem 3 Closing Journal Entries Date Accounts Debit Credit Acct 110 Chapter 6 Homework Handout 6 Problem 4 Shown below is an adjusted trial balance, journalize the closing entries on the journal entry template found in the tab labeled "P4Journal." Dye Custom Chemicals Adjusted Trial Balance January 31, 2020 Cash 6,000 Accounts Receivable 1,400 1,250 Supplies Prepaid Insurance 600 7,350 Equipment Accumulated Depreciation - Equipment 1,850 Accounts Payable 2,600 13,100 Roger Dye, Capital Roger Dye, Withdrawals 700 Service Revenue 4,950 Supplies Expense 650 500 550 Insurance Expense Depreciation Expense - Equipment Salaries Expense Utilities Expense 2,600 900 Totals 22,500 22,500 Acct 110 Chapter 6 Homework Handout 6 Problem 4 Shown below is an adjusted trial balance, journalize the closing entries on the journal entry template found in the tab labeled "P4Journal." Dye Custom Chemicals Adjusted Trial Balance January 31, 2020 Cash 6,000 Accounts Receivable 1,400 1,250 Supplies Prepaid Insurance 600 7,350 Equipment Accumulated Depreciation - Equipment 1,850 Accounts Payable 2,600 13,100 Roger Dye, Capital Roger Dye, Withdrawals 700 Service Revenue 4,950 Supplies Expense 650 500 550 Insurance Expense Depreciation Expense - Equipment Salaries Expense Utilities Expense 2,600 900 Totals 22,500 22,500 Acct 110 Chapter 6 Homework Handout 7 Problem 4 Closing Journal Entries Date Accounts Debit Credit Acct 110 Chapter 6 Homework Handout 8 Problem 5 On December 31, 2019, the ledger of Hartley Engineering Company contained the following account balances: Accounts Payable $4,000 Fees Income $85,000 Accounts Receivable 2,400 Supplies 1,600 Accumulated Depreciation 3,000 Salaries Expense 28,000 Cash 36,000 Supplies Expense 4,000 Depreciation Expense 3,000 Telephone Expense 3,600 Equipment 30,000 Eric Hartley, Capital 46,200 Eric Hartley, Drawing 24,000 Utilities Expense 7,200 If you can't see the information above, view the information in the pdf version of the template. All the accounts have normal balances. Journalize the closing entries. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts