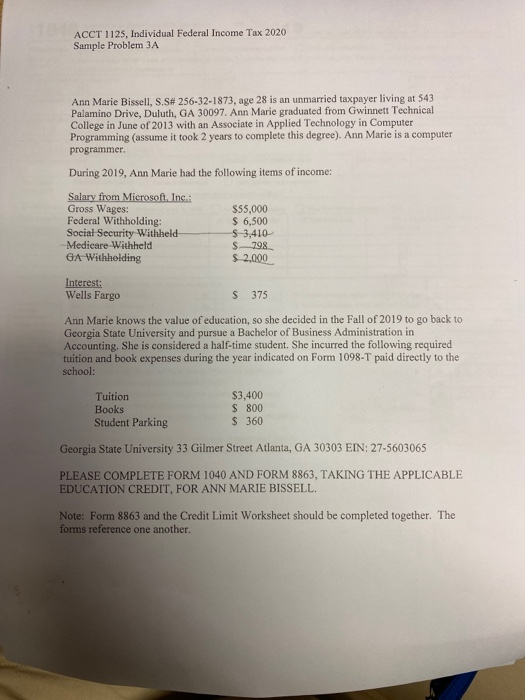

ACCT 1125, Individual Federal Income Tax 2020 Sample Problem 3A Ann Marie Bissell, S.S# 256-32-1873, age 28 is an unmarried taxpayer living at 543 Palamino Drive, Duluth, GA 30097. Ann Marie graduated from Gwinnett Technical College in June of 2013 with an Associate in Applied Technology in Computer Programming (assume it took 2 years to complete this degree). Ann Marie is a computer programmer. During 2019, Ann Marie had the following items of income: Salary from Microsoft, Inc.: Gross Wages: Federal Withholding: Social Security Withheld Medicare Withheld GA Withholding S55,000 $ 6,500 $ 3,410 $798 $ 2.000 Interest: Wells Fargo S 375 Ann Marie knows the value of education, so she decided in the fall of 2019 to go back to Georgia State University and pursue a Bachelor of Business Administration in Accounting. She is considered a half-time student. She incurred the following required tuition and book expenses during the year indicated on Form 1098-T paid directly to the school: Tuition Books Student Parking $3,400 $ 800 $360 Georgia State University 33 Gilmer Street Atlanta, GA 30303 EIN: 27-5603065 PLEASE COMPLETE FORM 1040 AND FORM 8863, TAKING THE APPLICABLE EDUCATION CREDIT, FOR ANN MARIE BISSELL. Note: Form 8863 and the Credit Limit Worksheet should be completed together. The forms reference one another. ACCT 1125, Individual Federal Income Tax 2020 Sample Problem 3A Ann Marie Bissell, S.S# 256-32-1873, age 28 is an unmarried taxpayer living at 543 Palamino Drive, Duluth, GA 30097. Ann Marie graduated from Gwinnett Technical College in June of 2013 with an Associate in Applied Technology in Computer Programming (assume it took 2 years to complete this degree). Ann Marie is a computer programmer. During 2019, Ann Marie had the following items of income: Salary from Microsoft, Inc.: Gross Wages: Federal Withholding: Social Security Withheld Medicare Withheld GA Withholding S55,000 $ 6,500 $ 3,410 $798 $ 2.000 Interest: Wells Fargo S 375 Ann Marie knows the value of education, so she decided in the fall of 2019 to go back to Georgia State University and pursue a Bachelor of Business Administration in Accounting. She is considered a half-time student. She incurred the following required tuition and book expenses during the year indicated on Form 1098-T paid directly to the school: Tuition Books Student Parking $3,400 $ 800 $360 Georgia State University 33 Gilmer Street Atlanta, GA 30303 EIN: 27-5603065 PLEASE COMPLETE FORM 1040 AND FORM 8863, TAKING THE APPLICABLE EDUCATION CREDIT, FOR ANN MARIE BISSELL. Note: Form 8863 and the Credit Limit Worksheet should be completed together. The forms reference one another