Acct 135, Comprehensive Problem Chapter 7

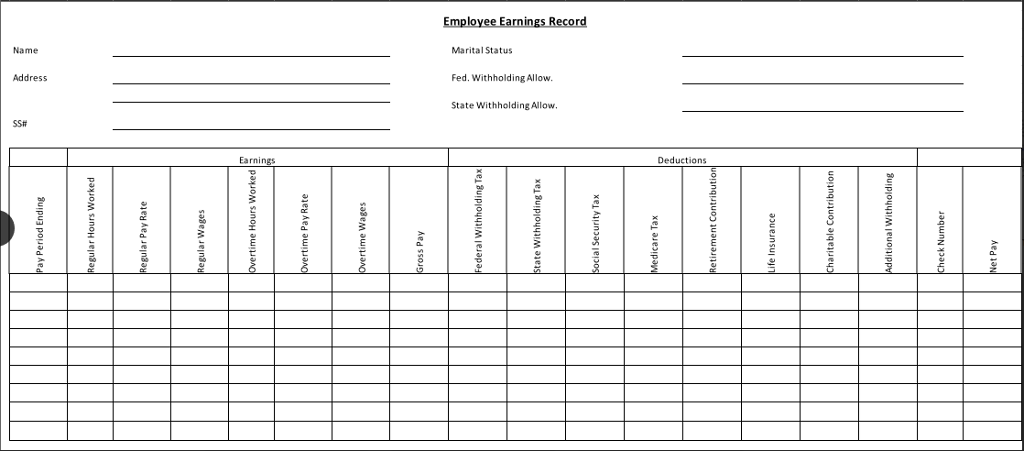

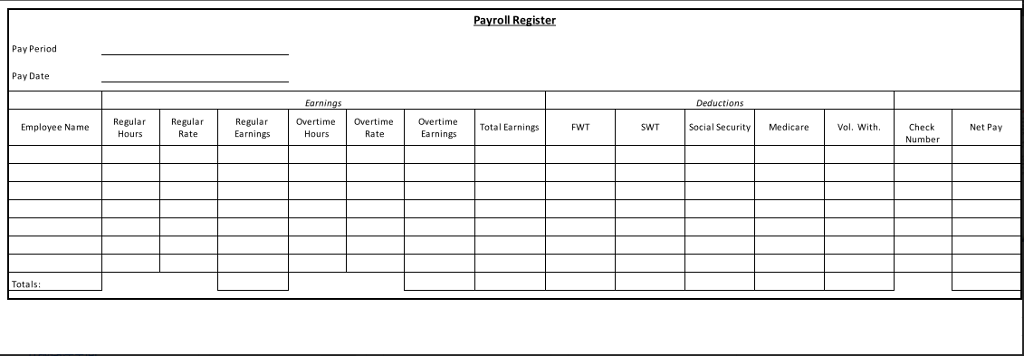

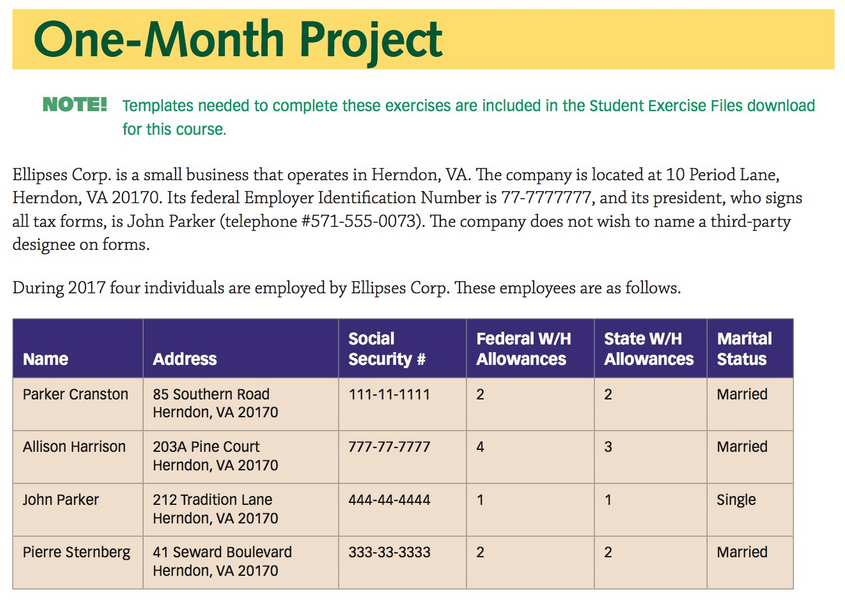

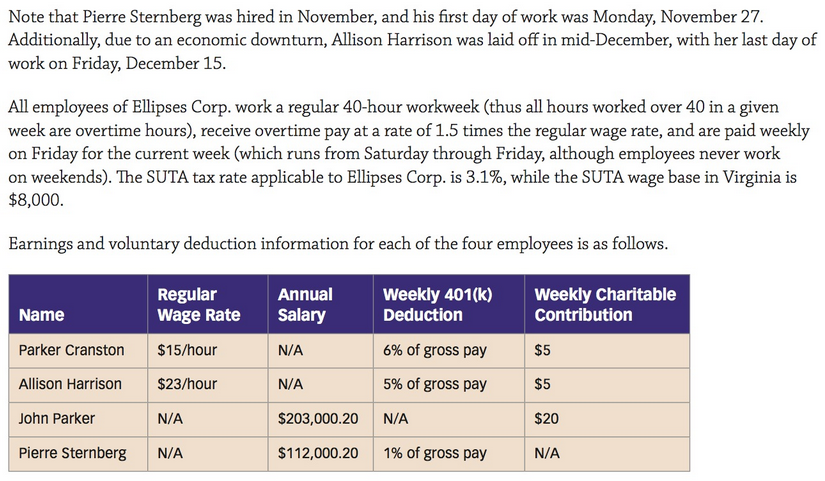

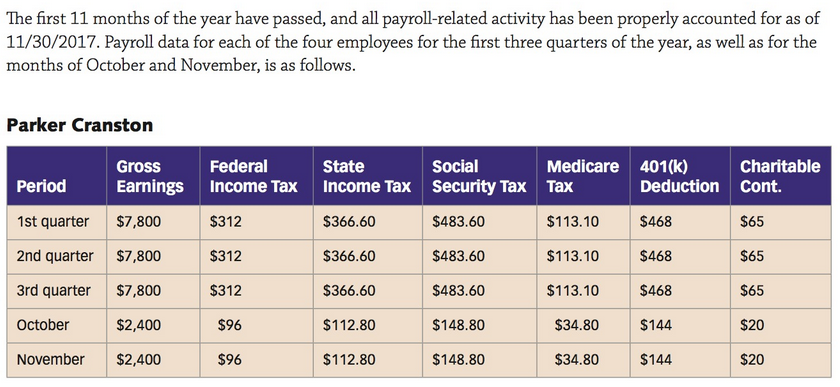

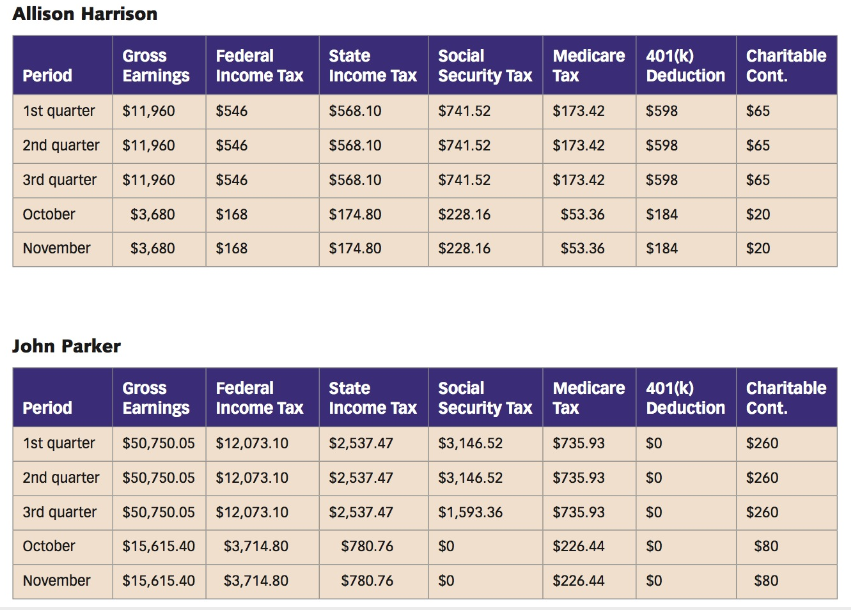

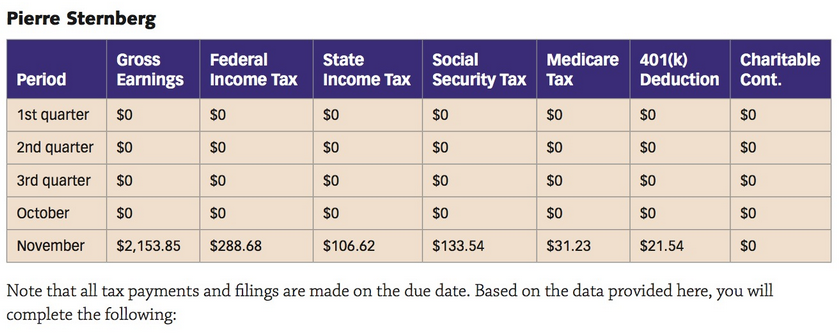

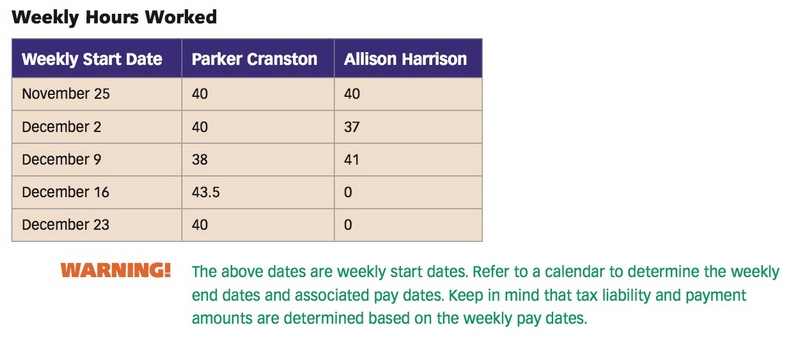

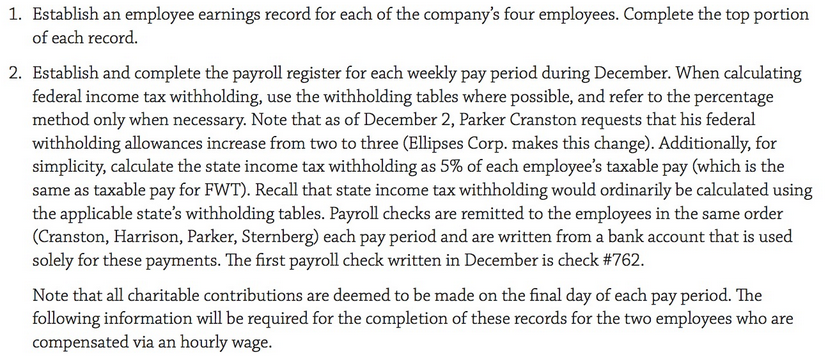

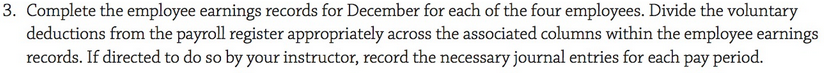

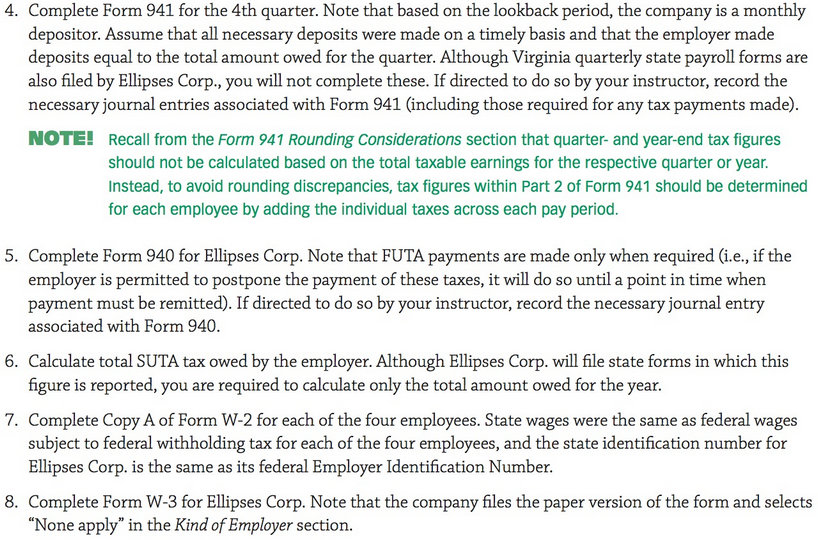

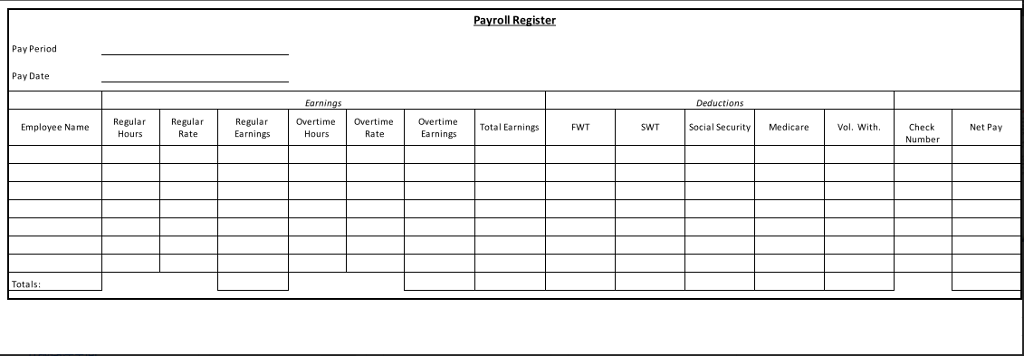

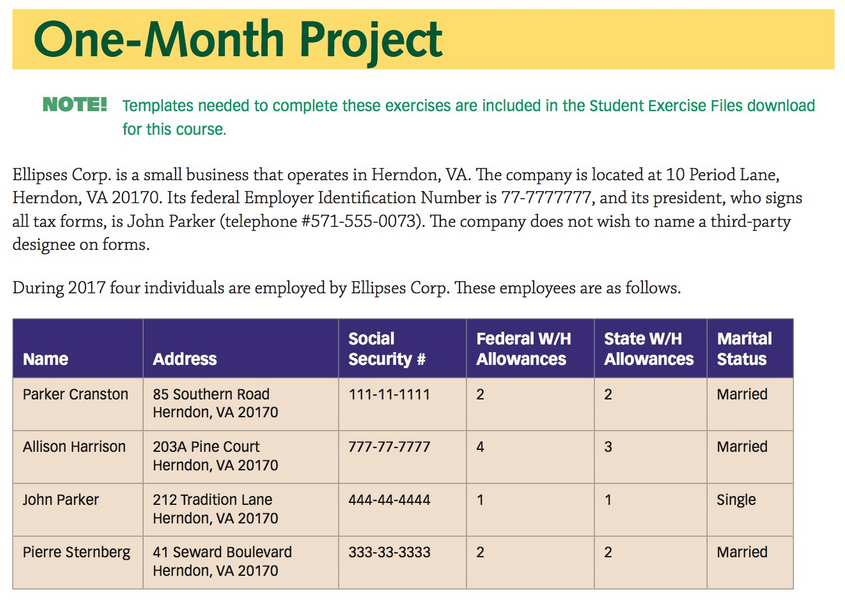

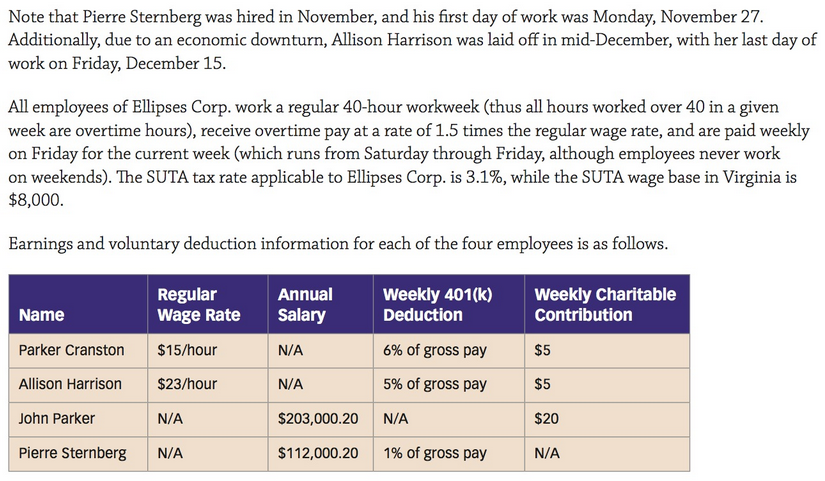

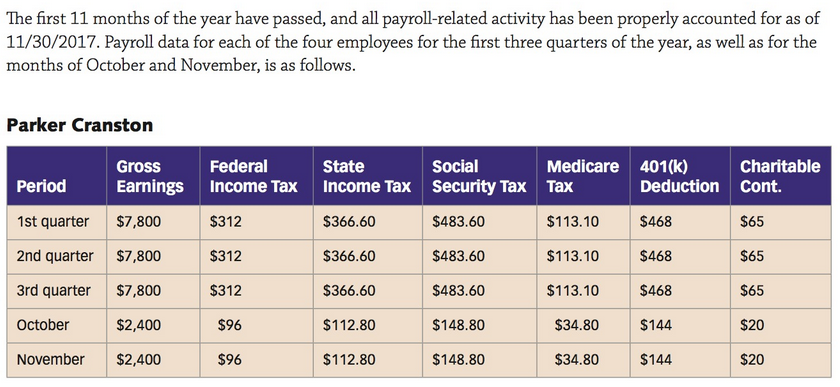

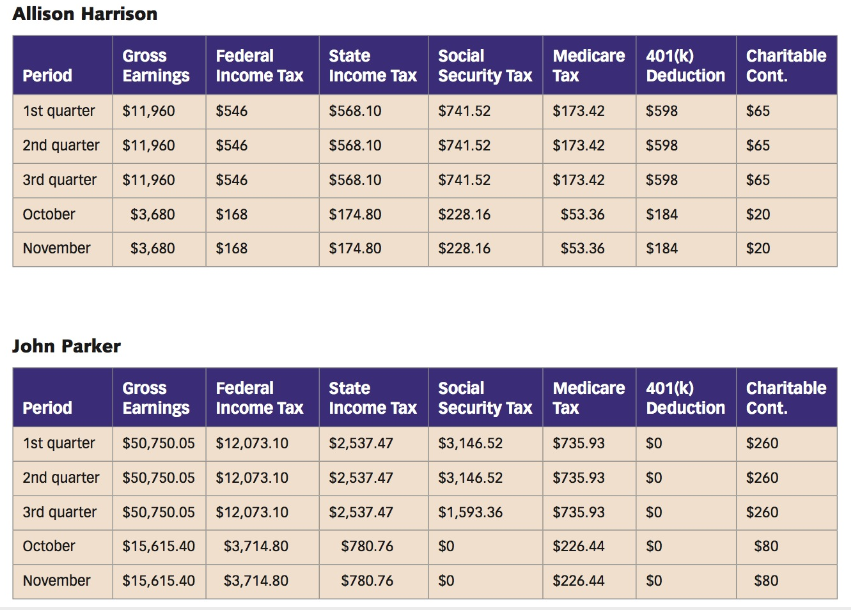

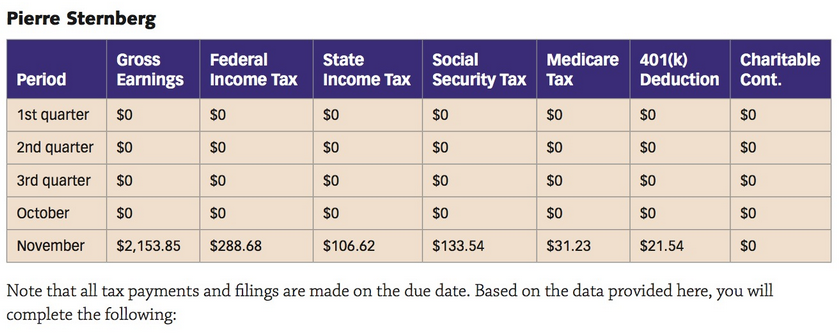

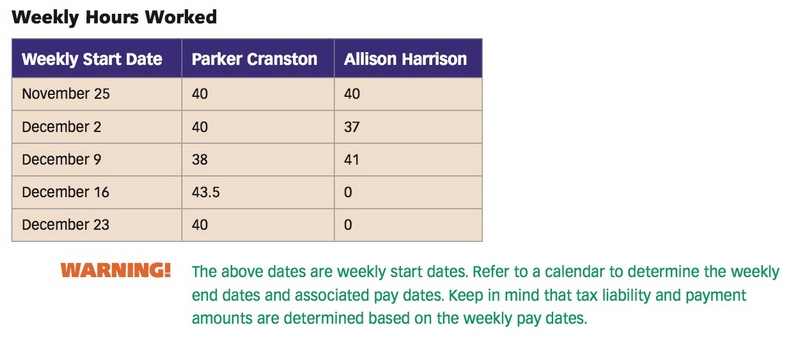

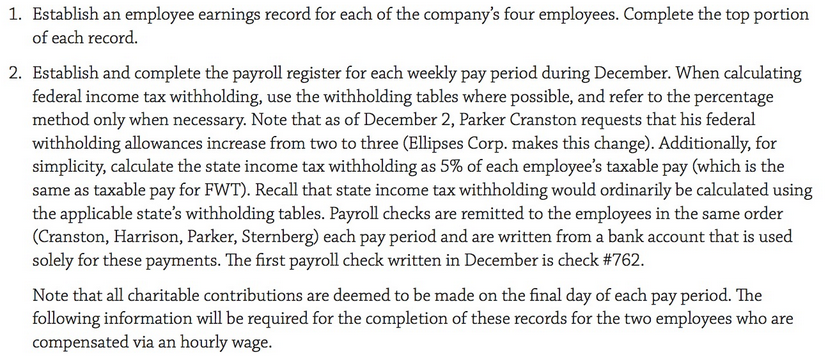

Payroll Register Pay Period Pay Date Deductions Earninas Regular Overtime Overtime Earnings Overtime Earnings SWT Social Security Meare Vol. With. Check Net Pay Regular Hours Regular Rate Total Earnings FWT Number Employee Na me Hours Rate Totals: The first 11 months of the year have passed, and all payroll-related activity has been properly accounted for as of 11/30/2017. Payroll data for each of the four employees for the first three quarters of the year, as well as for the months of October and November, is as follows Parker Cranston State Earnings Income Tax Income Tax Security Tax Tax $366.60 $366.60 $366.60 $112.80 $112.80 Gross Federal Social Medicare 401(k) Charitable Period 1st quarter $7,800 2nd quarter $7,800 3rd quarter $7,800 October November $2,400 $312 $312 $312 S96 $96 $483.60 $483.60 $483.60 $148.80 $148.80 $113.10 $113.10 $113.10 $34.80 $34.80 Deduction Cont. $468 $468 $468 $144 $144 $65 $65 $65 $20 $20 $2,400 Allison Harrison Social State Earnings Income Tax Income Tax Security Tax Tax $568.10 $568.10 $568.10 $174.80 $174.80 Gross Federal Medicare 401(k) Charitable Period 1st quarter $11,960 2nd quarter $11,960 3rd quarter $11,960 October November $546 $546 $546 $168 $168 $741.52 $741.52 $741.52 $228.16 $228.16 $173.42 $173.42 $173.42 $53.36 $53.36 Deduction Cont. $598 $598 $598 $184 $184 $65 $65 $65 $20 $20 $3,680 $3,680 John Parker Federal Social Medicare 401(k) Charitable Gross Earnings Income Tax Income Tax Security Tax Tax State Period 1st quarter $50,750.05 $12,073.10 2nd quarter $50,750.05 $12,073.10 3rd quarter $50,750.05 $12,073.10 October November $15,615.40 $3,714.80 $2,537.47 $2,537.47 $2,537.47 $780.76 $780.76 $3,146.52 $3,146.52 $1,593.36 $0 $0 $735.93 $735.93 $735.93 $226.44 $226.44 Deduction Cont. $0 $0 $0 SO SO $260 $260 $260 $80 $80 $15,615.40 $3,714.80 Pierre Sternberg State Charitable Gross Earnings Income Tax Income Tax Security Tax Tax Federal Social Medicare 401(k) Period 1st quarter $O 2nd quarter $O 3rd quarter $O October November $2,153.85 $288.68 $0 S0 $0 S0 SO SO SO $0 $106.62 $0 $0 $0 $0 $133.54 $0 $0 $0 $0 $31.23 Deduction Cont. $0 S0 $0 $0 $21.54 $0 S0 $0 SO $0 $0 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following: 3. Complete the employee earnings records for December for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period. Payroll Register Pay Period Pay Date Deductions Earninas Regular Overtime Overtime Earnings Overtime Earnings SWT Social Security Meare Vol. With. Check Net Pay Regular Hours Regular Rate Total Earnings FWT Number Employee Na me Hours Rate Totals: The first 11 months of the year have passed, and all payroll-related activity has been properly accounted for as of 11/30/2017. Payroll data for each of the four employees for the first three quarters of the year, as well as for the months of October and November, is as follows Parker Cranston State Earnings Income Tax Income Tax Security Tax Tax $366.60 $366.60 $366.60 $112.80 $112.80 Gross Federal Social Medicare 401(k) Charitable Period 1st quarter $7,800 2nd quarter $7,800 3rd quarter $7,800 October November $2,400 $312 $312 $312 S96 $96 $483.60 $483.60 $483.60 $148.80 $148.80 $113.10 $113.10 $113.10 $34.80 $34.80 Deduction Cont. $468 $468 $468 $144 $144 $65 $65 $65 $20 $20 $2,400 Allison Harrison Social State Earnings Income Tax Income Tax Security Tax Tax $568.10 $568.10 $568.10 $174.80 $174.80 Gross Federal Medicare 401(k) Charitable Period 1st quarter $11,960 2nd quarter $11,960 3rd quarter $11,960 October November $546 $546 $546 $168 $168 $741.52 $741.52 $741.52 $228.16 $228.16 $173.42 $173.42 $173.42 $53.36 $53.36 Deduction Cont. $598 $598 $598 $184 $184 $65 $65 $65 $20 $20 $3,680 $3,680 John Parker Federal Social Medicare 401(k) Charitable Gross Earnings Income Tax Income Tax Security Tax Tax State Period 1st quarter $50,750.05 $12,073.10 2nd quarter $50,750.05 $12,073.10 3rd quarter $50,750.05 $12,073.10 October November $15,615.40 $3,714.80 $2,537.47 $2,537.47 $2,537.47 $780.76 $780.76 $3,146.52 $3,146.52 $1,593.36 $0 $0 $735.93 $735.93 $735.93 $226.44 $226.44 Deduction Cont. $0 $0 $0 SO SO $260 $260 $260 $80 $80 $15,615.40 $3,714.80 Pierre Sternberg State Charitable Gross Earnings Income Tax Income Tax Security Tax Tax Federal Social Medicare 401(k) Period 1st quarter $O 2nd quarter $O 3rd quarter $O October November $2,153.85 $288.68 $0 S0 $0 S0 SO SO SO $0 $106.62 $0 $0 $0 $0 $133.54 $0 $0 $0 $0 $31.23 Deduction Cont. $0 S0 $0 $0 $21.54 $0 S0 $0 SO $0 $0 Note that all tax payments and filings are made on the due date. Based on the data provided here, you will complete the following: 3. Complete the employee earnings records for December for each of the four employees. Divide the voluntary deductions from the payroll register appropriately across the associated columns within the employee earnings records. If directed to do so by your instructor, record the necessary journal entries for each pay period