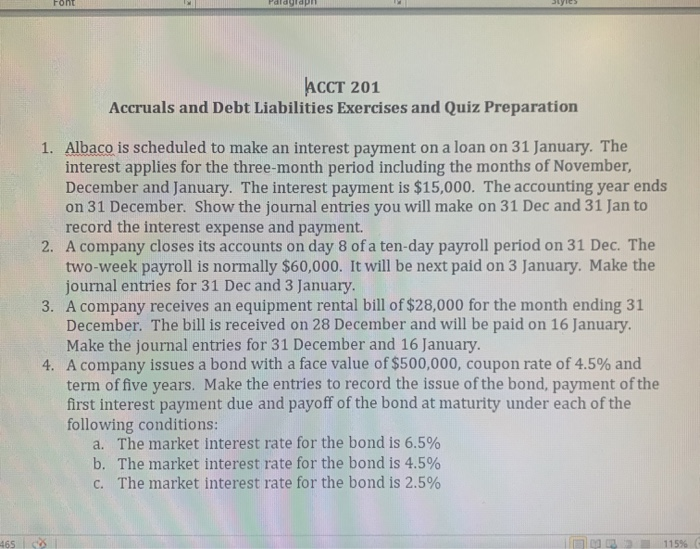

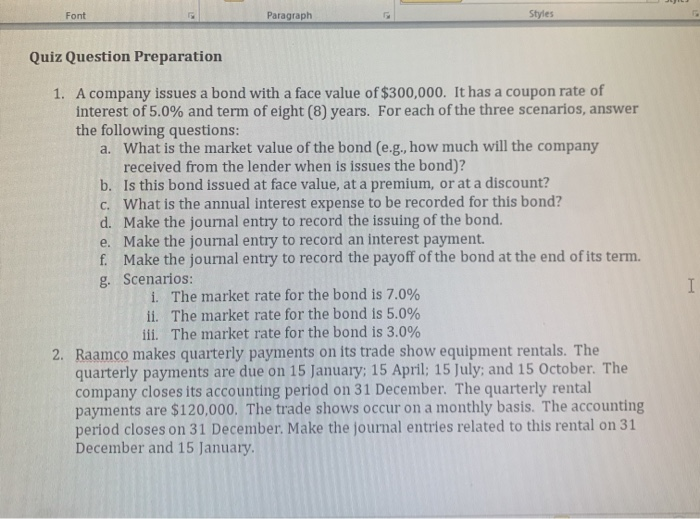

ACCT 201 Accruals and Debt Liabilities Exercises and Quiz Preparation 1. Albaco is scheduled to make an interest payment on a loan on 31 January. The interest applies for the three-month period including the months of November, December and January. The interest payment is $15,000. The accounting year ends on 31 December. Show the journal entries you will make on 31 Dec and 31 Jan to record the interest expense and payment. 2. A company closes its accounts on day 8 of a ten-day payroll period on 31 Dec. The two-week payroll is normally $60,000. It will be next paid on 3 January. Make the journal entries for 31 Dec and 3 January. 3. A company receives an equipment rental bill of $28,000 for the month ending 31 December. The bill is received on 28 December and will be paid on 16 January, Make the journal entries for 31 December and 16 January. 4. A company issues a bond with a face value of $500,000, coupon rate of 4.5% and term of five years. Make the entries to record the issue of the bond, payment of the first interest payment due and payoff of the bond at maturity under each of the following conditions: a. The market interest rate for the bond is 6.5% b. The market interest rate for the bond is 4.5% C. The market interest rate for the bond is 2.5% Font Paragraph Styles Quiz Question Preparation 1. A company issues a bond with a face value of $300,000. It has a coupon rate of interest of 5.0% and term of eight (8) years. For each of the three scenarios, answer the following questions: a. What is the market value of the bond (e.g., how much will the company received from the lender when is issues the bond)? b. Is this bond issued at face value, at a premium, or at a discount? c. What is the annual interest expense to be recorded for this bond? d. Make the journal entry to record the issuing of the bond. e. Make the journal entry to record an interest payment. f. Make the journal entry to record the payoff of the bond at the end of its term. g. Scenarios: i. The market rate for the bond is 7.0% ii. The market rate for the bond is 5.0% ill. The market rate for the bond is 3.0% 2. Raamco makes quarterly payments on its trade show equipment rentals. The quarterly payments are due on 15 January: 15 April; 15 July; and 15 October. The company closes its accounting period on 31 December. The quarterly rental payments are $120,000. The trade shows occur on a monthly basis. The accounting period closes on 31 December. Make the journal entries related to this rental on 31 December and 15 January ACCT 201 Accruals and Debt Liabilities Exercises and Quiz Preparation 1. Albaco is scheduled to make an interest payment on a loan on 31 January. The interest applies for the three-month period including the months of November, December and January. The interest payment is $15,000. The accounting year ends on 31 December. Show the journal entries you will make on 31 Dec and 31 Jan to record the interest expense and payment. 2. A company closes its accounts on day 8 of a ten-day payroll period on 31 Dec. The two-week payroll is normally $60,000. It will be next paid on 3 January. Make the journal entries for 31 Dec and 3 January. 3. A company receives an equipment rental bill of $28,000 for the month ending 31 December. The bill is received on 28 December and will be paid on 16 January, Make the journal entries for 31 December and 16 January. 4. A company issues a bond with a face value of $500,000, coupon rate of 4.5% and term of five years. Make the entries to record the issue of the bond, payment of the first interest payment due and payoff of the bond at maturity under each of the following conditions: a. The market interest rate for the bond is 6.5% b. The market interest rate for the bond is 4.5% C. The market interest rate for the bond is 2.5% Font Paragraph Styles Quiz Question Preparation 1. A company issues a bond with a face value of $300,000. It has a coupon rate of interest of 5.0% and term of eight (8) years. For each of the three scenarios, answer the following questions: a. What is the market value of the bond (e.g., how much will the company received from the lender when is issues the bond)? b. Is this bond issued at face value, at a premium, or at a discount? c. What is the annual interest expense to be recorded for this bond? d. Make the journal entry to record the issuing of the bond. e. Make the journal entry to record an interest payment. f. Make the journal entry to record the payoff of the bond at the end of its term. g. Scenarios: i. The market rate for the bond is 7.0% ii. The market rate for the bond is 5.0% ill. The market rate for the bond is 3.0% 2. Raamco makes quarterly payments on its trade show equipment rentals. The quarterly payments are due on 15 January: 15 April; 15 July; and 15 October. The company closes its accounting period on 31 December. The quarterly rental payments are $120,000. The trade shows occur on a monthly basis. The accounting period closes on 31 December. Make the journal entries related to this rental on 31 December and 15 January