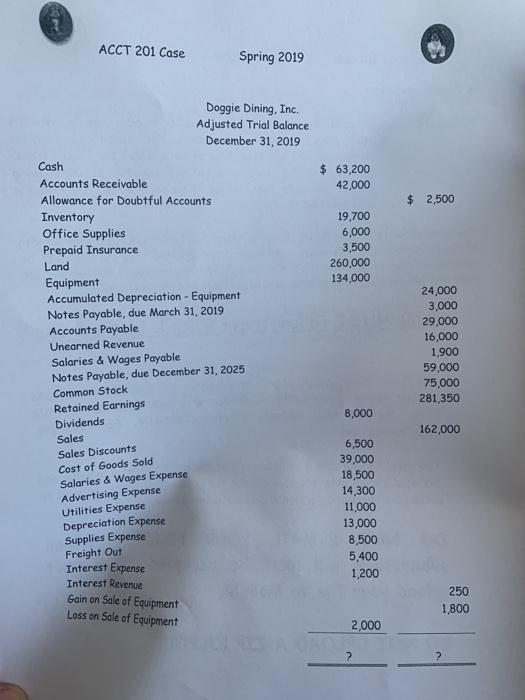

ACCT 201 Case Spring 2019 4. Financial Statements REQUIRED: Based on the adjusted trial balance on the next page, prepare the Multi-Step Income Statement, the Retained Earnings Statement, and the Classified Balance Sheet for Doggie Dining Company for the fiscal year ending December 31, 2019, using Excel. You must follow all of these instructions including the ones provided for Excel. The information for Doggie Dining, Inc.'s adjusted trial balance is to be entered onto an Excel spreadsheet. Formulas and links to the adjusted trial balance must be created in order to generate the three financial statements. Basic instructions are given in this case. If you need additional help, please see your instructor You MUST follow these EXCEL instructions You should upload a copy of your trial balance and financial statements to your instructor using Moodle. (Please name your uploaded excel file using the JaneDoeSection1.) following format: YourNameSection# For example, You should also staple a printed copy of the adjusted trial balance and financial statements into this case in the appropriate place. Be sure to write your name and section # on your printed copy DO NOT E-MAIL YOUR FILE!!!! E-mail submissions will NOT be accepted. You must upload your file to Moodle DO NOT UPLOAD A ZIP FILE!!! ACCT 201 Case Spring 2019 Doggie Dining, Inc. Adjusted Trial Balance December 31, 2019 Cash $ 63,200 42,000 Accounts Receivable Allowance for Doubtful Accounts $2,500 Inventory Office Supplies Prepaid Insurance Land Equipment Accumulated Depreciation - Equipment Notes Payable, due March 31, 2019 Accounts Payable Unearned Revenue Salaries &Wages Payable Notes Payable, due December 31, 2025 Common Stock Retained Earnings 19,700 6,000 3,500 260,000 134,000 24,000 3,000 29,000 16,000 1,900 59,000 75,000 281,350 8,000 Dividends 162,000 Sales Sales Discounts Cost of Goods Sold 6,500 39,000 18,500 14,300 11,000 13,000 8,500 5,400 1,200 Salaries & Wages Expense Advertising Expense Utilities Expense Depreciation Expense Supplies Expense Freight Out Interest Expense Interest Revenue Gain on Sale of Equipment Loss on Sale of Equipment 250 1,800 2,000