Answered step by step

Verified Expert Solution

Question

1 Approved Answer

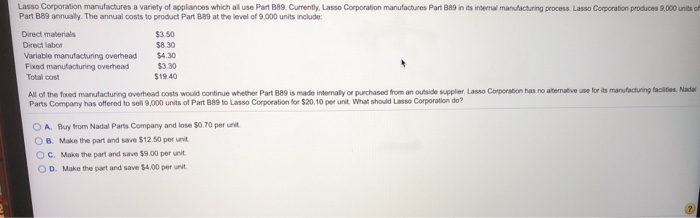

Acct 202 Lasso Corporation manufactures a variety of Appliances which al use Parts Part 89 annually. The costs to product Part 9 at the eve

Acct 202  Lasso Corporation manufactures a variety of Appliances which al use Parts Part 89 annually. The costs to product Part 9 at the eve of 9000 Curreny Lasso Corporation manufactures Part 389 in its internal manufacturing process. Lasso Corporation produces 2.000 units of include Direct materials Direct labor Variable manufacturing overhead Fored manufacturing overhead Total cost $350 3830 $430 $19.40 All of the foxed manufacturing overhead costs would continue whether Part B is made internally or purchased from an outside wupplier Lasso Corporation has no atomotive use for its manufacturing facies. Nadal Parts Company has offered to sell 9,000 units of Part 380 to Liso Corporation for $20.10 per unit What should Lasso Corporation do? O A Buy from Nadal Parts Company and lose 70 per unit OB. Make the part and save $12.50 per unit OC. Make the part and save $9.00 per unit OD Make the part and save $400 per unit

Lasso Corporation manufactures a variety of Appliances which al use Parts Part 89 annually. The costs to product Part 9 at the eve of 9000 Curreny Lasso Corporation manufactures Part 389 in its internal manufacturing process. Lasso Corporation produces 2.000 units of include Direct materials Direct labor Variable manufacturing overhead Fored manufacturing overhead Total cost $350 3830 $430 $19.40 All of the foxed manufacturing overhead costs would continue whether Part B is made internally or purchased from an outside wupplier Lasso Corporation has no atomotive use for its manufacturing facies. Nadal Parts Company has offered to sell 9,000 units of Part 380 to Liso Corporation for $20.10 per unit What should Lasso Corporation do? O A Buy from Nadal Parts Company and lose 70 per unit OB. Make the part and save $12.50 per unit OC. Make the part and save $9.00 per unit OD Make the part and save $400 per unit

Acct 202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started