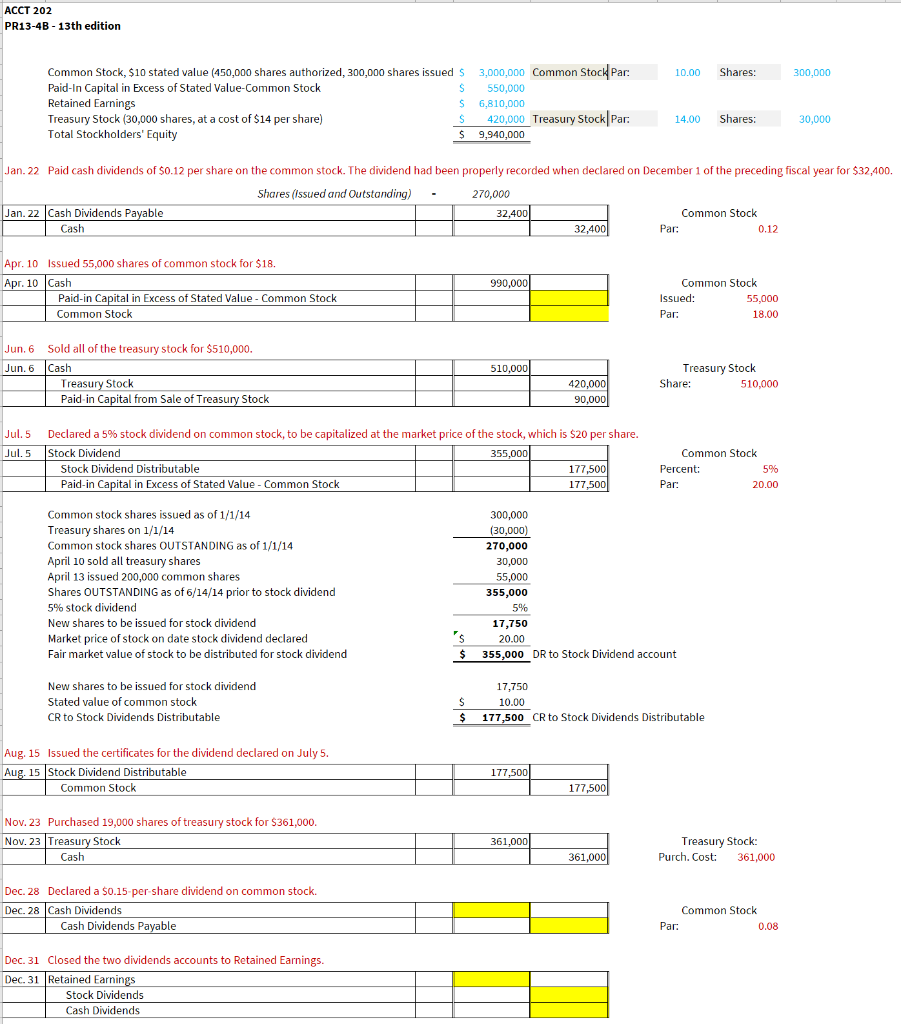

ACCT 202 PR 13-4B - 13th Edition

*PLEASE HELP WITH FINDING SOLUTIONS FOR HIGHLIGHTED SECTIONS WITH SHOWING WORK*

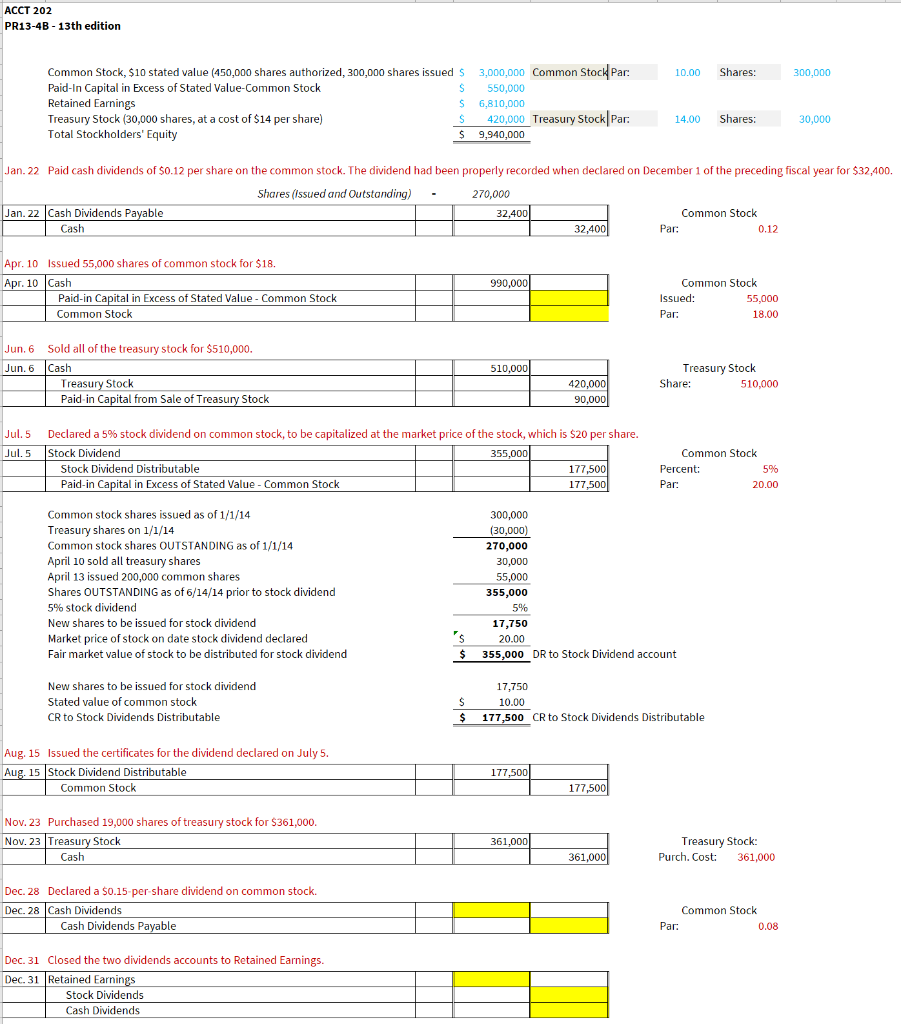

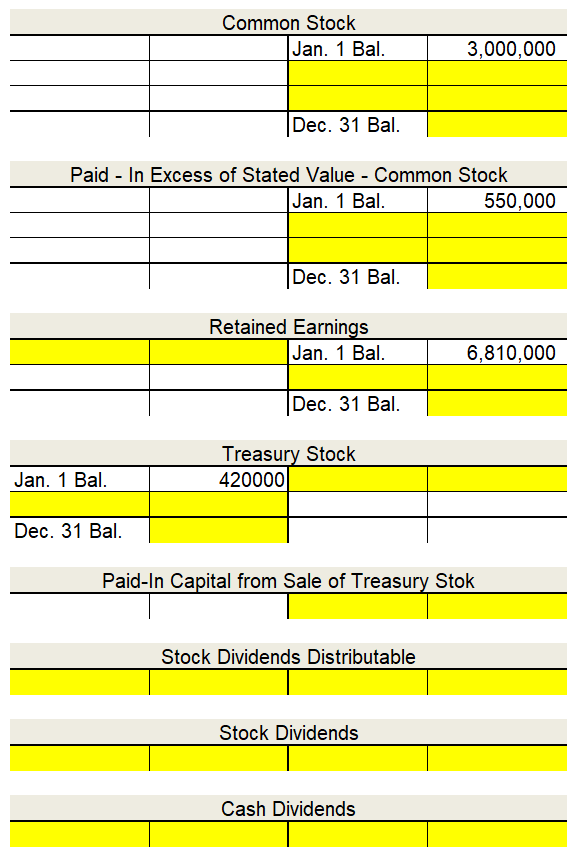

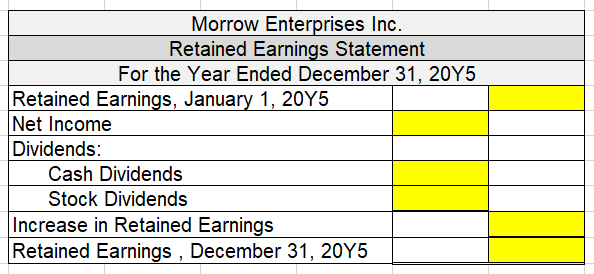

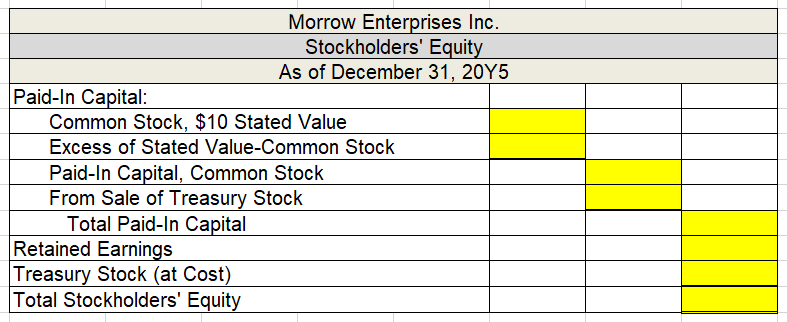

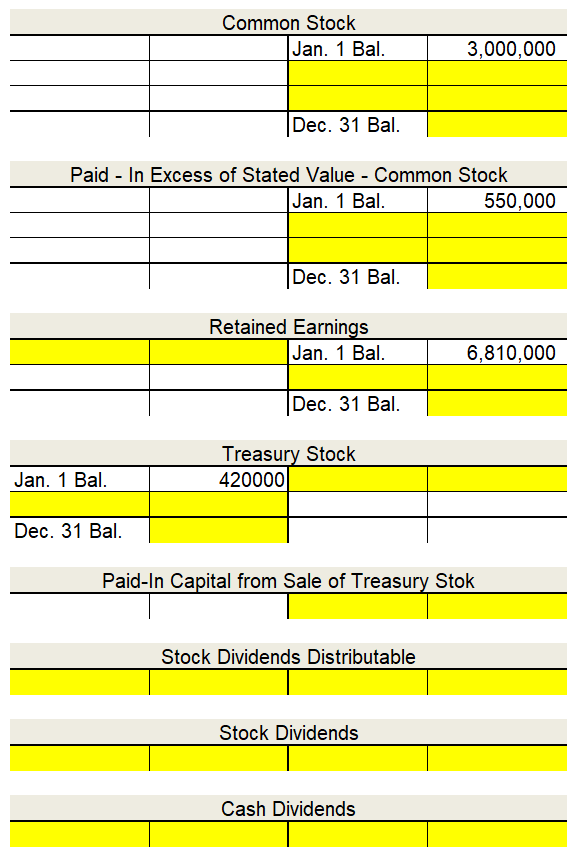

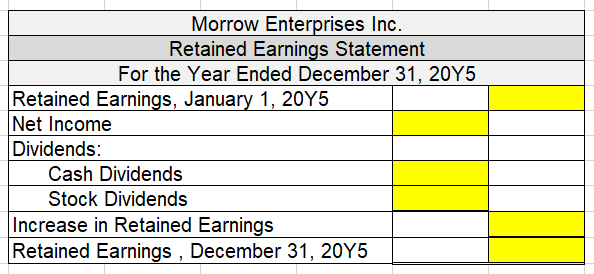

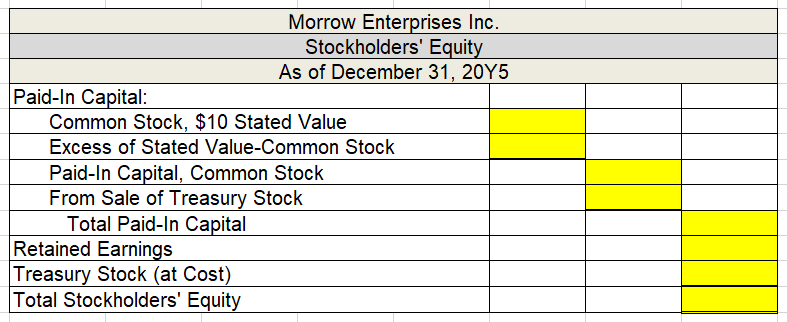

ACCT 202 PR13-4B - 13th edition 10.00 Shares: 300,000 Common Stock, $10 stated value (450,000 shares authorized, 300,000 shares issued $ Paid In Capital in Excess of Stated Value-Common Stock $ Retained Earnings S Treasury Stock (30,000 shares, at a cost of $14 per share) S Total Stockholders' Equity 3,000,000 Common Stock Par. 550,000 6,810.000 420,000 Treasury Stock|Par. 9,940,000 14.00 Shares: 30,000 $ Jan.22 Paid cash dividends of $0.12 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $32,400 Shares (Issued and Outstanding) 270,000 Jan. 22 Cash Dividends Payable 32,400 Common Stock Cash 32,400 Par: 0.12 990,000 Apr. 10 Issued 55,000 shares of common stock for $18. Apr. 10 Cash Paid-in Capital in Excess of Stated Value - Common Stock Common Stock Common Stock Issued: 55,000 Par: 18.00 510,000 Jun. 6 Sold all of the treasury stock for $510,000. Jun. 6 Cash Treasury Stock Paid-in Capital from Sale of Treasury Stock 420,000 90,000 Treasury Stock Share: 510,000 Jul. 5 Jul. 5 Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. Stock Dividend 355,000 Stock Dividend Distributable 177,500 Paid-in Capital in Excess of Stated Value - Common Stock 177,500 Common Stock Percent: Par: 20.00 5% Common stock shares issued as of 1/1/14 Treasury shares on 1/1/14 Common stock shares OUTSTANDING as of 1/1/14 April 10 sold all treasury shares April 13 issued 200,000 common shares Shares OUTSTANDING as of 6/14/14 prior to stock dividend 5% stock dividend New shares to be issued for stock dividend Market price of stock on date stock dividend declared Fair market value of stock to be distributed for stock dividend 300,000 (30,000) 270,000 30,000 55,000 355,000 5% 17,750 20.00 355,000 DR to Stock Dividend account 'S $ New shares to be issued for stock dividend Stated value of common stock CR to Stock Dividends Distributable S $ 17,750 10.00 177,500 CR to Stock Dividends Distributable Aug. 15 Issued the certificates for the dividend declared on July 5. Aug. 15 Stock Dividend Distributable Common Stock 177,500 177,500 Nov. 23 Purchased 19,000 shares of treasury stock for $361,000. Nov. 23 Treasury Stock Cash 361,000 Treasury Stock: Purch. Cost: 361,000 361,000 Dec. 28 Declared a $0.15-per-share dividend on common stock. Dec. 28 Cash Dividends Cash Dividends Payable Common Stock Par: 0.08 Dec. 31 Closed the two dividends accounts to Retained Earnings. Dec. 31 Retained Earnings Stock Dividends Cash Dividends Common Stock Jan. 1 Bal. 3,000,000 Dec. 31 Bal. Paid - In Excess of Stated Value - Common Stock Jan. 1 Bal. 550,000 Dec. 31 Bal. Retained Earnings Jan. 1 Bal. 6,810,000 Dec. 31 Bal. Treasury Stock 420000 Jan. 1 Bal. Dec. 31 Bal. Paid-In Capital from Sale of Treasury Stok Stock Dividends Distributable Stock Dividends Cash Dividends Morrow Enterprises Inc. Retained Earnings Statement For the Year Ended December 31, 2045 Retained Earnings, January 1, 2015 Net Income Dividends: Cash Dividends Stock Dividends Increase in Retained Earnings Retained Earnings , December 31, 2015 Morrow Enterprises Inc. Stockholders' Equity As of December 31, 2015 Paid-In Capital: Common Stock, $10 Stated Value Excess of Stated Value-Common Stock Paid-In Capital, Common Stock From Sale of Treasury Stock Total Paid-In Capital Retained Earnings Treasury Stock (at Cost) Total Stockholders' Equity