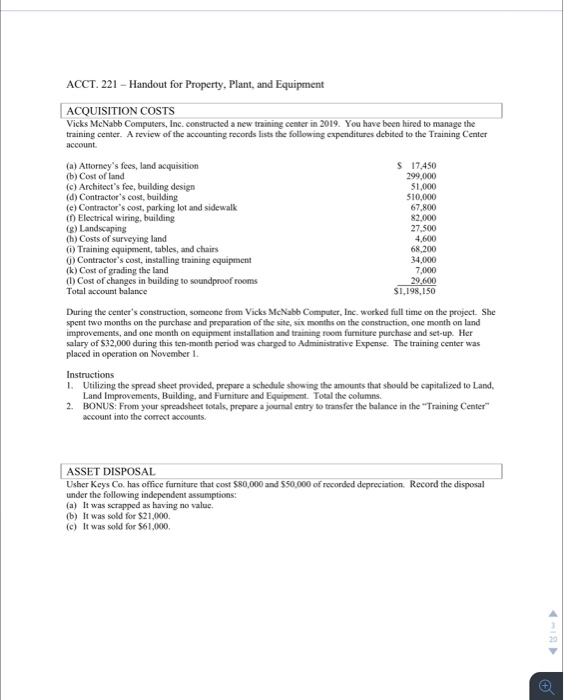

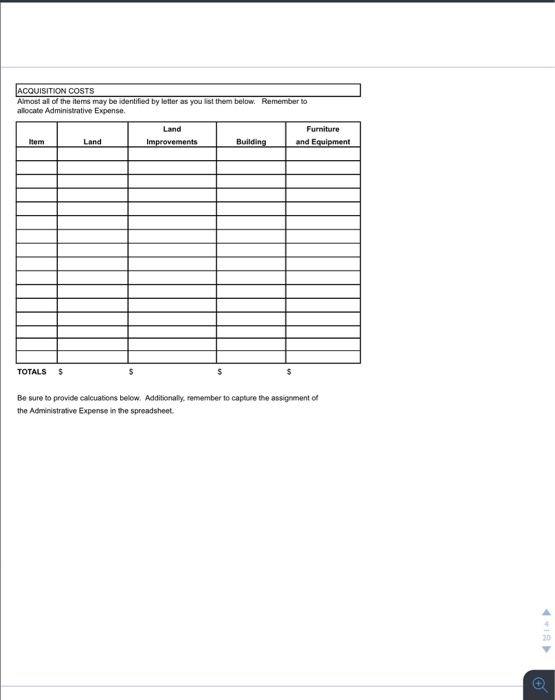

ACCT. 221 - Handout for Property, Plant, and Equipment ACQUISITION COSTS Vicks McNabb Computers, Inc. constructed a new training center in 2019. You have been hired to manage the training center. A review of the accounting records lists the following expenditures debited to the Training Center (a) Attorney's fees, land acquisition (b) Cost of land (c) Architect's fee, building design (d) Contractor's cost, building (c) Contractor's cost, parking lot and sidewalk Electrical wiring, building (e) Landscaping ch) Costs of surveying land Training equipment, tables, and chairs () Contractor's cost, installing training equipment (k) Cost of grading the land (1) Cost of changes in building to soundproof rooms Total account balance S 17450 299,000 SIOOD $10.000 67.00 R2200 27.500 4.600 68.200 34.000 7 000 29,600 S1.198,150 During the center's construction, someone from Vicks McNabb Computer, Inc. worked full time on the project. She spent two months on the purchase and preparation of the site, six months on the construction, one month on land improvements, and one month on equipment installation and training room furniture purchase and set-up. Her salary of $32,000 during this ten-month period was charged to Administrative Expense. The training center was placed in operation on November 1 Instructions 1. Utilizing the spread sheet provided, prepare a schedule showing the amounts that should be capitalized to Land, Land Improvements, Building, and Furniture and Equipment. Total the columns 2. BONUS: From your spreadsheet totals, prepare a journal entry to transfer the balance in the "Training Center account into the correct accounts ASSET DISPOSAL Usher Keys Co has office furniture that cost $80,000 and $50,000 of recorded depreciation Record the disposal under the following independent assumptions: (a) It was scrapped as having no value (b) It was sold for $21.000 (c) It was sold for $61.000 ACQUISITION COSTS Almost all of the items may be identified by letter as you let them below. Remember to allocate Administrative Expense Land Furniture and Equipment Improvements Building TOTALS $ $ $ Be sure to provide calcuation below. Additionally, remember to capture the assignment of the Administrative Expense in the spreadsheet