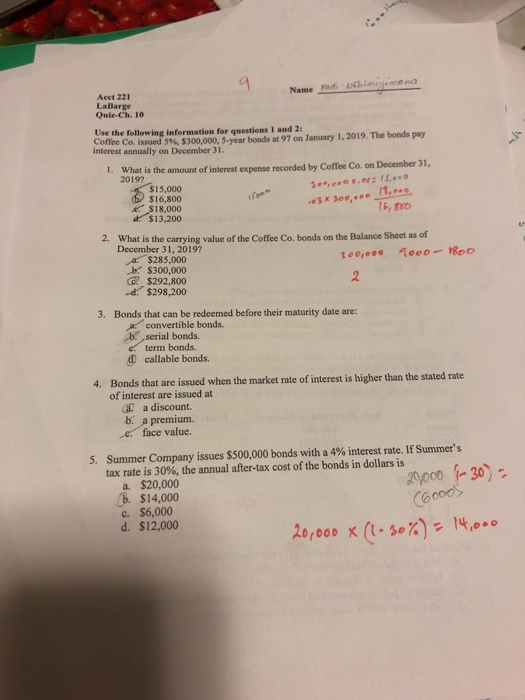

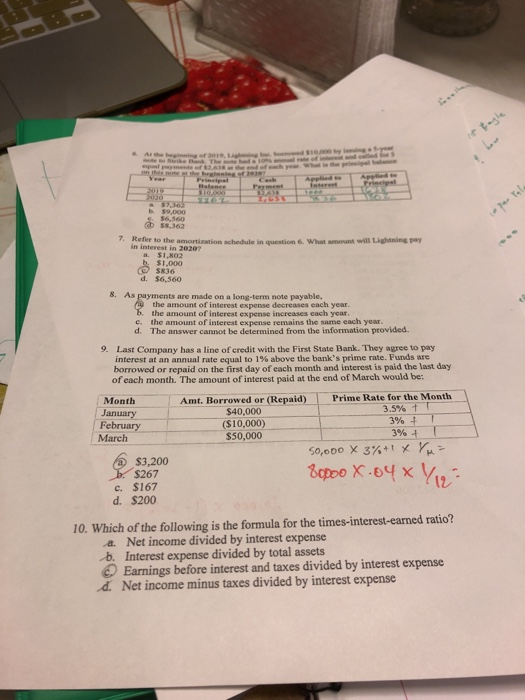

Acct 221 LaBarge Quiz-Ch. 10 Use the following information for questions 1 and 2 fee Co issued 5%, S300.000, 5-year bonds at 97 on January 1, 2019. The bonds pay interest annually on December 31. Cof What is the amount of interest expense recorded by Coffee Co. on December 31, 2019? 1. $15,000 $16,800 $18,000 $13,200 N,.. -e31 300, 2. What is the carrying value of the Coffee Co. bonds on the Balance Sheet as of December 31, 2019? $285,000 $300,000 $292,800 d$298,200 Bonds that can be redeemed before their maturity date are: 3. convertible bonds b.,serial bonds. term bonds. d callable bonds. Bonds that are issued when the market rate of interest is higher than the stated rate 4. of interest are issued at a a discount. b. a premium. face value. Summer Company issues S500,000 bonds with a 4% interest rate. If Summers tax rate is 30%, the annual after-tax cost of the bonds in dollars is 5, a. $20,000 . $14,000 c. $6,000 d. $12,000 (6000 20,000 x (t-30%): 14,ooo 58.362 n intc teste antiation schedule in question &. What amount will Lightning pey t in 20207 a. $1,802 $1,000 5836 d. $6,560 8. As nts are made on a long-term note payable, the amount of interest expense decreases each year. the amount of interest expense increases each year e. the amount of interest expense remains the same each year d. The answer cannot be determined from the information provided. Last Company has a line of credit with the First State Bank. They agree to pay interest at an annua rate equal to 1% above the bank's prime rate. Funds are borrowed or repaid on the first day of each month and interest is paid the last day of each month. The amount of interest paid at the end of March would be: 9. Amt. Borrowed or (Repaid) Prime Rate for the Month Month January February March t-T 3.5% 3% 3% $40,000 ($10,000) $50,000 $3,200 $267 c $167 d. $200 12 10. Which of the following is the formula for the times-interest-earned ratio? a Net income divided by interest expense b. Interest expense divided by total assets Earnings before interest and taxes divided by interest expense Net income minus taxes divided by interest expense d