Answered step by step

Verified Expert Solution

Question

1 Approved Answer

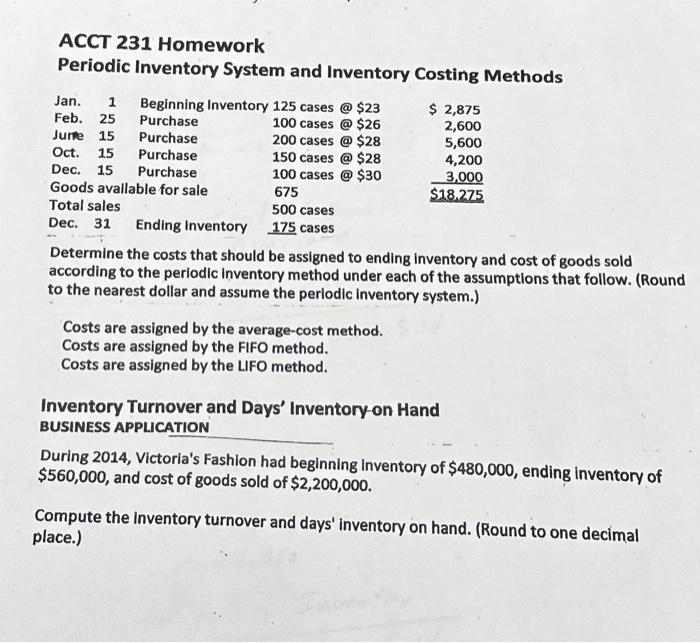

ACCT 231 Homework Periodic Inventory System and Inventory Costing Methods Jan. 1 Beginning Inventory 125 cases @ $23 Feb. 25 Purchase 100 cases @ $26

ACCT 231 Homework Periodic Inventory System and Inventory Costing Methods Jan. 1 Beginning Inventory 125 cases @ $23 Feb. 25 Purchase 100 cases @ $26 June 15 Purchase Oct. 15 Purchase Dec. 15 Purchase Goods available for sale Total sales Dec. 31 Ending Inventory 200 cases @ $28 150 cases @ $28 100 cases @ $30 675 500 cases 175 cases $ 2,875 2,600 5,600 4,200 3,000 $18.275 Determine the costs that should be assigned to ending inventory and cost of goods sold according to the periodic inventory method under each of the assumptions that follow. (Round to the nearest dollar and assume the periodic inventory system.) Costs are assigned by the average-cost method. Costs are assigned by the FIFO method. Costs are assigned by the LIFO method. Inventory Turnover and Days' Inventory on Hand BUSINESS APPLICATION During 2014, Victoria's Fashion had beginning inventory of $480,000, ending inventory of $560,000, and cost of goods sold of $2,200,000. Compute the inventory turnover and days' inventory on hand. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started