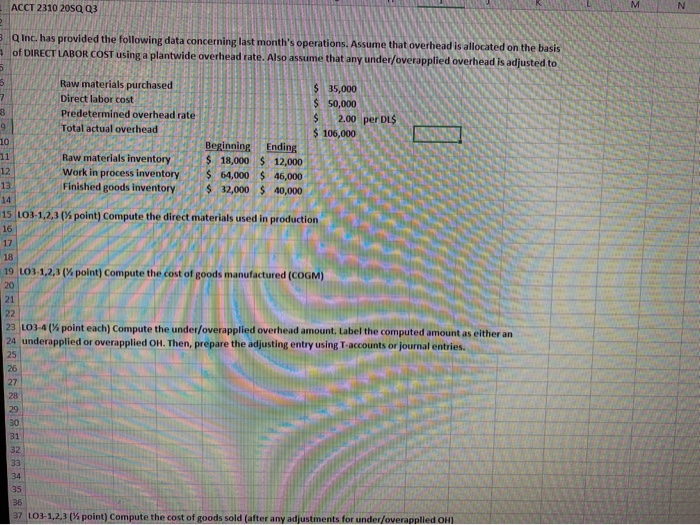

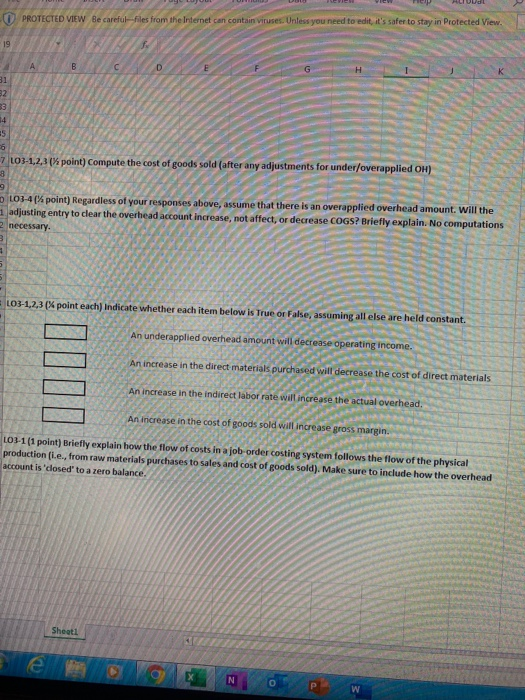

ACCT 2310 205Q Q3 U 3. Q Inc. has provided the following data concerning last month's operations. Assume that overhead is allocated on the basis of DIRECT LABOR COST using a plantwide overhead rate. Also assume that any under/overapplied overhead is adjusted to 5 $ 8 Raw materials purchased Direct labor cost Predetermined overhead rate Total actual overhead $ 35,000 $ 50,000 $ 2.00 per DLS $ 106,000 9 10 11 12 13 14 Raw materials inventory Work in process inventory Finished goods inventory Beginning Ending $ 18,000 $ 12,000 $ 64,000 $ 46,000 $ 32,000 $ 40,000 15 103-1,2,3 % point) Compute the direct materials used in production 16 17 18 19 103 1,2,3 ( point) Compute the cost of goods manufactured (COGM) 20 21 22 23 LO3-4% point each) Compute the under/overapplied overhead amount, Label the computed amount as either an 24 underapplied or overapplied OH. Then, prepare the adjusting entry using T-accounts or journal entries. 25 26 27 28 29 30 31 32 33 34 35 36 37 LO3-1,2,3 (% point) Compute the cost of goods sold (after any adjustments for under/overapplied OHI ACIDUL O PROTECTED VIEW Be carefulfiles from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. 19 A B D 31 32 33 14 ES 5 7 103-1,2,3 % point) Compute the cost of goods sold (after any adjustments for under/overapplied OH) 8 9 103-4(% point) Regardless of your responses above, assume that there is an overapplied overhead amount. Will the adjusting entry to clear the overhead account increase, not affect, or decrease COGS? Briefly explain. No computations 2 necessary L03-1,2,3 (% point each) Indicate whether each item below is True or False, assuming all else are held constant. An underapplied overhead amount will decrease operating income. An increase in the direct materials purchased will decrease the cost of direct materials An increase in the indirect labor rate will increase the actual overhead. An increase in the cost of goods sold will increase gross margin. LO 3-1 (1 point) Briefly explain how the flow of costs in a job order costing system follows the flow of the physical production (i.e., from raw materials purchases to sales and cost of goods sold). Make sure to include how the overhead account is closed to a zero balance, Sheet1 9 N W