Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acct 232 Brewster Company manufactures elderberry wine, Last vear, Brewster earned operating income of $195,000 after income taxes. Capital employed equaled $2.6 million. Brewster is

Acct 232

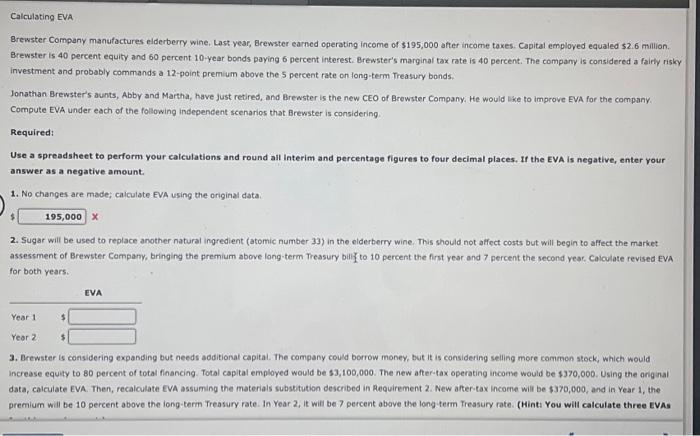

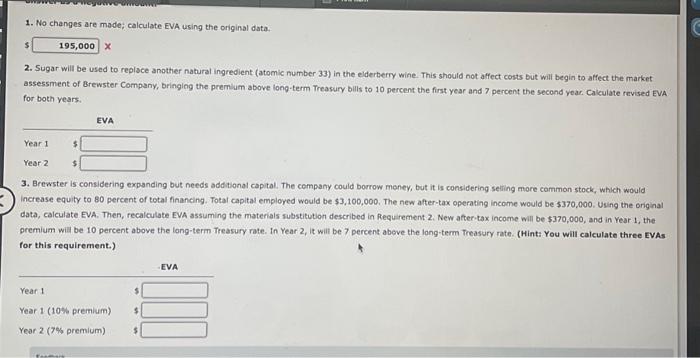

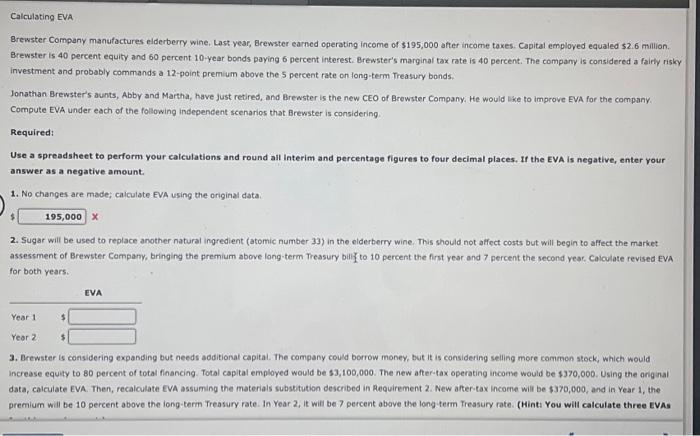

Brewster Company manufactures elderberry wine, Last vear, Brewster earned operating income of $195,000 after income taxes. Capital employed equaled $2.6 million. Brewster is 40 percent equity and 60 percent 10 -year bonds paying 6 percent interest. Brewster's marginal tax rate is 40 percent. The company is considered a fairly risk investment and probably commands a 12 -point premium above the 5 percent rate on long-term treasury bonds. Jonathan Brewster's aunts, Abby and Martha, have Just retired, and Brewster is the new CEO of Brewster Company. He would like to improve EVA for the company. Compute EVA under each of the following independent scenarios that Brewster is considering. Required: Use a spreadsheet to perform your calculations and round all Interim and percentage figures to four decimal places, If the EVA is negative, enter your answer as a negative amount. 1. No changes are made; calculate EVA using the original data. $ 2. Sugar will be used to replace another natural ingredient (atomic number 33) in the elderberry wine. This should not affect costs but will begin to affect the market assessment of Brewster Company, bringing the premium above long-term Treasury bill to 10 percent the first year and 7 percent the second year, Calculate revised Eva for both years. 3. Brewster is considering expanding but needs additional capital. The company could borrow money, but it is considering selling more commen stock, which would increase equity to 80 percent of total financing. Total capital employed would be $3,100,000. The new after-tax operating income would be $370,000. Using the ong nail data, calculate EVA. Then, recalculate EVA assuming the materials substution described in Requirement 2 . New after-tax incorne will be $370,000, and in Year 1, the premium will be 10 percent above the iong-term Treasury rate. In Year 2 , it will be 7 percent above the long term freasury rate. (Hint: You will calculate three EVAs 1. No changes are made; calculate EVA using the original data. 2. Sugar will be used to replace another natural ingredient (atomic number 33 ) in the elderberry wine. This should not affect costs but will begin to affect the market assessment of Brewster Company, bringing the premium above long-term Treasury bills to 10 percent the first year and 7 percent the second year. Cakulate revised EVA for both vears. 3. Brewster is considering expanding but needs additional capital. The company could borrow money, but it is considering selling more common stock, which would increase equity to 80 percent of total financing. Total capital employed would be $3,100,000. The new after-tax operating income would be $370,000. Using the onginal data, calculate EVA. Then, recalculate EVA assuming the materials substitution described in Requirement 2 . New after-tax income will be $370,000, and in Year 1, the premium will be 10 percent above the long-term Treasury rate. In Year 2 , it will be 7 percent above the long-term Treasury rate. (Hint: You will calculate three EvAs for this requirement.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started